After raking in a staggering $92 million in weekly inflows and outshining all other chains in revenue this year, SOL is rapidly becoming the altcoin to watch, much to the delight of those who enjoy a good financial spectacle.

Solana Sees Major Institutional Interest

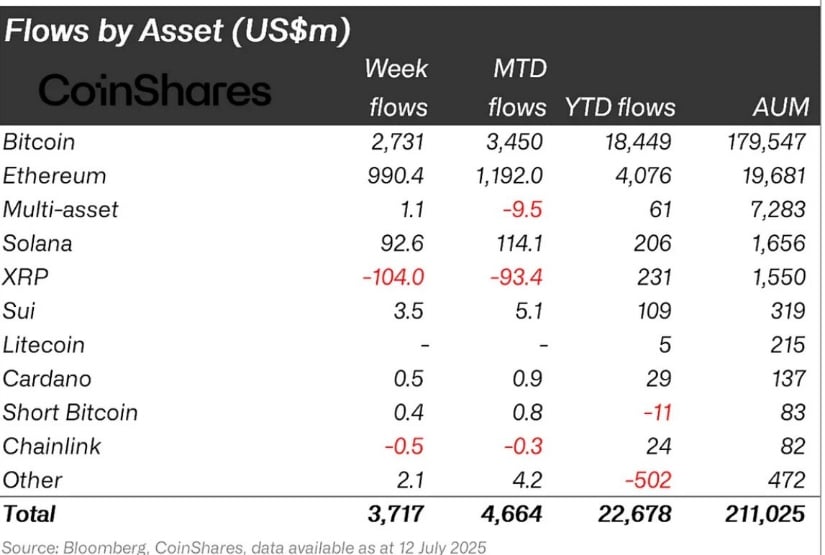

As the market’s risk appetite returns, Solana has logged one of its most impressive institutional weeks on record, pulling in a cool $92.6 million in net inflows, according to CoinShares data shared by SolanaFloor. Bitcoin, predictably, led the charge with a whopping $2.7 billion, but Solana’s performance places it in a league of its own, far above the usual suspects. 🏆

Institutional buyers are finally looking beyond the usual suspects. Solana’s year-to-date inflows now stand at $206 million, closing in on Ethereum’s $4 billion at a pace that would make a hare blush. While XRP saw the biggest outflow at -$104M, Solana’s rise in allocation highlights a shift in how capital is being distributed across the layer-1 space. 🚀

Solana Revenue Outpaces All Chains by a Wide Margin

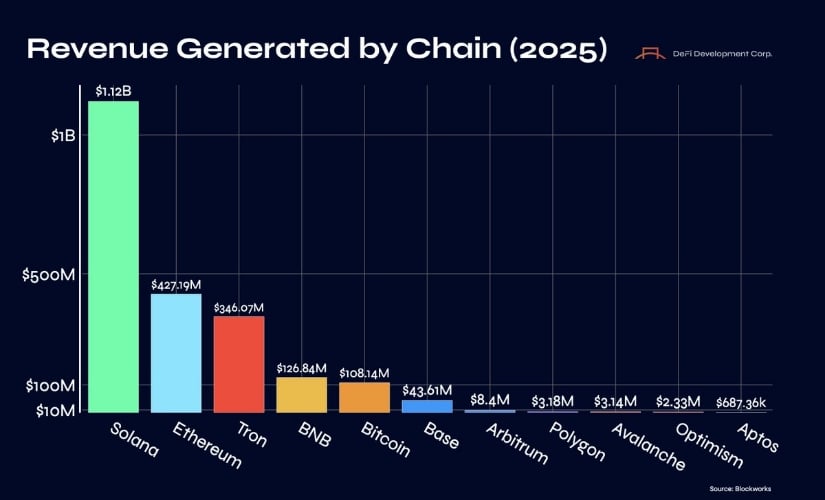

Solana isn’t just attracting capital; it’s turning that attention into cold, hard cash. The latest on-chain reveal by Defi Dev Corp shows that Solana has generated $1.12 billion in revenue year-to-date, more than double Ethereum’s $427 million and nearly triple what TRON has managed. This isn’t just a marginal lead; it’s a landslide. 🏆🏆🏆

With its massive institutional inflows and this level of revenue performance, Solana’s market position is looking increasingly solid. This combination of investor confidence and on-chain strength suggests that the price is likely to see a positive impact. When usage and revenue are this high, it’s hard to bet against it. 💰

Solana Price Holds Range With $263 Breakout Potential

While Solana’s fundamentals continue to strengthen, the chart is yet to reflect this momentum. According to Danny Marques, SOL remains firmly within its ascending accumulation range, currently hovering around the lower trendline support. The chart shows a clear channel forming with support at roughly $125 and resistance extending toward $190. Multiple oscillators, including the stochastic RSI, are curling up from oversold levels, signaling a possible rotation out of the bottom of the range. 📈

This technical base pairs well with the growing narrative around inflows and revenue. With SOL still trading under $170 despite being at the forefront of capital and usage metrics, the setup looks favorable from a risk-reward standpoint. Until resistance near $190 breaks, the play remains accumulation within the channel. But if it does break, the upper targets are between $263 and $415, marked by key Fib extensions. 🚀

SOL/BTC Pair on the Brink of a Breakout

The SOL/BTC chart is starting to show early signs of a potential trend reversal. After months of a slow bleed within a descending structure, price is now testing a key horizontal support zone that has historically held up during major cycle resets. As seen in Rendoshi’s chart, there’s a clean confluence of prior demand and a falling trendline that could flip if SOL gets a solid weekly close above the 0.00135 BTC level. A move through this zone would invalidate the current downtrend and open room toward the 0.0018 to 0.0020 BTC resistance area. 📊

This pairs well with Solana’s broader narrative. Now, with Solana price showing relative strength against Bitcoin, it becomes the next key metric to watch. A breakout in the SOL/BTC pair would further validate Solana’s growing role as a core player in this cycle. 🌟

Solana Presses Higher, But BTC Still Holds the Keys

Solana is attempting to break through its short-term range just above a local resistance near $168, as highlighted by Crypto Chase. While SOL’s structure looks constructive, it’s waiting for Bitcoin to continue holding its strength. The current setup shows a clear horizontal range breakout attempt, but momentum remains tentative, likely waiting on broader confirmation from BTC before committing to a stronger move. 🕵️♂️

That relationship matters because Bitcoin is still the dominant trend-setter, and Solana’s ability to rally meaningfully hinges on BTC maintaining strength above its key levels. If Bitcoin stabilizes or continues upward, SOL could see a clean extension from this breakout area. 📈

Final Thoughts: What Next for Solana?

Solana is walking into a sweet spot where both the numbers and the narrative are aligning. Massive institutional inflows, top-of-the-chain revenue, and early signs of price rotation all suggest that SOL isn’t just trending; it’s building a sustainable foundation. That $190 level might be the short-term ceiling, but if it cracks, the chart opens up in a big way, with potential towards $263 and even $415. 🚀🚀🚀

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- USD CNY PREDICTION

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Shiba Inu Shakes, Barks & 🐕💥

- Silver Rate Forecast

- USD VND PREDICTION

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- EUR USD PREDICTION

2025-07-15 00:59