In the month of July, a curious phenomenon unfolded: public and private companies, in a fit of enthusiasm, added a staggering 107,082 bitcoins to their coffers. This surge, now valued at a dizzying $428 billion, has been chronicled in the latest July Adoption Report by Bitcoin Treasuries, which, one might say, is the gossip column of the crypto world.

The report, which you can find at bitcointreasuries.net, reveals that the total holdings of all monitored entities-be they companies, exchange-traded funds (ETFs), governments, or funds-have reached a remarkable 3.64 million BTC by the end of the month. Public companies alone are hoarding 955,048 BTC, while their private counterparts clutch 292,364 BTC like a child with a favorite toy.

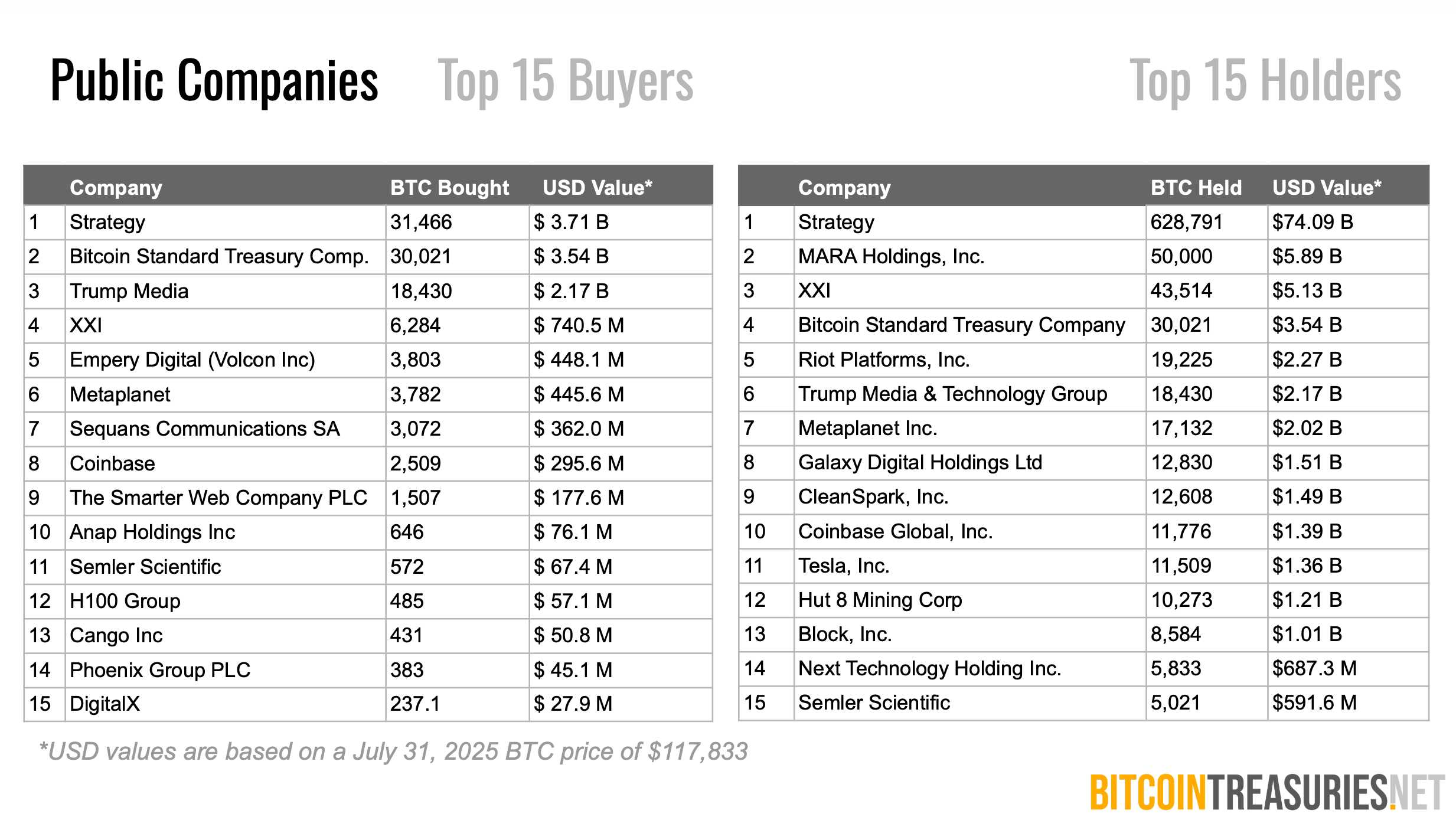

According to the diligent researchers at Bitcoin Treasuries, the significant net additions by companies accounted for nearly two-thirds of the 166,000 BTC added across all categories tracked in July. Major players, it seems, are not just dipping their toes but diving headfirst into the crypto pool. Strategy (MSTR) alone added 31,466 BTC, bringing its total to a jaw-dropping 628,791 BTC (worth a cool $74 billion). Talk about a shopping spree!

Newcomers to this extravagant party, such as the Bitcoin Standard Treasury Company (BSTR), have disclosed their own impressive acquisitions-30,021 BTC ($3.54 billion), while the Trump Media & Technology Group (DJT) added 18,430 BTC ($2.17 billion). Other notable buyers included Metaplanet, XXI, and Coinbase, as detailed in the Bitcoin Treasuries’ analysis. It’s like a game of Monopoly, but with real money!

Beyond the glittering allure of bitcoin, companies have also turned their gaze toward altcoins. Ethereum holdings by tracked entities total roughly $10 billion, while Solana holdings have reached $530 million. Firms have even announced plans exceeding $2 billion for future purchases of coins like BNB and XRP. It seems the crypto buffet is open, and everyone is hungry!

The researchers, with a twinkle in their eye, anticipate continued corporate acquisitions, driven by dedicated buying strategies, persistent ETF inflows, and the ever-hopeful expectations of a sustained bull market. If the momentum holds, institutional positioning could become a defining force in global capital allocation strategies for the years to come. Who knew finance could be so thrilling?

Rising commitments to multiple digital assets hint at a broader shift toward diversified crypto treasuries. This evolving approach signals that corporations may increasingly treat blockchain-based assets as strategic reserves, blending traditional portfolio management with the emerging economics of decentralized finance (DeFi). Who would have thought that finance could be so… entertaining? 😄

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- Solana Resilient? Yeah, Sure, Even Hackers Love It Too!

- XRP Whales Hoard Crypto Like Scrooge McDuck 😂💸 – Will Market Survive This Greed?

2025-08-06 16:58