In the bustling town of Shiba, where ledgers flutter like moths around a smoky lamp and the mayor is always a tweet away, the noble SHIB confronted a spectacle that would make a clerk drop his inkpot: a full hundred percent fall, while the register merely whispered “zero burns” for the second time in less than seven days. January 2026 closed its doors with the burn rate sunk to nil, as if the universe itself had misplaced the match that lights the candle of profit and promptly forgot where it left the flame.

SHIB price slides as market sentiment turns bearish

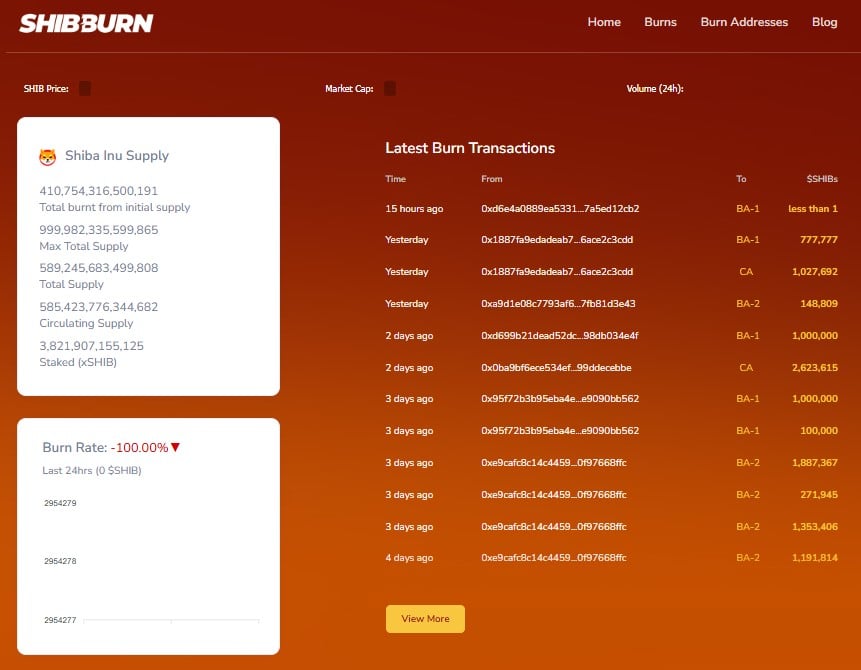

Shibburn, that pedantic scribe of burn rates, notes with the gravity of a town crier that there has been no burn activity in the last 24 hours. This zero burn rate, like a rumor with no substance, seems to have cast a chill over the coin’s price, which declined more than 5% in the same interval-because nothing says “optimism” quite like a chart that looks back at you with a sigh.

To be fair, the Shiba Inu ecosystem periodically burns SHIB from its total supply in a move meant to reduce the circulating stock. This is the grand trick: coax a bit of scarcity from the heavens in hopes the price will be coaxed to rise, like a miser counting coins under a lamp to pretend the night never happened.

Yet, with the burn rate crashing to zero, the circulating supply stands stubbornly at 585,423,776,344,682 SHIB, as if the number were carved in stone by a bored sage.

This proves that the grand deflationary mechanism-burn, burn, burn-has the charm of a damp match in a hurricane. The last burst of fire happened some 48 hours ago, scorching only 777,777 SHIB, a pyre so tiny it could barely keep a candle alight in a windstorm.

Shiba Inu has slid from a daily high of $0.000006809 to a trough of $0.000006415 as bearish winds blow across the market. At the moment of writing, SHIB trades at $0.000006475, down 4.51% in the last 24 hours, a number that would make a fortune-teller blink and tell you to buy a lottery ticket instead. The trading volume, a respectable $180.43 million, has a distinct flavor of sell-off-a carnival banner that reads: “Everything must go.”

The drama is not limited to SHIB alone. Bitcoin-the grand old tyrant of the crypto market-has wandered downwards, losing more than $5,000 in a single day as it slips from $76,486.24 to $71,222. Market participants, bless them, clutch at straws and hope for a rebound past $72,500 to grant the market a momentary nap from the never-ending nightmare of churning red candles.

Analyst Warns of Further Downside Risks for Shiba Inu

For Shiba Inu, the descent could continue if fortune smiles on misfortune and things swing in a manner consistent with gravity. As the renowned on-chain analyst Ali Martinez notes, SHIB now dangles below a critical ruddy threshold of $0.000006672, a line in the sand that trembles like a counterfeit coin in a bustling market. Martinez paints a portrait of doom-an 81% plunge from current levels-that would wipe out nearly three years of Shiba Inu’s hard-won gains, a fate that would make even a fatigue-worn clerk sigh in exasperation.

Meanwhile, in the last 24 hours, SHIB spot flows rose by over 1,500%, a wild crowd surge that would ordinarily herald some heroic reversal, if only the stars aligned. Instead, it was not enough to lift SHIB out of the red zone, as if the crowd were cheering for a ghost that refuses to leave the theater.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- SKY Crypto Surges: Is a Pullback Coming? 🚀

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- AI, Crypto, and Gen Z: The Future of Holiday Shopping is Here (And It’s Ridiculous!)

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2026-02-05 12:59