Yeah, the analysts are waving flags, okay? Caution all around, with some traders leaning into short positions as selling pressure builds across the whole market. It’s like everyone woke up and said, “Let’s go downhill together!” 😅 What’s the deal with that?

Short Signal Active Around $7.59

Crypto analyst BKCRT rolled out a fresh short setup for UNI/USDT, saying, “Enter around $7.59-$7.62.” Stop-loss at $7.64, take-profits near $7.58 and $7.55. The risk/reward ratio sits at 1.67, which basically says the downside is louder than the upside-no big bulls here, just a cautious whisper. 🧐

This setup screams: UNI can’t bust above the $7.60 ceiling, huh? Resistance keeps slapping rallies down. So BKCRT figures sellers are sharpening their pitchforks, ready to pounce on fading momentum. The chart is basically: higher highs kept failing on shorter timeframes-great drama, less action. 🙄

For short-term traders, this setup says: tread carefully. Unless the token blasts above $7.65 with real conviction, the path of least resistance might tilt lower, maybe toward the mid-$7.50s. Yep, it’s a one-way street that looks suspiciously like a slide. 🏂

Stagnant Amid Tight Trading Range

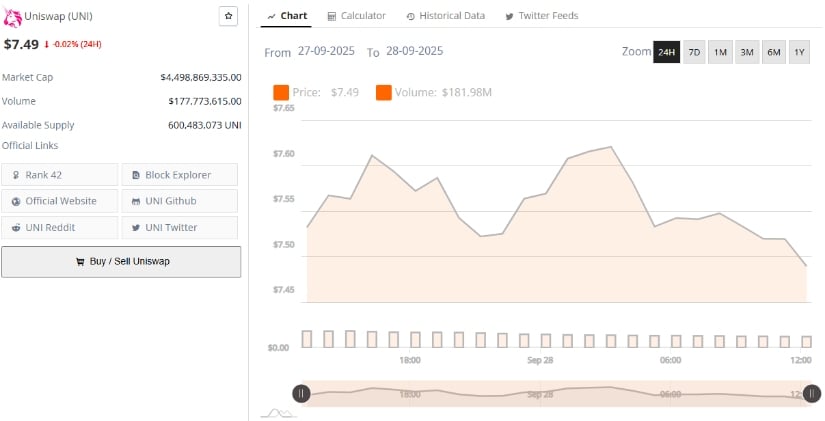

On one hand, BraveNewCoin data shows UNI swinging around directionless at about $7.49. The price is as flat as a pancake over the last 24 hours, but liquidity is staying robust, with over 600 million tokens circulating. Market sentiment? Muted. Buyers and sellers are playing a game of keep-away between support near $7.40 and resistance near $7.65. 🤷♂️

This sideways vibe feels like indecision before a real move, probably a bigger headline somewhere. Traders note that staying above $7.40 is critical to keep the current structure intact. Dip below and we might get a deeper retreat; pop above $7.65 cleanly and maybe momentum shifts in bulls’ favor-maybe. It’s a cliffhanger, folks. 😬

Technicals Show Volatility Cooling, Bears Pressing

Meanwhile, TradingView’s daily UNI/USDT chart says momentum cooled somewhat since early September. Bollinger Bands tightened up, which is basically market-saying, “We’re bored.” Price is creeping toward the lower band near $7.35. The baseline around $7.50 acts as immediate resistance, and the repeated rejections there spell continued selling pressure. 🔍

Adding to the cautious mood, the Chaikin Money Flow (CMF) sits at -0.13, signaling capital outflows and weakening buying strength. It’s not a crash, but it’s not a stampede either-sellers are gradually dominating order books. If inflows don’t come back, we might slip into a deeper correction phase. 😬

For bulls, reclaiming mid-band resistance near $7.50-$7.55 would be the first constructive signal. Until then, the asset looks vulnerable to more consolidation or downside testing, in line with BKCRT’s short-term bearish bias. 🤷♂️

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD THB PREDICTION

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- Gold Rate Forecast

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

2025-09-28 17:31