Monsieur Stripe, that illustrious merchant of virtual coinage, hath not simply dallied in a market bazaar by acquiring Privy and Bridge—oh non, messieurs et mesdames! He hath announced to the world, as loudly as a town crier with a megaphone, “The crypto experiment, c’est fini!” The dice hath been rolled, and Stripe bets his fine doublet that this will make him the crowned king of tech ducats. 💸

Behold! The picture is clear as the bottom of a wine bottle at the end of a Parisian soirée: the future jangles not between stodgy banks and crypto wizards, but in the miraculous blending of both—like an accountant who secretly loves Molière’s comedies.

Acquisitions Expose a Comedy of Errors

With a purse lighter by a billion (or two), Stripe exposes to all what every Parisian tailor already knows: the crypto wardrobe is in tatters, hastily stitched by rival couturiers never intending to share a mannequin. Pray, have you ever seen bankers attempt needlework? The result—friction most unbecoming!

As if payments themselves were not enough of a dramatic entrée, users crave more: trading stablecoins like a juggler with too many eggs, tokenizing real-world assets (a goat! a vineyard! a slightly dishonest lawyer!), and jumping headfirst into the wild world of smart contracts. Yet, as these ambitious souls careen from service to service, they hit more snags than a marquise in a corset two sizes too small.

But Stripe, wise as a fox and twice as cunning, purchases the best trinkets—hoping to smooth those wretched seams that have kept crypto adoption as rare as an honest financier. Whether it be compliance gaps, technological fistfights, or the classic “but my smart contract doesn’t talk to yours,” all stand exposed in this comedy of cross-purposes.

The Full-Stack Illusion

Now, a word on those who believe one can sheath a sword with band-aids: the full-stack philosophy! Only those who build their empire from cellar to garret—each brick carved with the love of a craftsman and not glued on with ye olde startup optimism—shall ascend.

Marvel at what a true crypto opera demands: a liquidity bazaar fit for any caprice, a tokenization forge hotter than Tartuffe’s temper, cloud palaces for ever-multiplying users, AI servants to spy on risk, and ironclad custody—where not even Figaro’s schemes can break security.

To think, dear reader, that one may bolt together the compliance of a monk, the user joy of Molière’s audience, and the technical standards of a Parisian barber, is folly! Each must be composed with the others in mind if the show is not to dissolve into farce.

Native Crypto or Bust!

The plot thickens! Let not the gray-haired bankers believe they can gild their ledgers with some flashy crypto features and take a bow. Non! True innovation is for those who marry programmable money and programmable assets in a spectacle of intelligence, automation, and global mischief.

Victory, messieurs, shall go to the platforms boasting a seamless masquerade of full-service offerings—wherever compliance wears her wig, and users glide from custody to trading to tokenization without even a stubbed toe.

Building atop antique infrastructure is as effective as reciting comedy with your breeches around your ankles. The industry’s Argan must adopt an all-encompassing vision, wherein compliance, joy, architecture, and business ambitions unite in a singular prenuptial contract.

Onward, to Crypto’s Burlesque!

The grand convergence is nigh! Soon, dear creditors and debitors, whether you seek swift global settlements or wish clever robbers to automate your IOUs, the wonders of crypto shall be yours—perhaps without you even knowing it. As invisible as a secret passage in a French farce, technology will lurk behind the curtain.

Let it be said: the next age shall not be ruled by the banker’s add-on affair, hastily stitched like Don Juan’s list of lovers. Nay, success will pour upon the crypto-native stages, with platforms both compliant and secure—yet flamboyant enough to win applause from even the most skeptical notary.

Who will seize the scepter for the coming decade? Those who, with the bravado of Scapin, orchestrate seamless spectacles across the land of digital assets, seeing finance as programmable, borderless, and ever-dramatic. And should any regulator protest, remind them: all the world’s a stage, but only some shall exit—rich.

P.S. The views above are more the whimsy of this humble author than the wishes of CoinDesk or its noble house. 🎭

Tether and Adecoagro Try Bitcoin Mining in Brazil—Renewables and Laughable Plans Unite!

Traders Assemble Short Positions as Bitcoin Doth Approach Fame and Folly Once Again

PEPE Leaps 10%—Will the Memecoin Commedia Ever End?

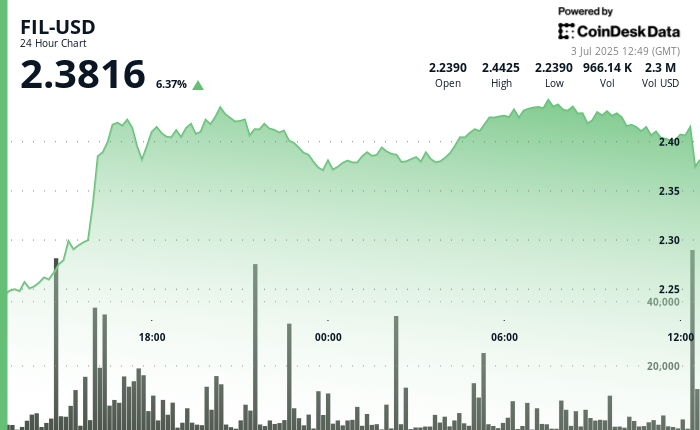

Filecoin Rises 9%—Crypto’s Farcical Fates Twirl Yet Again

Coinone Courts Victory—South Korean Judges Join the Crypto Pantomime!

Abu Dhabi’s Tokenized Bonds: HSBC, FAB, and a Cast of Regulatory Characters

US Jobs Report: 147K Added, Unemployment Falls—The Chorus Cheers!

One Currency to Beat Bitcoin—Macro Markets in a Slapstick Race!

US Baffled by Absence of Bitcoin Reserve—Ask Notary, Blame Everyone?

IMF Says “Non!” to Pakistan’s Bitcoin Mining Subsidy—Drama or Farce?

XRP Bets Flood the Scene as Memecoin Mania Wedges into Act II

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- USD VND PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Shiba Inu Shakes, Barks & 🐕💥

- BNB PREDICTION. BNB cryptocurrency

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2025-07-03 19:06