In the dark, mysterious, and slightly damp world of crypto prognostication, Glassnode—the Discworld equivalent of a wizard peering into a bowl of particularly expensive custard—has waved its analytical wand over the $97,000 to $98,000 zone for Bitcoin. Why? Well, apparently this patch of digital sod is positively crawling with financial foot traffic. 🪙🐾

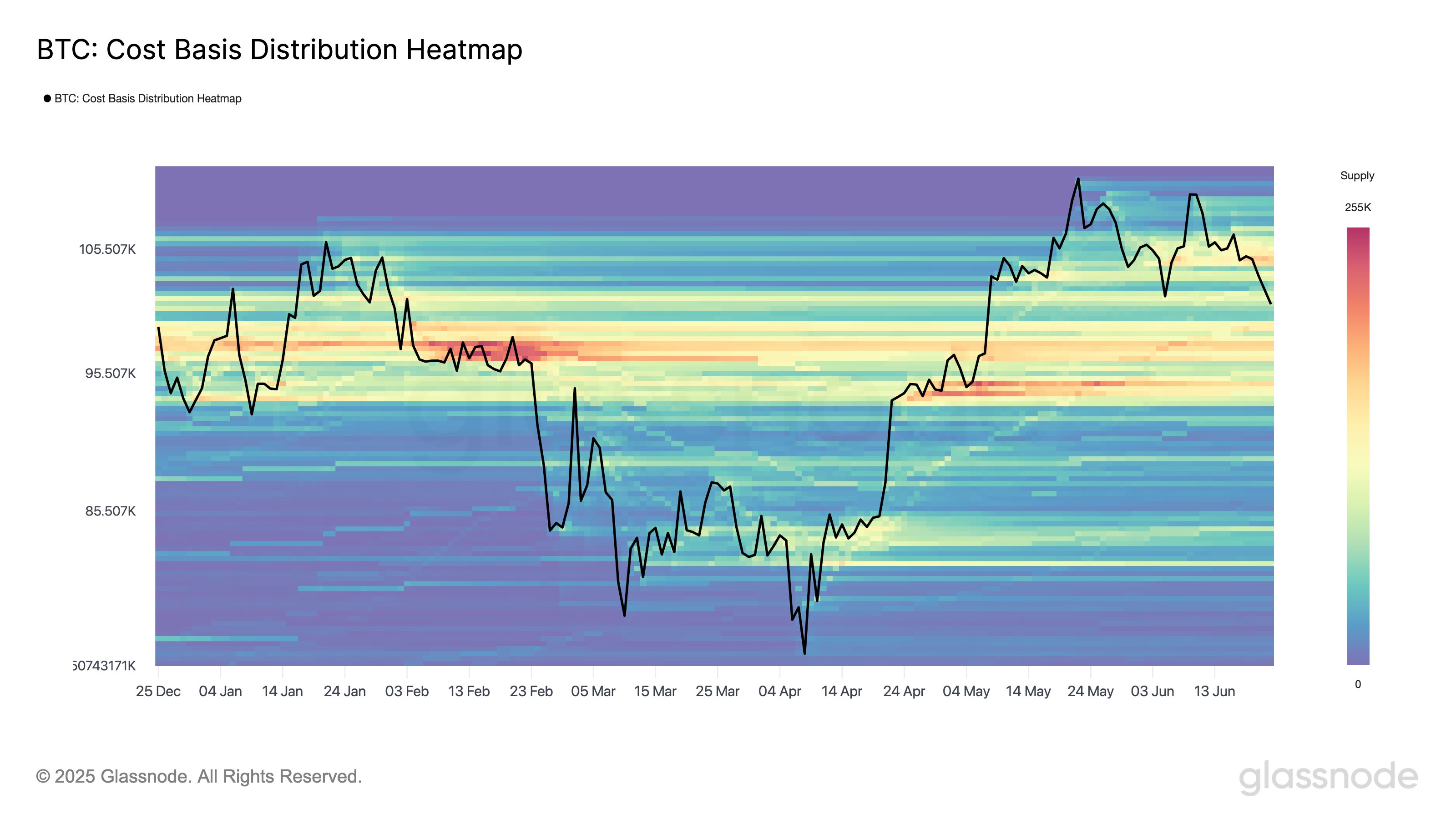

Cost Basis Distribution: Where Spreadsheets Meet Fiction

Imagine, if you will, the Cost Basis Distribution, or CBD for short. (No, it won’t help you relax, though your portfolio might wish for that.) This arcane metric examines where the masses last handed over their hard-earned coin for a slice of Bitcoin pie. Picture a carnival game where you try to guess where people last lost their money; now replace the stuffed animals with graphs, and voilà.

What you’ll notice—apart from your own bafflement—is a suspiciously chunky concentration in the $97k-$98k bracket. It’s like every Bitcoin holder stopped here to rest, refuel, and argue over whose turn it is to drive the Lambo. If a price drops back down to this neighbourhood, expect old investors to either double down or shout “Taxi!” and leg it.

Should prices fall, the logic is simple: “Buy the dip!” says one part of the crowd. “Sell before the dip gets any dippier!” says the other. Shakespeare would have written a tragicomedy about these people, if he’d known about blockchains and laser eyes. Yesterday, Bitcoin did the hokey pokey around this price band before tottering away again, presumably after a stiff drink.

