Uniswap: Uh Oh, Spaghetti-O’s? 📉

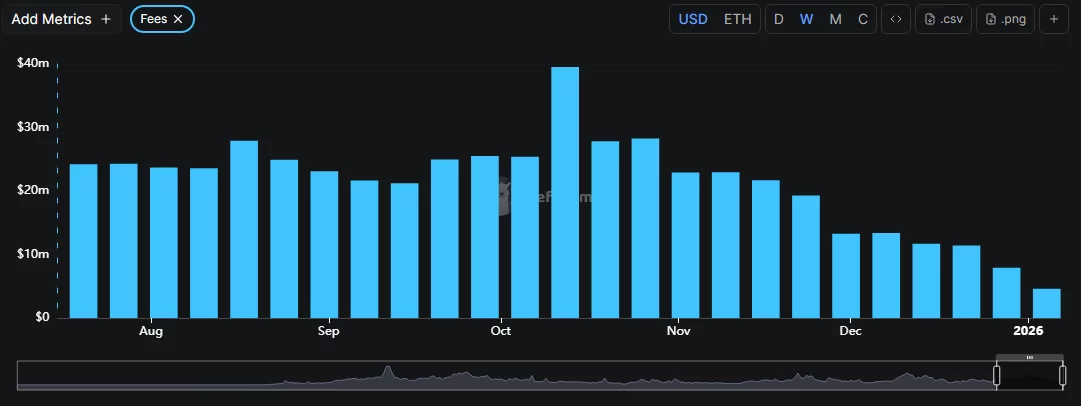

Last I checked (Thursday, Jan 1st – Happy New Year, by the way, let’s hope it’s better than this!), Uniswap (UNI) was chilling at $5.64. That’s down 12.5% from Sunday and a whopping 53% below its August glory days. It’s like, remember when things were good? Pepperidge Farm remembers.