As the river of regulation meanders through its endless tundra, the guardians of capital have raised their flags. Confusion swells, a fog creeping in from the Dnieper, suffocating the campfires of certainty for Ripple, for XRP, for all the trembling hosts who dare dream of an ETF with a hint of the forbidden.

Grayscale’s ETF: Approved, Then Abandoned (Or So It Seems…)

Picture it: July 3—the world yawns; the birds sing; the SEC, a brooding sentry, suddenly pulls hard on the reins of Grayscale’s GDLC. Just days prior, the same gatekeepers had nodded graciously as the fund—Bitcoin and Ethereum at the helm, yet with a polite tip of the cap to XRP (4.8%) and Solana (2.8%)—was ushered onto the stage of NYSE Arca. The curtain barely twitching before that eternal Rule 431 is invoked, yanking GDLC back behind the scenes for “internal review.” The drama!

“Unexpected,” Grayscale muttered, casting side-eye over the chessboard of finance in an email to Decrypt. They waxed philosophical, as one must: “It reflects the dynamic and evolving nature of regulatory landscapes surrounding a first-of-its-kind digital asset product…”—the precise poetry you recite when someone confiscates your sledgehammer at the demolition derby.

Everyone watching the Ripple-SEC legal vaudeville felt their monocles drop, their hearts jump, and their wallets wince simultaneously.

XRP and Solana: Now Featured Targets in This Theatrical Hunt

If the SEC explained their actions in more detail, surely the world would be draped in roses and lollipops. But, no. Whispers abound that the real culprit here is simply the presence of altcoins—XRP and Solana in particular—whose debutante balls as stand-alone ETFs are still somewhere beyond the seventh horizon.

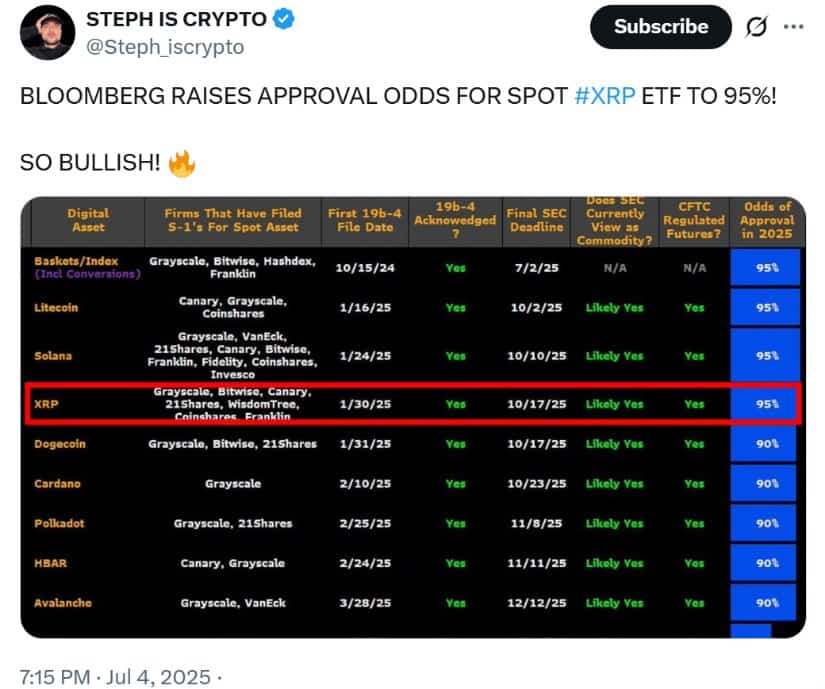

James Seyffart, Bloomberg’s ETF chronicler, mused that this was merely a “precautionary measure.” Translated: “Let’s wait until the ink on the ‘Regulatory Framework’ is less watercolour.” The SEC prefers to perfect its origami swan before letting the rest of us attempt a paper airplane.

