Amidst the cacophony of a mixed crypto market, Solana emerges like a stealthy protagonist, orchestrating a recovery so sharp it could slice through Bitcoin’s ego. 🎭 From the 4-hour charts whispering tales of reclaimed trends to the double-bottom signals screaming “rebound,” SOL is donning the cape of a market turnaround hero. 🦸

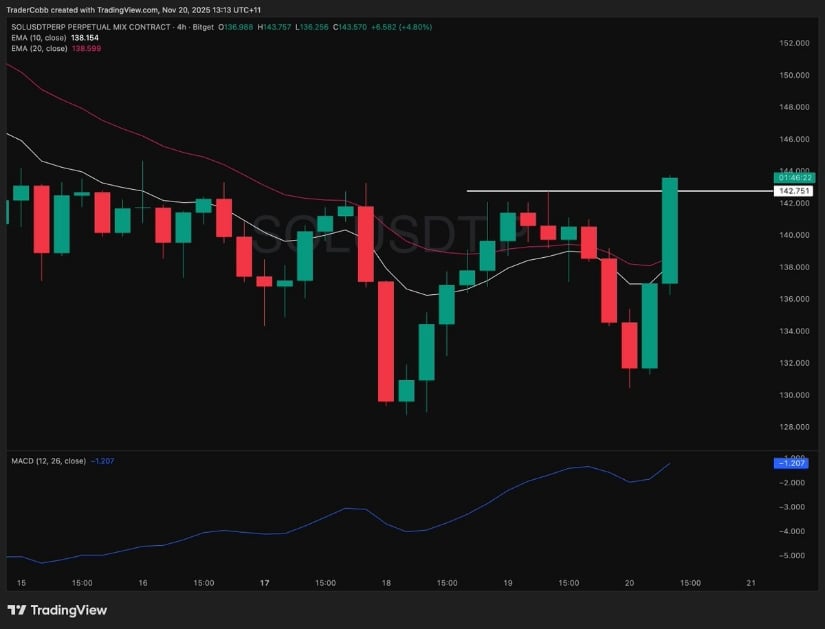

Solana’s 4H Recovery: A Market Ballet

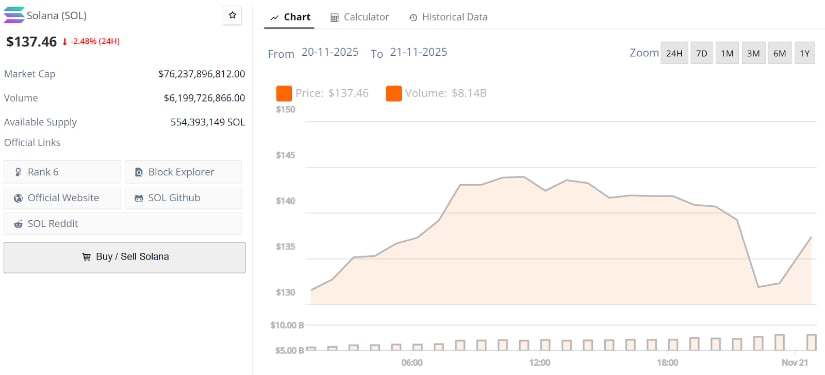

Solana pirouettes ahead of its peers, reclaiming the 4-hour trend level with the grace of a prima ballerina. 🩰 Trader Cobb’s charts reveal SOL breaking above short-term resistance near $143-$145, trading above the EMA cluster like it owns the place. The candlestick expansion? Cleaner than a freshly laundered bedsheet. The wicks? Tighter than a miser’s wallet. Buyers? Conviction-fueled warriors. ⚔️

Here’s the kicker: SOL didn’t just bounce-it reclaimed a level, which is like saying, “I didn’t just survive the winter, I built a ski resort.” Historically, when Solana reclaims its 4-hour structure before its peers, it leads the next market rotation. This early reclaim is akin to buyers screaming, “We’re back, baby!” 🎉

