Markets

What to know:

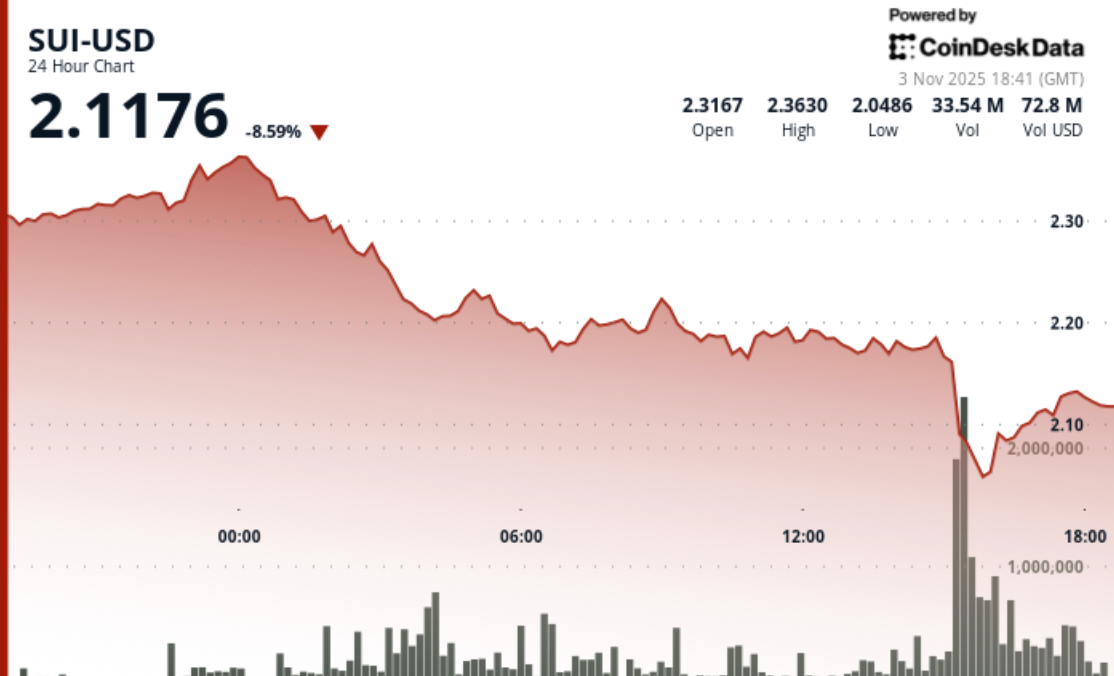

- SUI dropped 9% to $2.10 in 24 hours, falling nearly 5% more than the broader crypto market. 🤡

- Trading volume surged over 600% above average as SUI broke key support, pointing to institutional selling. 🧠💸

- A sharp rebound from $2.04 stalled below $2.13, showing weak follow-through from buyers after the crash. 😭

In the shadow of the market’s tempest, SUI, the native token of the Sui network, plunged 9% to $2.10 over the past 24 hours. A spectacle of despair, it outperformed the broader crypto market’s selloff-by a margin of 5%, no less. 🧨

The token’s 4.89% lag behind the crypto market suggests this was no mere storm; it was a calculated purge, a Sui-specific purgatory. 🕯️

The selloff carried the hallmarks of institutional liquidation, a ballet of chaos. Prices dropped from $2.32 to test critical support, with trading volume surging 53% above the 7-day average. A high-stakes game of chess, where the pieces were sold en masse. 🏰♟️

At the core of the move was a decisive breakdown at $2.16. SUI dropped through that level on volume of 99.13 million tokens-628% above its 24-hour average-confirming strong bearish pressure. A V-shaped bounce from $2.04, as if the market itself were whispering, “Buy the dip… but only if you’re a fool.” 🧠💸

Still, the recovery lost steam near $2.13, a psychological resistance zone. Volume declined into the close, suggesting buyers lacked conviction to push SUI meaningfully higher in the short term. A tale of woe, written in numbers. 📉

Elsewhere, the CoinDesk 5 Index (CD5) saw a 3.35% drop to $1,860.70, including a flash crash to $1,826.66 before bouncing back. The move also showed signs of institutional selling, overwhelming technical support in a high-volatility session. A circus of chaos, where the clowns wore suits and ties. 🎪

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- USD VND PREDICTION

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- GBP MYR PREDICTION

- FTX Customers Claim Law Firm Was Key Player in Crypto Fraud – Shocking Revelations!

2025-11-03 22:32