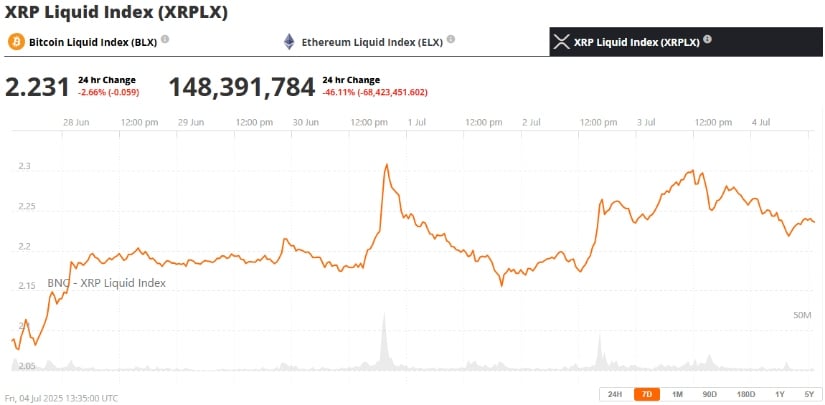

XRP holders, meanwhile, sit atop their coins, wondering if the next sunrise will herald regulatory fall or a flight to the heavens. The price lingers, spectators whispering from the gallery: $2.23 today. The plot thickens, but the soup remains tepid.

Ripple vs SEC: Stakes That Outrun a Single Fund

Beneath this single pause, a wider ballet of consequences pirouettes. Those with a keen eye recall the partial victory scored by Ripple in 2023 (XRP not a security when passed between mortals on secondary markets). Yet the regulator—like an aggrieved Dostoevsky character—returns to haunt Ripple Labs, fixated on institutional dealings and sales between shadows.

GDLC’s forced intermission? A masterstroke in the art of bureaucratic timewasting—a breath held while the halls of power observe if investors faint or flourish. No hard rejection, just a sly wink, as if hinting: “The game is on, but the dice aren’t quite loaded yet.”

Until some transparent decree descends from the marble sky, XRP and kindred souls must weather more ambushes in the endless regulatory chess match.

Market Mood: Borscht with a Side of Hope

The regulatory fog thickens, but—like Russian winter—there remains a stubborn optimism among analysts. If the lawsuit finds its epilogue and the ETF gods bless XRP, perhaps a deluge of institutional gold awaits.

If the SEC ever allows an XRP ETF to dance in the daylight, well, bulls say $3.50 could visit soon. Some dei ex machina place XRP price prediction 2025 even above $10, assuming Ripple outwits the regulatory Sphinx.

But for now, the price forecast is as knotted as Boris’s scarf—inseparably tangled with court intrigue and laws rewritten at midnight.

What Fate Befalls the XRP ETF?

To bring altcoins to ETF masquerade balls evidently takes more than a well-cut suit; it demands an entire tailor’s guild. Bitcoin and Ethereum have waltzed onto the floor, encrusted with $50 billion in ETF finery. Meanwhile, XRP’s invitation seems delayed in the mail—possibly being steam-opened by an SEC clerk.

Grayscale, ever hopeful and perhaps slightly masochistic, forges onward: “We are working closely with key stakeholders…” (read: there’s a lot of coffee and pacing). The XRP lawsuit news, like a samovar, keeps bubbling, filling the room with steam and suspense. Is the delay a hiccup, or the beginnings of a coma? Only the SEC’s next dispatch—signed in ink or, more appropriately, invisible regulatory runes—will tell.

Parting Echoes

This abrupt stalling of Grayscale’s ETF testifies not only to XRP’s uncertain fate, but to the broader chaos in the empire of altcoin ETFs. XRP remains in purgatory, awaiting a verdict not from economic winds but from faceless jurists. Until regulations assert themselves or irony finally decides to drop the curtain, the stage belongs to uncertainty—and perhaps, a few brave jesters on both sides of the aisle. 😏⚖️

Read More

- Brent Oil Forecast

- Silver Rate Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- SEI PREDICTION. SEI cryptocurrency

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- FET PREDICTION. FET cryptocurrency

2025-07-04 20:28