Solana (SOL) is currently trading at $233.0, with 24-hour volatility at 0.7%. Its market capitalization is $126.97 billion, and the 24-hour trading volume is $9.96 billion. After two days of 6% gains, the price only increased by 3% on October 3rd. The price stalled just below the $240 mark, potentially due to increased selling pressure from users withdrawing their staked SOL.

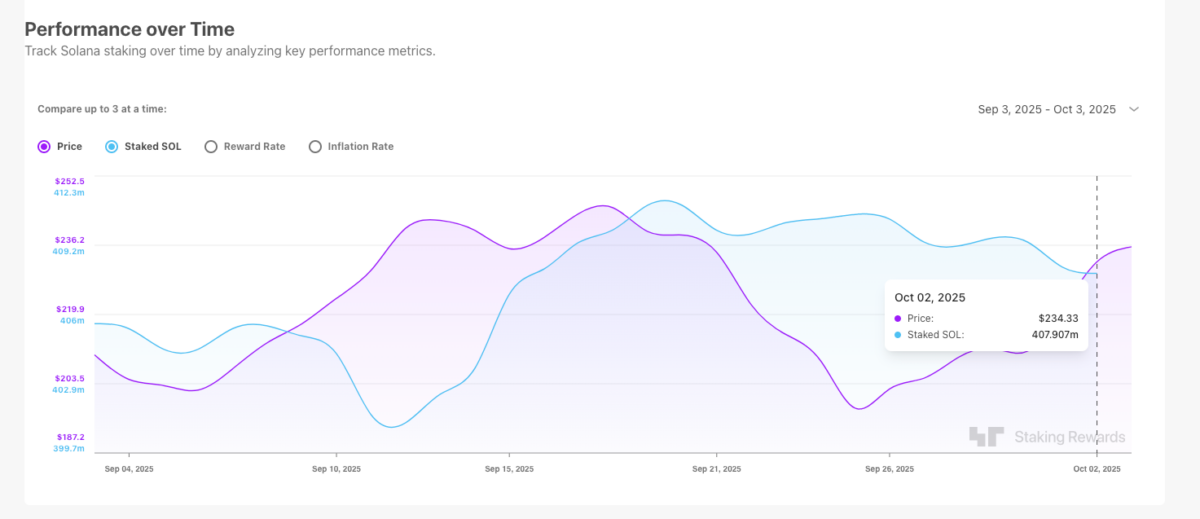

Solana saw a brief increase in price on Friday, but it only rose by about 3% before hitting a selling point around $240. Since the Federal Reserve hinted at potential interest rate cuts on September 18th, the amount of SOL staked on the network has decreased from 411.28 million to 407.9 million.

Between September 19th and October 3rd, 2025, the total amount of SOL staked on the Solana network decreased by 3.38 million SOL, which is equivalent to $787 million. (Source: StakingRewards)

Data from StakingRewards shows that over the past two weeks, 3.38 million SOL-worth about $787 million based on today’s price of $233 per SOL-has been withdrawn.

Introducing a significant number of previously unavailable tokens into the market presents challenges. It boosts the number of tokens available for sale, and it becomes more difficult for price increases to continue and break through key price levels.

Even so, optimism about potential Solana ETFs is growing. On September 29th, Bloomberg’s Eric Balchunas stated that approval for a Solana ETF is almost guaranteed.

It’s now almost certain to happen. Standard listing rules have made the previous regulatory steps unimportant. Now, all that’s left is for the final approval from the Securities and Exchange Commission, and they’ve already submitted the fourth revision of their application for Solana. It could be approved very soon, so be prepared.

— Eric Balchunas (@EricBalchunas) September 29, 2025

As a crypto investor, I’m seeing a lot of positive energy around Bitcoin and Ethereum spot ETFs potentially getting approved soon, and the expectation that the Federal Reserve might start lowering interest rates is also helping keep demand strong. However, I’m a little concerned about Solana right now because people are consistently withdrawing their SOL from staking, which could put downward pressure on its price in the short term.

Solana Price Forecast: Golden Cross Points to Upside, but Resistance Remains Firm

Solana’s price recently jumped above $230, creating a bullish signal known as a Golden Cross. This happens when its short-term moving average crosses above longer-term averages – in this case, the 5-day average moved above the 8-day and 13-day averages – suggesting the price is likely to continue rising.

Solana (SOL) Technical Price Analysis | October 3, 2025

The MACD indicator is now showing positive momentum, as the MACD line has moved above the signal line, increasing from 1.37 to 1.80. Additionally, the Relative Strength Index (RSI) is at 57.6, suggesting there’s still some potential for price increases before the market becomes overbought.

If SOL surpasses the $245 resistance level, it might break out and move towards $280, but it will likely encounter selling pressure there.

If Solana (SOL) fails to break past $240, its price could fall back to around $220, especially if a lot of people start selling their staked SOL.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Brent Oil Forecast

- USD THB PREDICTION

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

2025-10-04 00:57