What to know:

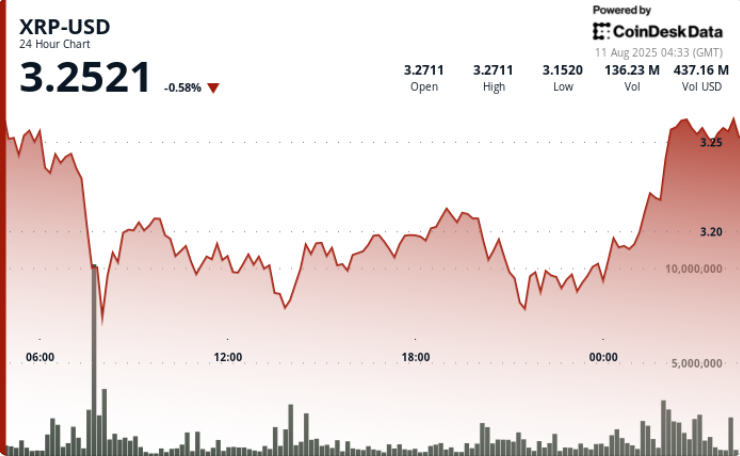

- XRP danced up 11% after the SEC decided it was too tired to chase Ripple Labs anymore, hitting a sublime $3.27.

- Institutional trading swelled by a comical 208% to $12.40 billion, as though some financial gatekeepers had just discovered a new playground.

- The $3.15-$3.16 zone established itself as a rather delightful support level, while resistance emerged at the overambitious heights of $3.24-$3.27.

Technical Analysis Overview

XRP careened up by 11% within 24 hours, transforming itself from $2.90 into a financial firework at $3.27, and gently settling at $3.22 as if it were always meant to be. This gala took place amidst institutional trading volumes vaulting up 208% to $12.40 billion after the SEC’s decision to toss its hat out of the ring regarding Ripple Labs.

Open interest in derivatives pirouetted up 15% to $5.90 billion, demonstrating that the big league players were playing a rather aggressive game of financial hopscotch.

Price action was nothing short of a theatrical performance, replete with early-session melodrama that saw a sharp drop from $3.24 to $3.16 during the 07:00 hour on a rather respectable volume of 144.54 million. However, buyers bravely defended the $3.15-$3.16 zone, leading to a late-session push that waltzed past the $3.22 resistance and held above $3.24 as the curtains fell.

News Background

Ah, the Securities and Exchange Commission and Ripple Labs have finally tucked their squabble away, opting instead to dismiss appeals in their long-running XRP saga. This delightful resolution lifts a regulatory cloud, heralding an era ripe for corporate and institutional adoption – much like a banquet for the hungry in financial dining rooms.

This rally, of course, is accompanied by a marked uptick in derivatives activity and some rather optimistic technical setups, with some institutional research desks eyeing potential medium-term gains stretching out to a fanciful $4.50-$5.00.

00 selloff from $3.24.

• A late-session breakout gracefully cleared the $3.22 resistance on the back of large orders above 4 million units, much to the delight of onlookers.

• The session danced within a charming range of $0.11 (3% volatility) between the lofty $3.27 high and the grounded $3.15 low.

Market Analysis and Economic Factors

The clarity bestowed upon us mere mortals has ignited a frenetic rebalancing of corporate treasuries coupled with new speculative inflows, as if financial establishments had lost their marbles. The $3.15 support now serves as a splendid reference point for short-term risk management, while $3.24-$3.27 tempts traders with its proximity as a near-term resistance.

A breakout above this cheerful band could send momentum soaring toward higher technical targets, especially if Japan’s ETF fandom decides to spread its sweet nectar into U.S. markets.

Technical Indicators Analysis

• Volume surged to a staggering $12.40B, a jovial 208% rise from the previous day.

• Open interest sauntered up by 15% to $5.90B, whispering of leveraged machinations.

• Resistance: $3.24-$3.27; Support: $3.15-$3.16.

• Breakout above $3.22 confirmed by whimsy and late-session institutional flows.

• Technical setup elegantly aligns with a breakout from multi-month consolidation, as if it were rehearsed.

What Traders Are Watching

• A hopeful follow-through above $3.27 would confirm the breakout needed to reach a tantalizing $3.50+.

• The durability of large-holder accumulation post-regulatory resolution, a veritable soap opera in the financial world.

• The effects of derivatives positioning on the captivating dance of spot market volatility.

• The potential ripple from Japan’s SBI Bitcoin-XRP ETF filing, which could be the cherry on their investment sundae.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD THB PREDICTION

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- Gold Rate Forecast

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

2025-08-11 08:20