In the grand theater of financial folly, the week concluded with a dramatic flourish: Bitcoin and Ether ETFs, those once-proud titans of the crypto realm, bled a combined $290 million, their wounds self-inflicted by the fickle hands of investors. Meanwhile, Solana ETFs, the unexpected hero of this tale, basked in a $44 million inflow, their green banner waving defiantly as October drew its final breath.

The Crypto ETFs’ Tale of Woe and Glory: Solana Ascends, Bitcoin and Ether Falter

The final act of the week revealed a scene all too familiar: a sea of red engulfing Bitcoin and Ether ETFs, while Solana stood as an oasis of green. Investors, ever the cautious lot, retreated into their shells as November loomed, withdrawing hundreds of millions from the leading crypto pairs. Yet, Solana’s momentum, a beacon of hope, continued to dazzle, leaving one to wonder if the crypto gods had simply misplaced their favor.

Bitcoin ETFs, once the darlings of the market, suffered a humiliating $191.60 million exodus across four major funds, ending their week on a note as sour as a Tolstoy novel. Blackrock’s IBIT, the erstwhile champion, took the brunt with a $149.33 million outflow, its early-week gains evaporating like dew under the sun. Ark & 21Shares’ ARKB followed suit with $19.30 million in redemptions, while Bitwise’s BITB and Fidelity’s FBTC trailed with $17.88 million and $11.97 million, respectively. Grayscale’s GBTC, the lone survivor, clung to a meager $6.88 million inflow. Despite a robust $4.25 billion in trading, total net assets shriveled to $147.71 billion, a testament to the market’s capricious nature.

Ether ETFs, not to be outdone in their misery, mirrored their Bitcoin counterparts with $98.20 million in outflows across five funds. Blackrock’s ETHA led the retreat with $38.63 million fleeing, followed by Fidelity’s FETH with $27.12 million. Grayscale’s ETHE and Ether Mini Trust added to the woes with $13.73 million and $12.07 million in redemptions, while Bitwise’s ETHW shed $6.65 million. With $1.61 billion traded, net assets held steady at $26.02 billion, a small consolation in a week of losses.

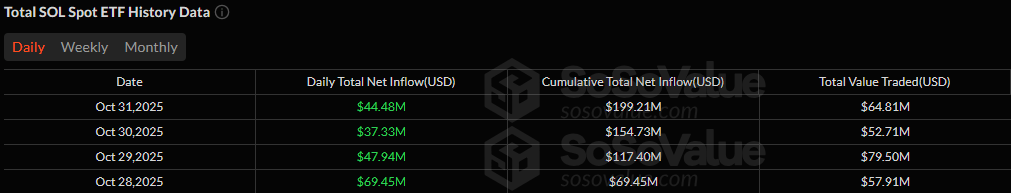

Amidst this carnage, Solana ETFs emerged as the phoenix of the market. Bitwise’s BSOL, the undisputed star, attracted the entire $44.48 million inflow, buoyed by unwavering investor confidence and $64.81 million in trading activity. Net assets soared past the half-billion mark to $502.04 million, solidifying Solana’s place in the ETF pantheon. One might say, in the spirit of Tolstoy, that while some were busy losing, Solana was quietly conquering.

Bitcoin and Ether may have stumbled to the finish line, but Solana’s ascent offered a glimmer of hope, a reminder that the crypto world, much like life itself, is ever-changing and full of surprises. 🌪️

FAQ 💸

- Why did Bitcoin and Ether ETFs end the week lower?

Investors, in their infinite wisdom (or lack thereof), withdrew over $290 million as risk sentiment cooled faster than a Russian winter. ❄️ - Which funds saw the biggest outflows?

Blackrock’s IBIT led the Bitcoin exodus with $149 million, while ETHA topped Ether redemptions at $39 million. A true tragedy of modern finance. 🎭 - Why did Solana ETFs buck the trend?

Bitwise’s BSOL attracted $44 million, proving that sometimes the underdog steals the show. 🐕 - What does this mean for crypto ETF sentiment?

While Bitcoin and Ether took a backseat, Solana’s resilience signals a growing appetite for the new and shiny. After all, who doesn’t love a good comeback story? 🚀

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Altcoins? Seriously?

- Gold Rate Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Silver Rate Forecast

- Brent Oil Forecast

- 🚀 Doge Goes Legit in Japan: From Memes to Money Moves! 💼

- USDe Booms Post-GENIUS Act, But Is Ethena’s Stablecoin the UST of This Cycle?

- Bitcoin’s Bounce: A Bullish Ballet or Just a Blip? 🎭💰

2025-11-02 01:58