In a most audacious flourish, PancakeSwap has waltzed into the realm of tokenized stocks, unveiling perpetual contracts for three titans of the American stock market.

Ah, the meteoric rise of platforms peddling tokenized stocks! It is as if the very essence of potential has donned a dazzling gown and taken to the stage, much to the delight of the audience. 🎭

PancakeSwap’s Daring Foray into Tokenized Stocks

In a proclamation that would make even the most stoic of investors raise an eyebrow, PancakeSwap – that illustrious DeFi protocol gracing the BNB Chain – has officially unfurled perpetual contracts for three iconic US stocks: Apple (AAPL), Amazon (AMZN), and Tesla (TSLA). These contracts, akin to a magician’s trick, are deployed on PancakeSwap V3 and boast a leverage of up to 25x. 🎩✨

“PancakeSwap Perpetuals are non-expiring derivative contracts that allow one to speculate on the price of an asset, including crypto, and now stocks, without the burden of actually owning the underlying asset. You may go long or short, trade with leverage, and access the markets 24/7,” the announcement declared, as if it were the latest fashion trend. 🕶️

This audacious maneuver marks the inaugural venture of a DEX into the hallowed halls of equity derivatives. It is a significant leap for DeFi, as it embraces traditional assets in a manner that would make even the most conservative of investors blush – a trend affectionately dubbed RWA (Real-World Assets). 💃

According to the oracle known as RWA.xyz, the tokenized stocks market has reached a staggering market cap of $374 million, a veritable feast of growth at 220% since June. Monthly transfer volume, a delightful morsel, sits at around $330 million. Algorand, that cunning fox, commands 66% of the tokenized stock market share, primarily driven by the EXOD stock from Exodus. 🦊

“If merely 1% of global stocks were to be tokenized, the market could soar beyond US$1.3T, propelling significant growth in on-chain assets and DeFi infrastructure toward mainstream adoption,” a report from Binance Research emphasized, as if it were a prophecy. 🔮

Yet, the same report reveals a rather disheartening truth: active on-chain addresses have surged from a mere 1,600 to a staggering 90,000. However, centralized exchanges, those grand establishments, outshine on-chain platforms by over 70 times in tokenized stock trading volume. 📈

But fret not, dear reader! This gap, while daunting, also illuminates the vast potential for DEX platforms in this burgeoning sector. 🌱

In a delightful twist, a protocol specializing in US stock tokenization, xStocks, has surpassed a jaw-dropping $2 billion in total trading volume merely three months post-launch. This meteoric rise signals an explosive and promising demand for trading stocks in tokenized form. Yet, the specter of competition from earlier movers looms large over PancakeSwap. 👻

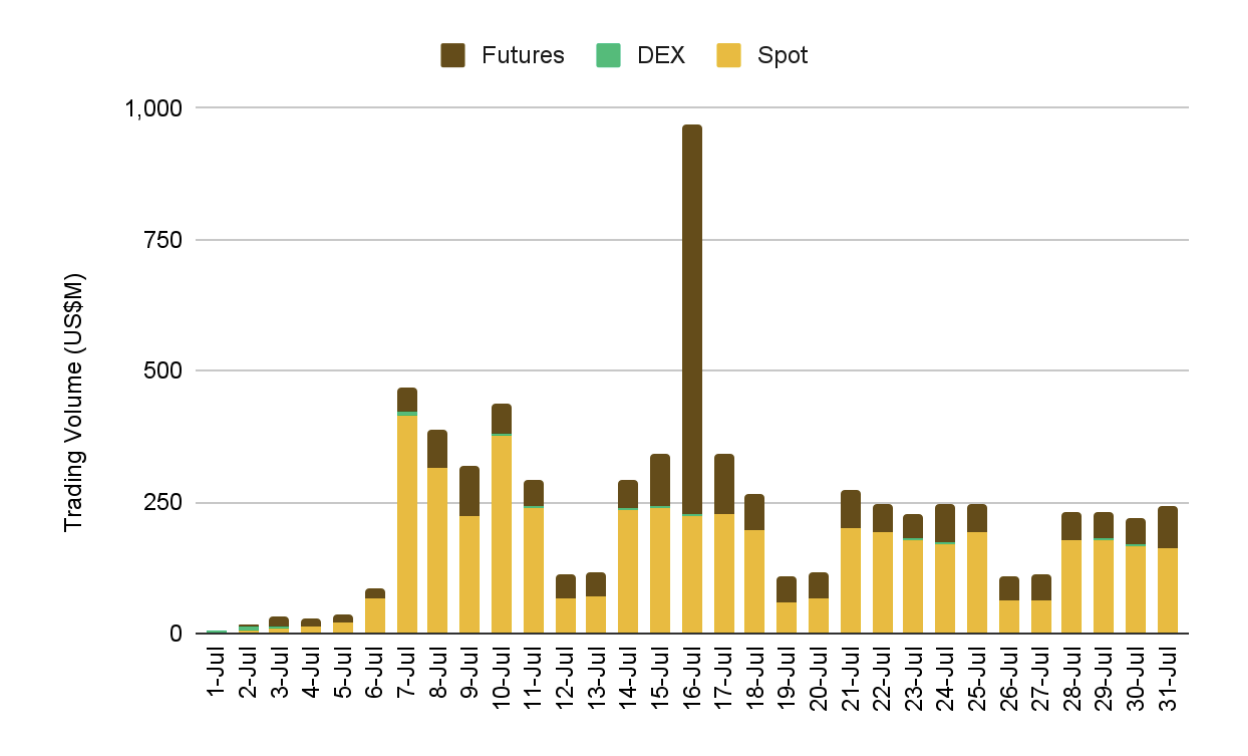

Data shared on X reveals that PancakeSwap has basked in a positive increase in users and trading volume in July. The platform generated over $188 billion in spot trading volume, accounting for a staggering 43% of the DEX trading volume market. 💰

As the curtain rises on the launch of perpetual stock contracts, one can only wonder if this will be the key growth driver for PancakeSwap in the months to come. 🍾

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- STETH PREDICTION. STETH cryptocurrency

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- Why Your Crypto is a Disaster (And Why You’re Still Buying)

- Bitcoin’s Descent: Bounce or Breakdown? 🚀💸

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

2025-08-07 16:48