Zcash’s Woes & Wins: A Tale of Profit & Perseverance 🤑💎

New suitors, improving fortunes, and a steadfast support zone now uphold its breakout aspirations, much like a gentleman’s unwavering devotion. 💖

New suitors, improving fortunes, and a steadfast support zone now uphold its breakout aspirations, much like a gentleman’s unwavering devotion. 💖

Apparently, the RBI’s latest report is all, “Who controls the money? We do. Next question.” Because letting stablecoins run wild is like letting your chaotic friend DJ your wedding-it’s fun until it’s not. 🎧💔

Stablecoins, those humble servants of the financial realm, are now one of the largest buyers of U.S. government debt. $46 trillion in volume last year? That’s more than the U.S. ACH network, and they’re just getting started. Regulatory uncertainty? Limited buy-in? Pfft. These are mere speed bumps on the highway to $10 trillion. 🛣️

With the precision of a Maestro composing a symphony on 154% crescendos, HTX has, as they boast, clung steadfastly to a 100% reserve ratio for its core assets. The method, mind you, is none other than the illustrious Merkle Tree audits, imbuing the annals of blockchain with a touch of mathematical elegance.

It seems the esteemed Mr. Selig, Chairman of the CFTC, has seen fit to reward Mr. Zaidi for, well, launching those… things. Bitcoin futures, they call them. One shudders to think what mischief might be afoot. 🧐

“Picture it,” he intoned, fingers steepled like a Bond villain who just remembered he forgot his lines, “$4.6 billion in whale selling, a cascade of deleveraging, liquidity vanishing faster than a butler at a tax audit-and all while we were busy believing in rainbows and ETF-driven unicorns.”

Qureshi, the managing partner at Dragonfly Capital (a crypto venture fund, don’t you know), is betting his bottom dollar that Bitcoin (BTC) will be scaling the heights like a mountain goat on a mission. 🏔️💰 He’s chirping about new all-time highs next year, with Bitcoin soaring a whopping 69% above its current value. Blimey, that’s enough to make one’s monocle pop out! 😲

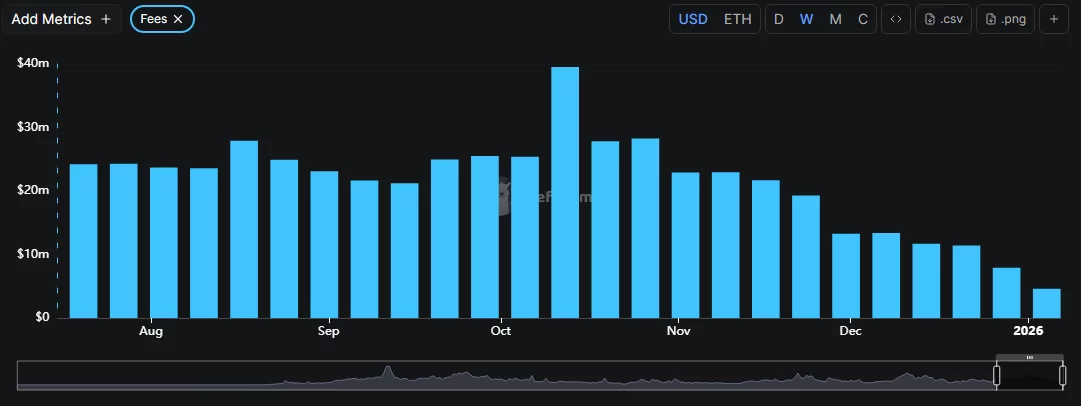

Last I checked (Thursday, Jan 1st – Happy New Year, by the way, let’s hope it’s better than this!), Uniswap (UNI) was chilling at $5.64. That’s down 12.5% from Sunday and a whopping 53% below its August glory days. It’s like, remember when things were good? Pepperidge Farm remembers.

December 31, 2025, XRP’s chilling at $1.87. Boring? Maybe. But hey, on-chain signals and derivatives are throwing a party, and we’re not invited. 🎉

Hayes claims the relentless squeeze of global dollar liquidity, which was giving the middle finger to risk assets in 2025, hit rock bottom in November. This isn’t some dry financial report we’re talking about-it’s the financial equivalent of a green light at the traffic light for the “money printer” narrative!