In the grand circus of crypto, Solana has been handed the ringmaster’s whip-Fidelity’s latest stunt, allowing millions of U.S. investors to purchase SOL, is less a “move” and more a declaration of war against sanity. Institutional and retail capital now waltz in lockstep, like two drunkards clinging to a railing, hoping not to plummet. The question isn’t whether this matters; it’s whether the floor will hold. 🤡

Fidelity Access Strengthens Solana’s Price Outlook

Capital Markets, that paragon of seriousness, confirmed Fidelity now lets U.S. brokerage clients buy SOL. With $5.8 trillion in assets, this is less an “integration” and more a herd of elephants trampling a butterfly-except the butterfly is your savings. Regulated access to Solana’s “scalable ecosystem” (read: crypto’s most chaotic circus) means fresh liquidity will pour in like champagne at a wedding… for a blockchain. 🍾

Solana Price Prediction: Breakout Structure Takes Shape

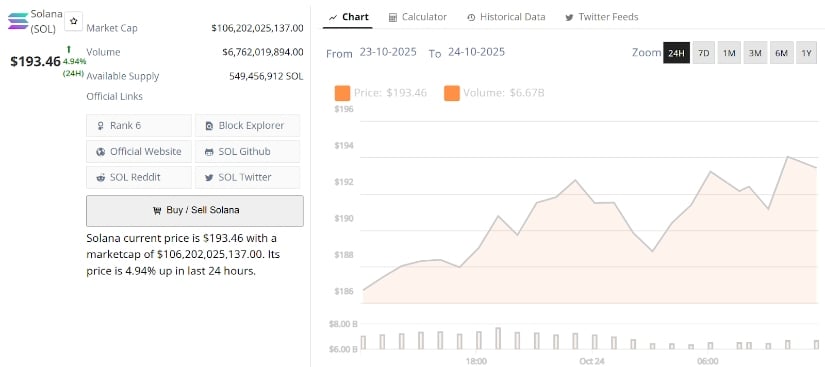

The SOL chart now resembles a geometrically blessed triangle, tightening near resistance like a coiled spring. Accumulation? Yes. Exhaustion? Only in the wallets of those who sold too early. This pattern, dear reader, is the prelude to a grand finale-a fireworks show funded by your future earnings. 🎆

If Solana breaks above $210-$220, the next target is $280-$300, a price range where even Gordon Ramsay would say, “This is unreasonable.” Downside? $170-$180 remains the “structural floor,” a.k.a. the last place where buyers still have enough sense to buy. Momentum compresses like a accordion in a crowded metro-soon, it’ll either play a tune or burst into flames. 🔥

Short-Term Setup Points Towards $200

Crypto Chef, that gastronomic oracle of markets, predicts SOL will breach $200 in 24 hours. Supported by an ascending channel? More like an ascending ladder to madness. Higher lows and pullbacks near $185-$190? A masquerade ball where everyone’s pretending they’re not terrified. 🎭

A sustained breakout through $200 could trigger a liquidity sprint toward $225-$240, assuming volume doesn’t vanish like a magician’s rabbit. Solana currently sits in the channel’s upper third-a prime real estate for acceleration, or a cliff’s edge. Choose your metaphor wisely. 🏗️

Indicators Confirm Strength Across Key Timeframes

Gemxbt’s dashboard now glows like a Christmas tree-SOL trading above EMAs, MACD bullish, RSI overbought. This isn’t technical analysis; it’s a symphony of greed. Historically, when bulls close above EMAs, they dance the cha-cha-cha into consolidation. But here, in this madness, the bulls wear tuxedos and never stop dancing. 🕺

The RSI nearing overbought territory is less a warning and more an invitation-like a villain in a comic book whispering, “I’m not evil… I’m unconventional.” Follow-through rallies? Expect 8-12% higher before the inevitable coffee break. Bulls, it seems, are the true party animals. 🐆

Final Thoughts: Institutional Momentum Meets Technical Strength

Between Fidelity’s love affair with SOL and Solana’s market structure tightening like a vice, we’re witnessing a financial ballet-where every pirouette is a pump, and every fall a dump. Direct retail access, bullish EMAs, and ascending triangles? A masterstroke of madness. The next target? $250-$280, because why not dream of a moonshot when the moon’s already been colonized? 🌕

If price clears $200-$210, the next target is $250-$280. Fundamentals? Strengthening. Adoption? Global. Solana’s trajectory? Increasingly bullish, like a rocket fueled by caffeine and delusion. Buckle up, dear reader-the ride is only getting wilder. 🚀

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

2025-10-24 12:05