If Bitcoin trips, stumbles, and retraces its steps (like a wizard who forgot where he left his staff), this zone may be the pivot to watch—or the trapdoor leading into the Dungeon Dimensions of market sentiment. 🕳️

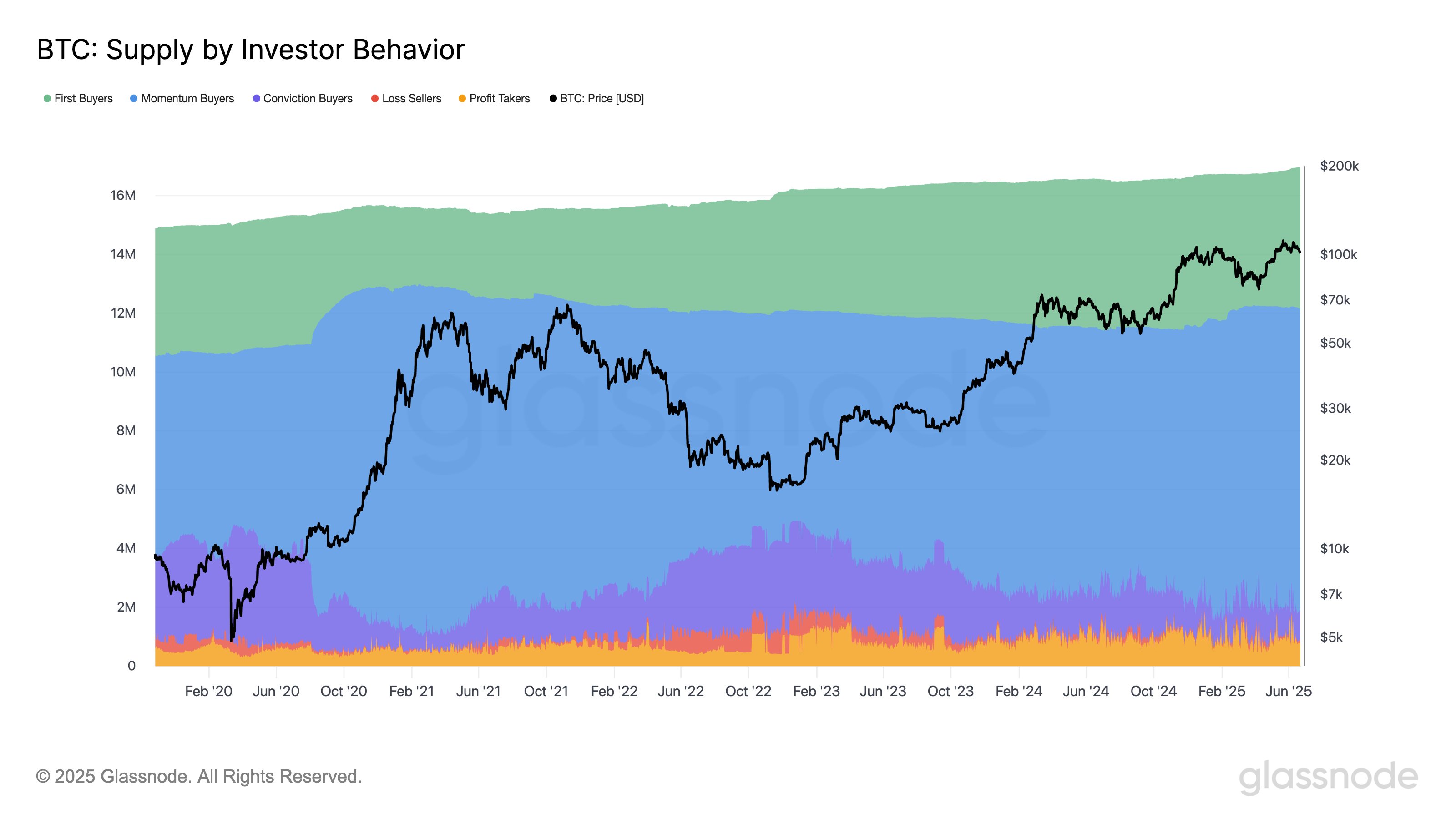

But wait! There’s more! While CBD merely shows where the supply is stacked up, it doesn’t tell us who’s hoarding or panicking. Enter Glassnode’s behavioral cohorts, those delightfully labelled ringwraiths of crypto: First Buyers, Momentum Buyers, Conviction Buyers, Loss Sellers, and Profit Takers. It’s less Tolkien, more financial pantomime.

First Buyers (in green) represent the newbies rushing into the fray, pockets jangling and eyes ablaze with fresh hope (read: “blissfully unaware”). Then we have Momentum Buyers (blue), surfing whatever wave looks shiniest, and Conviction Buyers (purple), defiantly nibbling on Bitcoin as prices drop, insisting it’s all part of their master plan. 🤦♂️

Trailing behind are Loss Sellers (red), who’ve discovered their legendary nerves were on extended holiday, and Profit Takers (yellow), cashing out just in time to tell their friends, “I always knew it would go up.” Glassnode noted a 29% surge in Loss Sellers lately—proving that panic is as contagious as laughter at a wizards’ convention. But Conviction Buyers are still buying, because sometimes denial isn’t just a river in Egypt—it’s a portfolio strategy.

BTC Price: Slightly Detached From Reality

As of this writing, Bitcoin hovers about $103,900—down 4% for the week. This is less a “plunge” and more a “vague totter,” like an elderly billionaire wandering through his wine cellar in the dark.

Stay tuned: markets, like wizards and cats, rarely do what you want them to do. But at least they’re never boring. 🪄🐈

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Ethereum’s Price Plummets, But Its Economy Dances Salsa – Here’s the Plot Twist!

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Gold Rate Forecast

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

2025-06-24 09:18