In the gray tundra of the market, where dreams often freeze and hope huddles for warmth, the token known as PENGU waddled forth. Its short and round body had struggled beneath icy resistance, but today, ah, today it burst above the infamous “neckline” — a phrase equally at home in financial jargon or a peasant’s collar on the Volga.

Behold the spectacle: Pudgy Penguins (PENGU) surged 23% in a single day, pecking at the air with a longing not seen since January 29. Its followers, clutching bags heavier than a Siberian exile’s sack, saw returns of 125% since the previous month’s bottom — and 370% higher than their year-to-date despair. “How?” you wonder, munching on dry bread. Simple: the penguin saw a fish, leapt, and every other creature scrambled after it, desperate not to starve.

Grubby and determined, PENGU’s rally propelled it to the apex of the crypto zoo, clawing its way to the rank of 89th. Its market cap whispered “one billion,” a sum so large it could make even a czar weep or at least nod in grudging respect. Optimism, once a rumor in the frozen wastelands, crawled back like a stray dog.

The cause of this flapping and squawking? The mighty U.S. Securities and Exchange Commission nodded — just a nod, mind you! — at Canary’s request for a PENGU ETF. Even the smallest bureaucratic gesture becomes “bullish” among those desperate for signals. (A penguin takes a step, fifty thousand penguin eggs are sold.)

This ETF, should it hatch, will stuff 80–95% of its nest with PENGU tokens, and garnish the rest with those “Pudgy Penguins” NFTs — proof that if you are cute enough, you, too, can be financialized. It’s like buying a winter coat and receiving a complimentary snowball.

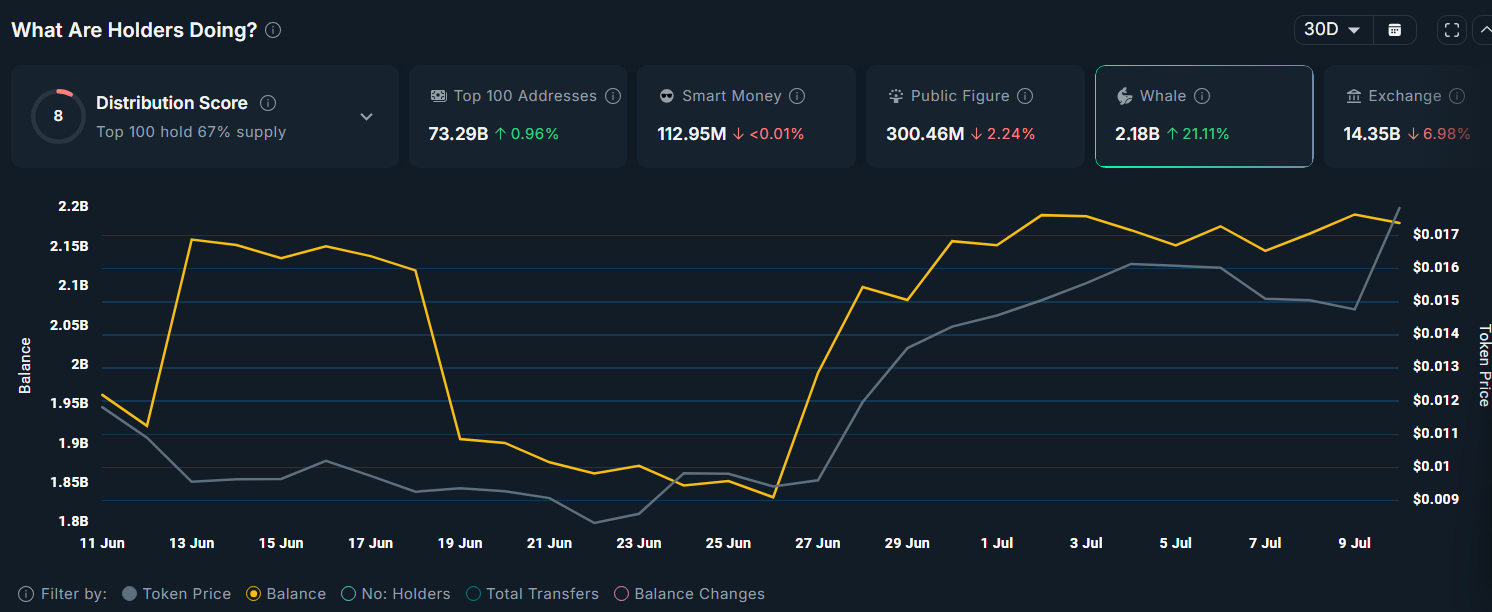

Meanwhile, the whales — those morose oligarchs of the blockchain ocean — gorged themselves on increased PENGU holdings, upping their stash by 21% this month. Together, they now control 2.18 billion tokens. Perhaps they see famine coming; perhaps they simply want to be the biggest penguins on the ice. Time will tell, or perhaps it won’t. 🐳🐧

PENGU’s supply on exchanges shrank — from 15.6 billion woes on June 12 to a svelte 14.3 billion now. If you’re wondering, yes, this is “bullish.” Tokens disappear from exchanges either because investors are holding tight, or because they have lost the password to their wallets. Either way, supply dwindles, hope festers.

On another battlefield, CoinGlass reports PENGU’s weighted funding rate for derivatives has gone positive, for the first time since July 1. Whatever it means, traders are finally opening long positions, so someone, somewhere, thinks penguins can fly — at least as far as $0.0318. Leverage rides high, and so does irony. 📈

PENGU price forms a cup and handle pattern

On the daily chart, mighty PENGU has formed a “cup and handle” — the kind you look for in a thrift store, or on days when you hope for miracles. Price first sank to $0.0037 (March), then crested at $0.0175 (May), sketching a curve rounder and deeper than the bowls served in a Moscow canteen. A “handle” followed: brief, unsatisfying, like a worker’s smoke break.

By tradition, this formation predicts a breakout — like a peasant sprinting from the overseer’s gaze. The vertical span, nearly 79%, means if one dares dream, $0.0318 is possible. A 75% gain lies in wait, providing no one loses faith (or drops support at $0.0142, that traitorous, crumbling patch of ice).

PENGU, at this hour, still shuffles far below its December summit of $0.06845. For the faithful, there remains much frozen wasteland to cross. For the skeptics, well, there’s always vodka — or maybe a “penguin” plushie for consolation.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- EUR ILS PREDICTION

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- USD CNY PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- ⚡Chekhov Spills The Tea-Will ADA’s $1.50 Dream Get a Chekhovian Plot Twist?😂

2025-07-10 10:19