2025’s Cryptocurrency Catastrophes: A Symphony of Spectacular Failures 🎻💥

10 worst-performing altcoins in 2025 | Source: CoinMarketCap

10 worst-performing altcoins in 2025 | Source: CoinMarketCap

Behold, the almighty 130 billion SHIB, a veritable deluge of tokens, now resides in exchange reserves, a silent symphony of bears preparing their next move. This structural shift, a tempest in a teacup, is met with skepticism, for what is a bearish omen if not a mirror held to the soul of the market? Yet, let us not be hasty, for interpretation, that elusive specter, remains as ghostly as ever 🐕🔥.

Now, their treasure chest overflows with 290,062.67 ZEC, a hoard that makes up about 1.76% of Zcash’s circulating supply. And get this-they’ve been building this pile at an average price of $334.41 per token. Talk about playing the long game. Or maybe they just really, really like privacy. 🤔

Our dear developer observed, almost with a sigh of resignation, that the infamous Shibarium hack transpired in part due to the absence of the supposed leaders, those gallant knights who were meant to swoop in and save the day. Alas, they were nowhere to be found, leaving everyone to fend for themselves in this chaotic crypto wilderness.

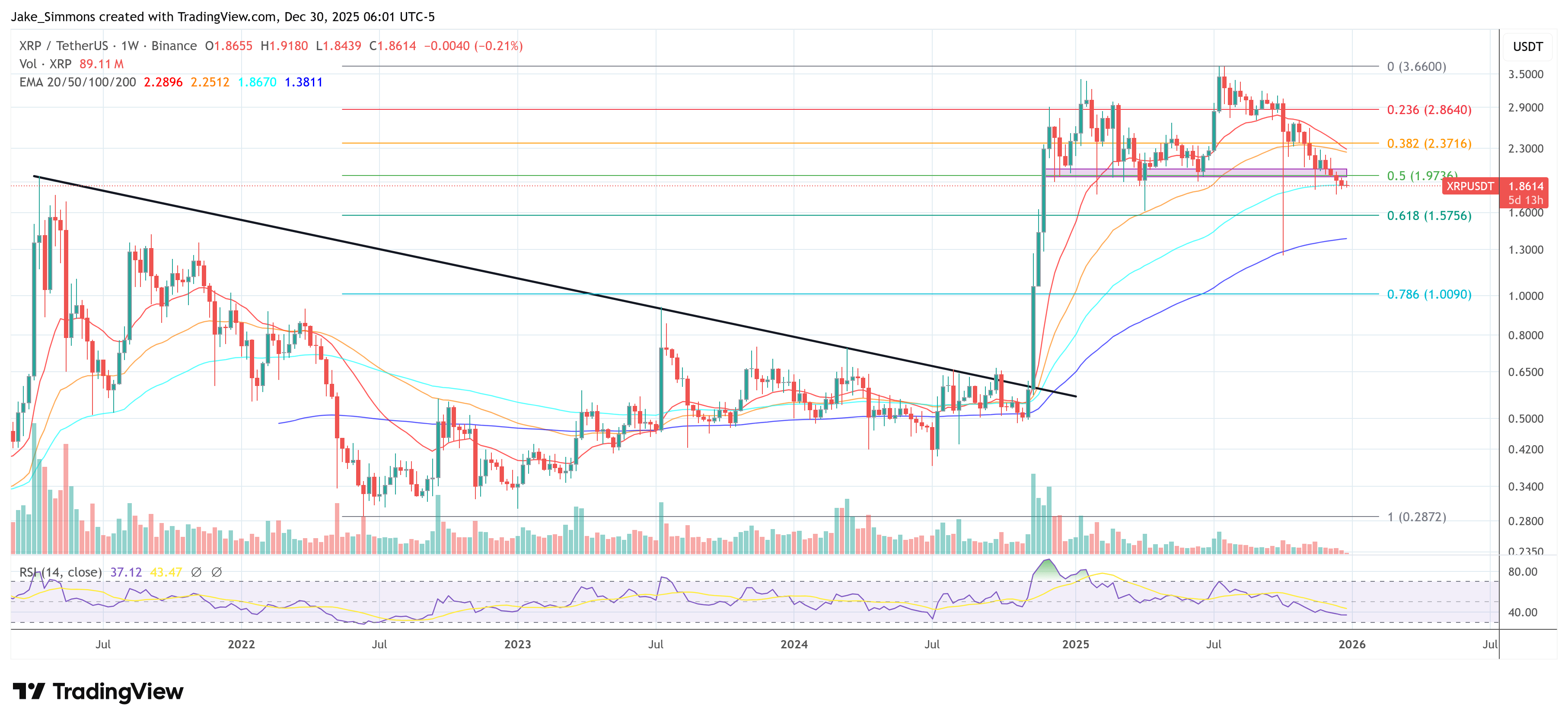

In his December 27 missive, aptly titled “Weekly Insight,” Taylor weaves a narrative as intricate as a Chekhovian drama. He posits that capital, ever restless, might abandon the staid confines of traditional markets for the siren call of crypto. Should this transpire, XRP, his “core position,” could emerge as the belle of the ball, basking in the glow of a cycle’s upside. But ah, the folly of it all! For Taylor’s optimism is tethered to a crypto market cap of $10 trillion-a figure as grandiose as it is uncertain. 🤑

When the $BTC price dared to breach the major trendline, it seemed the bottoming phase was finally over. 🤭 But alas, the $90,000 wall proved too formidable. The price recoiled like a startled cat, plummeting back to the ascending trendline. 🧨 A retest of the downtrend line? A mere formality, darling. 🤭

Announcing with great importance, new stewards of their house, Mr. Nick Vandenberg has been bestowed the title of Chief Executive Officer, whilst Mr. Jeremy Harkness shall wield the mantle of Chief Technology Officer, a detail disclosed with considerable air during the event.

On December 29, LaMothe announced her retirement with the kind of poise usually reserved for fleeing a collapsing neutron star. “After all these years, I’m leaving with a sense of honor and gratitude… primarily gratitude that I’ll no longer need to pronounce ‘Proof-of-Work’ correctly under scrutiny,” she declared.

Old man McGlone, Bloomberg’s senior commodity strategist, took to the Twitter-sphere (or whatever they call it these days) to sound the alarm on Ether. He’s wagging his finger, saying it’s more likely to tumble toward $2,000 than climb to $4,000. Seems the poor thing’s been underperforming longer than a lazy hound dog on a porch. 🐕☀️

Oh, the long-term dreamers still whisper sweet nothings about SOL’s future. But the charts? They’re drier than a bone, pointing to $105-$78 like a dusty map to buried treasure. Recovery? Might as well ask a rattlesnake to babysit.