Double-Bottom Structure: The $160 Dream

GTradeCrypto’s intraday chart showcases Solana breaking the descending channel while forming a textbook double bottom around $131-$133. 🏞️ Both lows are cleaner than a whistle, reactive like a cat on caffeine, and supported by oversold RSI readings. This trifecta often sets the stage for a continuation move so strong it could make Elon Musk tweet “wow.” 🚀

The double-bottom pattern points directly to $160, aligning with the upper channel boundary and the next high-volume node. With SOL trading around $140, the short-term resistance to clear sits at $146-$148. If bulls hold these levels, the path to $160 becomes as attainable as convincing a toddler to eat candy. 🍭

Bullish Catalysts: Solana’s Ecosystem Flourishes

Solana Sensei’s fundamentals whisper sweet nothings about bullish catalysts. Solana is #1 in app revenue, #1 in DEX volume, and boasts over 650 days of uptime-proving its stability like a seasoned yogi. 🧘♂️ Major institutions like Fidelity and VanEck have SOL ETFs live or approved, adding institutional fuel to the Solana fire. 🔥

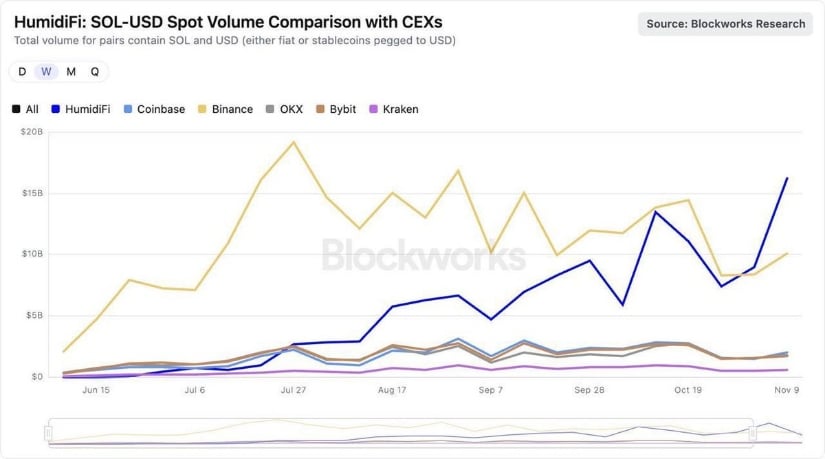

On-Chain Volume: The Silent Giant

Vibhu’s data reveals Solana’s most impressive feat: SOL/USDC on-chain volume outpaced all centralized exchanges combined. 🏆 This milestone is like finding out your favorite indie band just outsold Taylor Swift. The shift towards Solana’s low-fee, high-speed environment signals behavioral change, with on-chain liquidity surpassing aggregated CEX liquidity for the first time. 🌐

Solana’s Cup-and-Handle Structure: The Plot Thickens

While some predict a head-and-shoulders formation, the dude’s chart suggests a developing cup-and-handle structure. 🍵 The weekly range between $128-$180 remains intact, and despite volatility, Solana hasn’t broken below key macro support. The bearish scenario? A return to double digits, which feels as unlikely as a penguin winning a marathon. 🐧

Final Thoughts: Solana’s Recovery Symphony

Solana’s positioning as a strong large-cap performer is as clear as a cloudless sky. From 4-hour trend reclaims to intraday double-bottom formations, the technicals are singing a recovery hymn. 🎶 ETF inflows, growing user activity, and surging on-chain volume reinforce Solana’s dominance in the high-performance blockchain arena. If buyers defend support zones and momentum sustains, the next leg towards $160-$180 becomes as viable as a politician’s promise. 🤔

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CAD PREDICTION

- Brent Oil Forecast

- SOL PREDICTION. SOL cryptocurrency

- TON PREDICTION. TON cryptocurrency

- Nasdaq’s Nano Labs Plots Billion-Dollar BNB Grab—Did Binance Just Get a New Frenemy?

- Crypto’s $9.3B NFT Frenzy: Punks, Apes, and Penguins, Oh My!

- USD VND PREDICTION

2025-11-21 03:40