Ah, the inimitable Donald Trump, that paragon of subtlety and nuance, has declared his intention to metamorphose the United States into a ‘Bitcoin superpower.’ 🌟 How quaint! The man who once mistook a wind turbine for a national security threat now fancies himself the maestro of the crypto symphony. He believes, with all the conviction of a cat chasing a laser pointer, that this is the key to outshining China and other nations. 🌍✨

- The erstwhile President, with a flourish of his golden quill, vows to elevate the United States to the zenith of crypto glory, lest China or any other upstart nation dare to usurp the throne. 👑

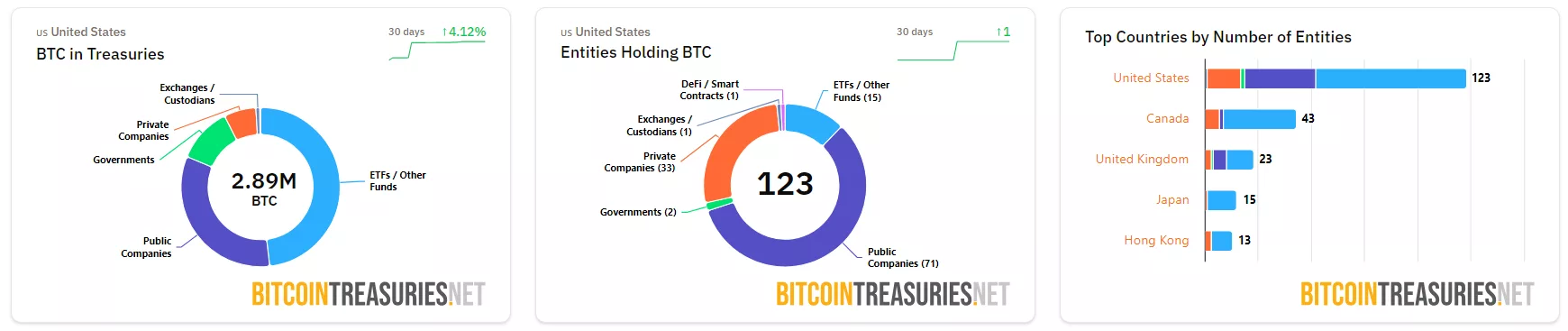

- As of November 6th, the U.S. boasts a treasure trove of 326,588 BTC, a sum so modest it could barely buy a single Van Gogh, yet it crowns them the largest government holder of Bitcoin. 🎨💰

At the America Business Forum in Miami, Florida-a locale as gaudy as his ties-Trump exhorted the assembled titans of industry and the plebeians alike to embrace crypto, particularly Bitcoin. 🌴 He waxed lyrical about its potential to alleviate the burden on the U.S. dollar, as though it were a panacea for all economic ills. “We’re making the United States the Bitcoin superpower, the crypto capital of the world,” he proclaimed, with the gravitas of a man who once sold steaks. 🥩

Not content with this grandiose vision, Trump also declared the U.S. the “undisputed leader in artificial intelligence,” a claim as tenuous as his grasp of geography. 🌐

Ever the dramatist, Trump invoked the specter of China, that perennial bogeyman, warning that if the U.S. does not dominate crypto, China will. “They’re starting it, but they want to do it. Other countries want to do it. If we don’t do it properly, it’s a big industry,” he intoned, with all the urgency of a soap opera cliffhanger. 🎭

China, once the crypto Grinch, has softened its stance, perhaps realizing that stablecoins are the new black. Experts, ever the Cassandras, urge China to collaborate with Hong Kong to issue yuan-backed stablecoins, a move as likely to topple the U.S. dollar as a kitten is to topple a skyscraper. 🐱

JPMorgan analysts, those soothsayers of finance, predict that stablecoin adoption could generate $1.4 trillion in demand for the U.S. dollar by 2027. 🤑

Trump, ever the revisionist, lauded his administration for rescuing crypto from the clutches of the Biden regime, whose regulators were as crypto-friendly as a vampire at a garlic festival. 🧄 “Crypto was under siege. It’s not under siege anymore,” he declared, referencing his executive orders that established a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile. 📜

How much Bitcoin does the U.S. hold?

At present, the U.S. reigns supreme as the largest government holder of BTC, with a hoard of 326,588 BTC, or $33.69 billion. This treasure, amassed from the spoils of criminal forfeitures, represents a mere 1.55% of the total BTC supply. 🏛️

China, the runner-up, holds 190,000 BTC, also acquired through the noble art of confiscation. 🥈

The U.S. also leads in the number of BTC-holding entities, with 123 companies stockpiling the digital gold. The top three-Strategy, MARA Holdings, and XXI-are all American, naturally. Canada and the U.K. trail behind, with 43 and 23 companies respectively. 🏆

Despite this, the U.S. dollar remains the undisputed king of the stablecoin market, commanding over 90% of the total market cap. 👑

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- EUR USD PREDICTION

- Silver Rate Forecast

- USD VND PREDICTION

- GBP MYR PREDICTION

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

- IP PREDICTION. IP cryptocurrency

- USD RUB PREDICTION

2025-11-06 15:27