Lo! The POL token of Polygon, that most enigmatic of digital assets, hath ascended upon a tide of ambition and chaos. A new era dawns, wrought by corporate metamorphosis, whispered acquisitions, and a burn rate so fervent it could reduce a saint to ash. One might ask, “Is this the dawn of prosperity or the prelude to ruin?” But let us not dwell on such trifles.

As of Jan. 9, when the clock struck publication, POL traded at $0.1558, a 16.59% leap in 24 hours. A mere trifle? Nay! For it reached an intraday high of $0.1584, while trading volume swelled to $312 million-167% higher than the previous night. A spectacle, truly, and one that would make the most stoic of investors weep… with either joy or despair. 🤡

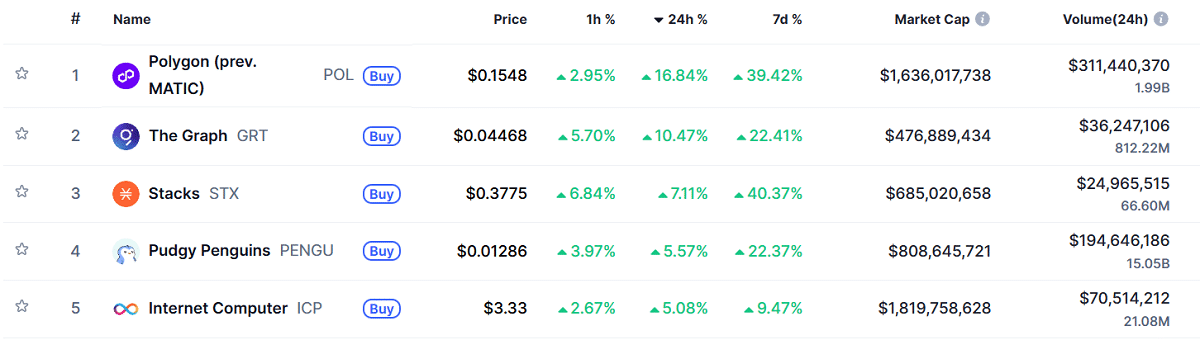

This, dear reader, is no mere fluctuation. It is the largest price surge among cryptocurrencies in 24 hours, a feat so grand it could rival the ambitions of Napoleon himself. Or perhaps, as some might cynically suggest, the result of a caffeine-fueled trader’s delusions. 🎭

Polygon’s triumph, as chronicled by CoinMarketCap, from Jan. 8 | Source: CoinMarketCap

The Open Money Stack: A Philosophical Gambit

What hath Polygon wrought? A “Open Money Stack,” they call it-a modular platform of such audacity it seeks to bridge fiat and crypto, to unite the chains of man’s greed into one seamless tapestry. A noble endeavor? Perhaps. A fool’s errand? Equally plausible. Yet, in the grand theater of finance, such paradoxes are par for the course. 🎩

Rumors swirl of a $100-125 million acquisition of Coinme, that quaint operator of crypto ATMs. Sources, unnamed and thus presumably truthful, whisper of 6,000+ machines poised to become the veins of Polygon’s “full-stack banking service.” A bridge between old-world finance and digital chaos? Or merely a desperate bid to stay relevant in an age of algorithmic madness? The answer, like the market itself, remains elusive. 🕵️♂️

Polygon, in a bold stroke, seeks to acquire Coinme, a relic of Bitcoin’s early days, to “bridge traditional finance and retail adoption.” A masterstroke? Or a tragicomedy in the making? Only time shall judge. – Max Avery (@realMaxAvery) January 9, 2026

And lo! The burn rate, that modern-day purifier of tokens, hath reached record heights. One million POL per day, sacrificed to the altar of deflation. CEO Sandeep Nailwal, with the solemnity of a prophet, declared it an “S curve moment.” A prophecy? A sales pitch? Perhaps both. For in the realm of crypto, even the most banal statements are cloaked in mystique. 🕯️

Three and a half percent of POL’s supply to be burned in 2026. “Massively deflationary,” Nailwal intones. A word so grand it could fill a cathedral. Yet one wonders: will this pyre of destruction birth a phoenix of value, or merely feed the flames of hubris? The question, like the market, remains unanswered. 🔥

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- Brent Oil Forecast

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- Crypto Chaos: 3 Stocks Dancing on the Edge of Madness 🌪️💸

- SushiSwap’s Stirring Saga: The DeFi Drama That Left Us in Stitches! 😂🍣

- USD THB PREDICTION

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

2026-01-10 01:04