In the grand theater of the world, a new act unfolds in the Philippines, where a bill, like a phoenix, rises from the ashes of August 2025, promising to catapult this Southeast Asian nation into the dizzying heights of sovereign digital asset holdings. Ah, the sweet scent of ambition! 🌟

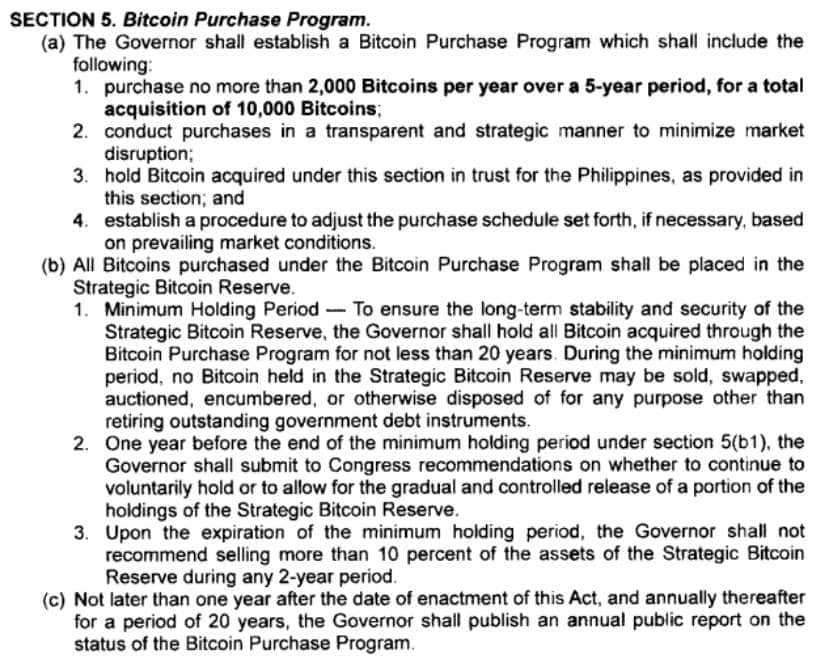

Enter stage left, Representative Miguel Luis Villafuerte from Camarines Sur, who, in June 2025, introduced House Bill 421. It was a quiet whisper at first, but by late August, it roared like a lion! This “Strategic Bitcoin Reserve Act” commands the central bank to hoard 2,000 Bitcoin each year for five years, culminating in a staggering 10,000 Bitcoin treasure chest worth over $1.1 billion. Who needs gold when you can have digital coins, right? 💰

The Plan Behind the Reserve

Ah, the meticulous plan! The Bangko Sentral ng Pilipinas (BSP) would tuck these digital gems away for a cozy 20 years. During this slumber, the government is forbidden from selling, trading, or using the Bitcoin-except, of course, to pay off the national debt. Because who doesn’t love a good debt story? 📉

And let’s not forget the rules! Even after the 20-year nap, the government can only sell 10% of the reserve every two years. It’s like treating Bitcoin as a fine wine-better to let it age than to guzzle it down too quickly! 🍷

Villafuerte, in his infinite wisdom, dubbed Bitcoin “digital gold,” citing its impressive 40% annual growth rate over the past five years. He warns that while other nations are diving into the Bitcoin pool, the Philippines must not be left on the sidelines, shivering in the cold. 🥶

How the System Would Work

Now, let’s talk about the mechanics! The proposed system is fortified with safety measures and oversight, as if guarding a dragon’s hoard. The BSP governor will collaborate with the Department of Finance, Department of Defense, and the Securities and Exchange Commission to manage this digital treasure. Because, you know, why not involve everyone? 🤷♂️

Quarterly reports will be published, detailing the Bitcoin stash, verified by independent auditors. Transparency is the name of the game, folks! We wouldn’t want any funny business, would we? 😂

