(Ah, the drama of our dear monetary adventures!) The on-chain lifeblood of Solana, dear friends, has slyly slipped into a realm better described by one gentle Russian author: the loss-taking zone. Much like our boreal brethren, the bears, Solana seems inclined to hibernate, its liquidity somehow evaporating before our very eyes.

Solana’s Liquidity: A Tale of Bearish Despair

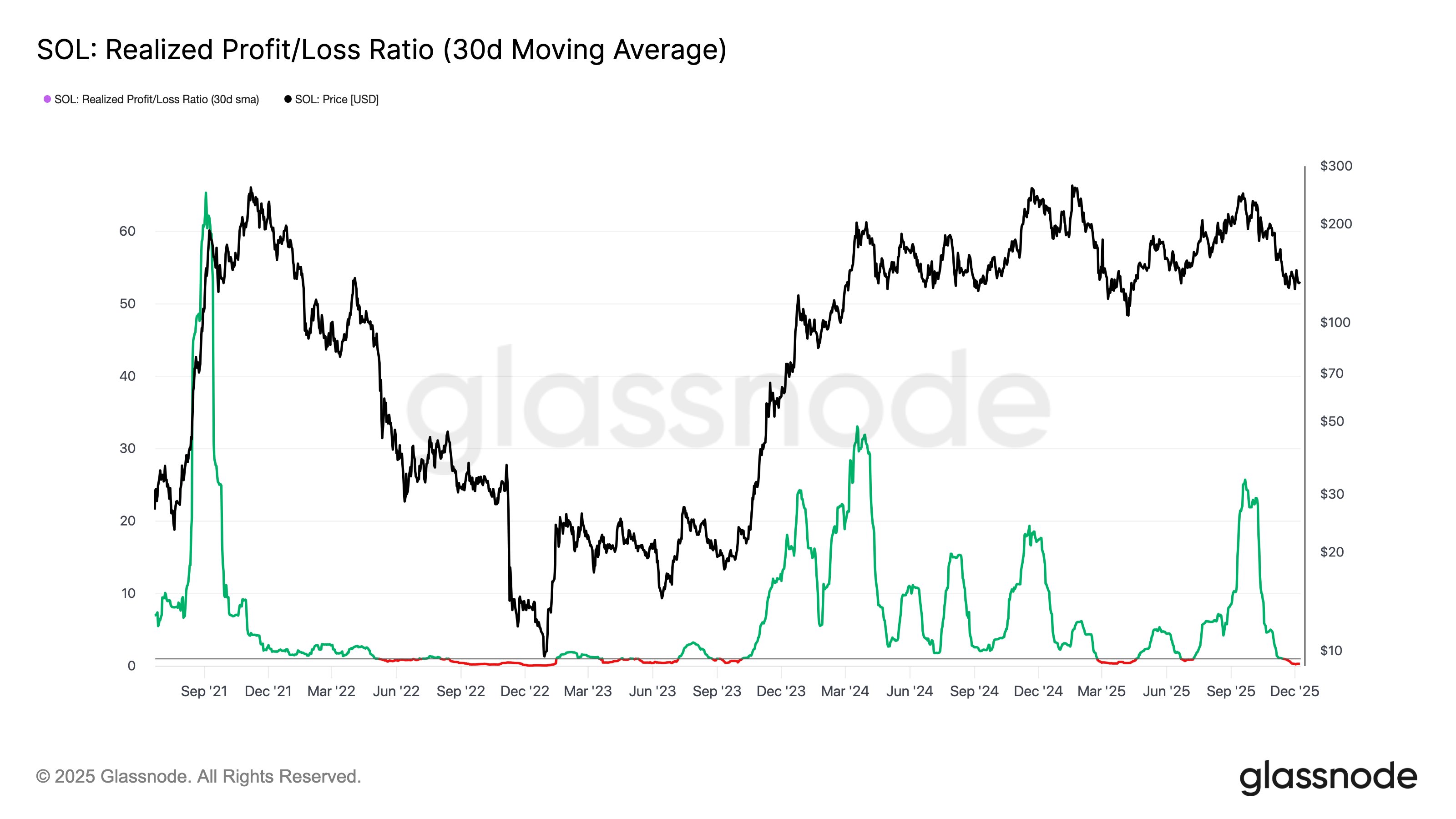

According to the confessions of the digital oracle, Glassnode, the illustrious liquidity of Solana has bonded quite unexpectedly with the dreary figures of past bear markets. As you may well guess from your prior explorations in logic and mathematics, the Realized Profit/Loss Ratio is their magical divining rod.

Here’s where it gets intriguing: imagine, if you will, every coin as a resident of a bustling town square, where they relay their market adventures. A coin joyously proclaiming itself sold at a higher price than last seen would be celebrating. Alas, if the opposite is true, they must gingerly step into a circle marked with the starker word: “loss.” A game of mathematical musical chairs, if you will.

Artisans of this quaint indicator meticulously combed through the market ledger, calculating this arithmetic tête-à-tête between the latest price and that of prior transactions. They counted their pennies and dined out accordingly, whether on profits bountiful or losses lamentable.

The visual aide below (courtesy of Glassnode’s cartographers and sorcerers of the digital sphere) paints the fluctuations of this peculiar race over several years:

A most generous spike in the delightful month of September! Oh, the delights of profit-taking at its finest. But alas, after reaching for the stars in October, this valiant hero’s journey descended with a fierce swiftness.

Norway’s winter stayed true to its reputation when the month of November ushered the Realized Profit/Loss below the esteemed number 1. This, for the uninitiated, signaled that losses shimmied past profits. Since that fateful day, the floorboards of this humble abode have grown more creaky in the loss-taking territory, a poetic yet disturbing melody of capitulation prevails.

Glassnode, always the observant spectator, notes this twist in our tale marks “liquidity that has contracted back to depths typically suggested by deep bear markets.” Remember 2022? Oh, what fond memories of SOL‘s acrobatic descent are brought forth.

Our stage now awaits the next act: will the liquidity make a beeline for solace, or has this transactional farce found a temporary resting place?

SOL Price: A Tale of Peaks and Falls

In its high frolic one merry Tuesday, SOL reached an apex of $144 only to descend to the more contemplative locale of $138. A sine qua non for those who, like us, find comfort in watching the ebbs and flows of fortune’s fickle favours.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- 🚨 Last Call for $BEST: The Wallet Revolution Ends in 3 Hours! 🚀

- Silver Rate Forecast

- BNSOL PREDICTION. BNSOL cryptocurrency

- USD VND PREDICTION

- Altcoin Frenzy: BANK Soars 60% While MET Plays Catch-Up 😱💸

- Privacy Coin Frenzy: Zcash’s $741 Surge Stirs the Crypto World

- HYPE PREDICTION. HYPE cryptocurrency

2025-12-11 06:12