Oh, dear Shiba Inu (SHIB), you’ve been as quiet as a mouse in a cheese factory these past few months! Over the last three months, the coin has barely budged, gaining a measly 0.09%. That’s right, it’s been as flat as a pancake while other big crypto critters have been jumping like kangaroos. As of now, the Shiba Inu price is floating around $0.0000122, down 1.4% over the past 24 hours, and a whopping 7.2% lower on the year. 📉

But why, oh why, has our furry friend been so still? Well, my dears, the answer lies in the mystical world of on-chain signals, and they’re whispering that the calm before the storm might just be about to break, with the sellers holding all the cards. 🤑

Profit-Taking Patterns Explain the Rangebound Trade

The Percent Supply in Profit for SHIB is currently at 24.3%, which is like being stuck in the middle of a seesaw. When this number climbs to 37%, the party usually comes to an end, and when it drops to 19%, it’s time to start the next rally. But poor SHIB is right in the middle, neither here nor there. 🤷♂️

This limbo land is why SHIB has been stuck in neutral for the past three months. There are just enough holders with profits to take a little off the table now and then, but not enough in the red to spark a buying frenzy. It’s like a game of musical chairs where nobody wants to sit down. 🎶

And so, SHIB remains pinned in a narrow band, twiddling its thumbs and waiting for something to happen. 🕵️♀️

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

But wait, there’s more! The 4-hour chart is showing a bearish divergence, where the price made a higher high, but the RSI (Relative Strength Index) logged a lower high. This means that while buyers were pushing the price up, their enthusiasm was waning, and the profit-takers were ready to pounce. 🐾

To put it simply, rallies are now facing more resistance than ever before, a classic setup that often leads to a downward spiral. 🌀

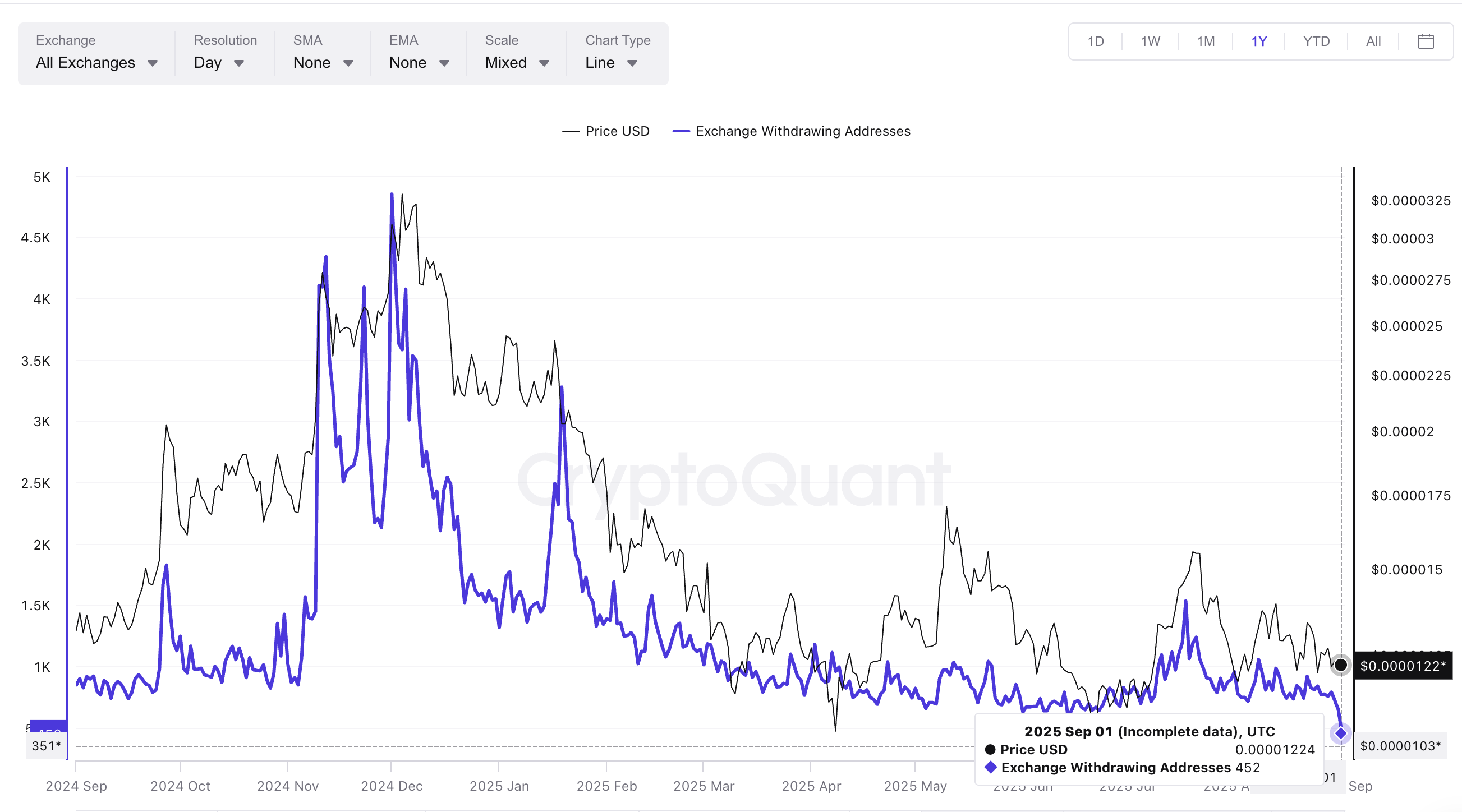

Weak Withdrawals Underscore Waning Interest

Now, let’s talk about withdrawals. Normally, when more coins are being withdrawn from exchanges, it’s a sign that investors are storing their tokens for the long haul. But instead of looking at the raw numbers, we should focus on the number of unique addresses making withdrawals. This gives us a better idea of how many people are actually participating in the market.

Guess what? The number of unique addresses withdrawing SHIB has plummeted to just 452, the lowest it’s been in a year. That’s like a ghost town in the Wild West! 🏭

With fewer people pulling coins from exchanges, there’s little new buying interest. In other words, even though SHIB’s price is near its lows, traders aren’t exactly rushing to buy. If this trend continues, the lack of demand will only add to the bearish pressure. 😢

Lack of Buyers Threatens Shiba Inu Price Levels

So, what does this all mean for poor SHIB? With the buying appetite fading and bearish signals flashing, the price chart looks pretty vulnerable. The immediate resistance is at $0.0000123, with a stronger barrier at $0.0000135. To break the bearish spell, SHIB would need to surge past $0.0000141, signaling a potential uptrend. 🚀

However, if the price drops below $0.0000119, it could be a slippery slope down to $0.0000116 or even lower, finally breaking out of its rangebound phase-but not in the way the bulls were hoping. 🐻

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- ADA’s Descent: A Tragicomedy of Errors (And a Pennant)

- Whale’s 17.76M ENA Bet: Can Ethena Break $0.30?

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- XRP XTRAVAGANZA: Is This the Crypto Comeback of the Century? 🚀💸

- GBP EUR PREDICTION

2025-09-01 23:29