These precious coins will be stored in secure “cold storage” facilities scattered across the archipelago, reducing the risk of losing everything in a single catastrophic event. Because who doesn’t love a good backup plan? 🔒

And fear not, dear citizens! The legislation promises not to meddle with private Bitcoin ownership or trading. You can still buy and sell your digital coins without the government peeking over your shoulder. Freedom reigns! 🎉

Global Context and Competition

If this bill passes, the Philippines will join an elite club. Currently, 11 countries hold about 480,196 Bitcoin combined-roughly 2.29% of all Bitcoin in existence. The U.S. leads the pack with 198,022 Bitcoin, while China follows closely behind. The Philippines’ proposed 10,000 Bitcoin reserve would outshine El Salvador’s 6,276 Bitcoin and nearly match Bhutan’s 10,565. Talk about keeping up with the Joneses! 🏆

El Salvador made headlines in 2021 by becoming the first country to embrace Bitcoin as legal tender. Despite mixed results, they continue to buy more. Meanwhile, Bhutan quietly amassed its Bitcoin stash through hydroelectric-powered mining. Who knew the land of happiness was also a Bitcoin haven? 😄

The timing is impeccable, aligning with global trends. President Trump has proposed a strategic Bitcoin reserve for the U.S., and several states are considering similar measures. It’s a Bitcoin bonanza! 🎊

Economic Motivations

The Philippines faces daunting economic challenges, with a debt of ₱16.09 trillion ($285 billion) as of November 2024. A staggering 68% of this debt is owed to its own citizens. Talk about a family affair! 👨👩👧👦

Traditional reserves like U.S. dollars and gold may not shield against inflation and currency woes. Bitcoin’s fixed supply of 21 million coins makes it a tempting hedge against currency devaluation. It’s like having a safety net made of digital silk! 🕸️

Moreover, the Philippines processes vast amounts of international money transfers. Filipino workers abroad send home billions each year. Bitcoin could make these transfers cheaper and faster, though the bill doesn’t explicitly mention this. A missed opportunity, perhaps? 🤔

Challenges and Next Steps

But alas, the road to glory is fraught with challenges! The bill must navigate committee reviews and floor votes in both houses of Congress. Political opposition may arise from those wary of Bitcoin’s volatility or the risks of managing such a colossal digital asset reserve. Because who doesn’t love a good debate? 🗣️

Critics are concerned about Bitcoin’s wild price swings. A major crash could leave the Philippines clutching assets worth far less than their purchase price. It’s like buying a ticket to a rollercoaster ride-thrilling, but you might lose your lunch! 🎢

Cybersecurity is another beast to tame. Government-held Bitcoin reserves could become prime targets for hackers. The proposed distributed storage system aims to mitigate this risk, but let’s be honest-no system is foolproof. 🦠

Lastly, the bill demands significant technical expertise from government officials, who may not be well-versed in cryptocurrency custody and security. Training and hiring qualified personnel could be a costly and time-consuming endeavor. It’s like teaching an old dog new tricks! 🐶

Looking Forward

For the global Bitcoin market, the Philippines’ sovereign adoption could spark a surge in institutional demand. This newfound legitimacy might coax traditional investors to dip their toes into the Bitcoin pool. 💦

The Strategic Bitcoin Reserve Act signals a paradigm shift in how governments perceive digital assets-not as mere speculative investments but as strategic tools for financial stability and economic sovereignty. Success could inspire other Southeast Asian nations to follow suit. Thailand, Malaysia, and Indonesia are already exploring various cryptocurrency initiatives. The digital revolution is upon us! 🚀

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Ethereum’s Wild Ride: Will This Crypto Riverboat Reach $4K or Crash a Paddle?

- Crypto Chaos: How Hackers Are Pulling Off the ‘Classic EIP-7702’ Wallet Heist

- Why Your Crypto is a Disaster (And Why You’re Still Buying)

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Bitcoin’s $100k Dream: 74% Say ‘No Way!’

2025-08-25 00:55