Ah, the crypto market-where numbers dance like drunks at a wedding and charts look like a toddler’s first attempt at abstract art. Right now, Uniswap (UNI) is sitting pretty at $8.15, and the liquidity signals are whispering sweet nothings about a potential upside. Or are they just gassing us up for another rollercoaster ride? 🌊🤡

Liquidity Growth: The Unsung Hero or Overhyped Sidekick?

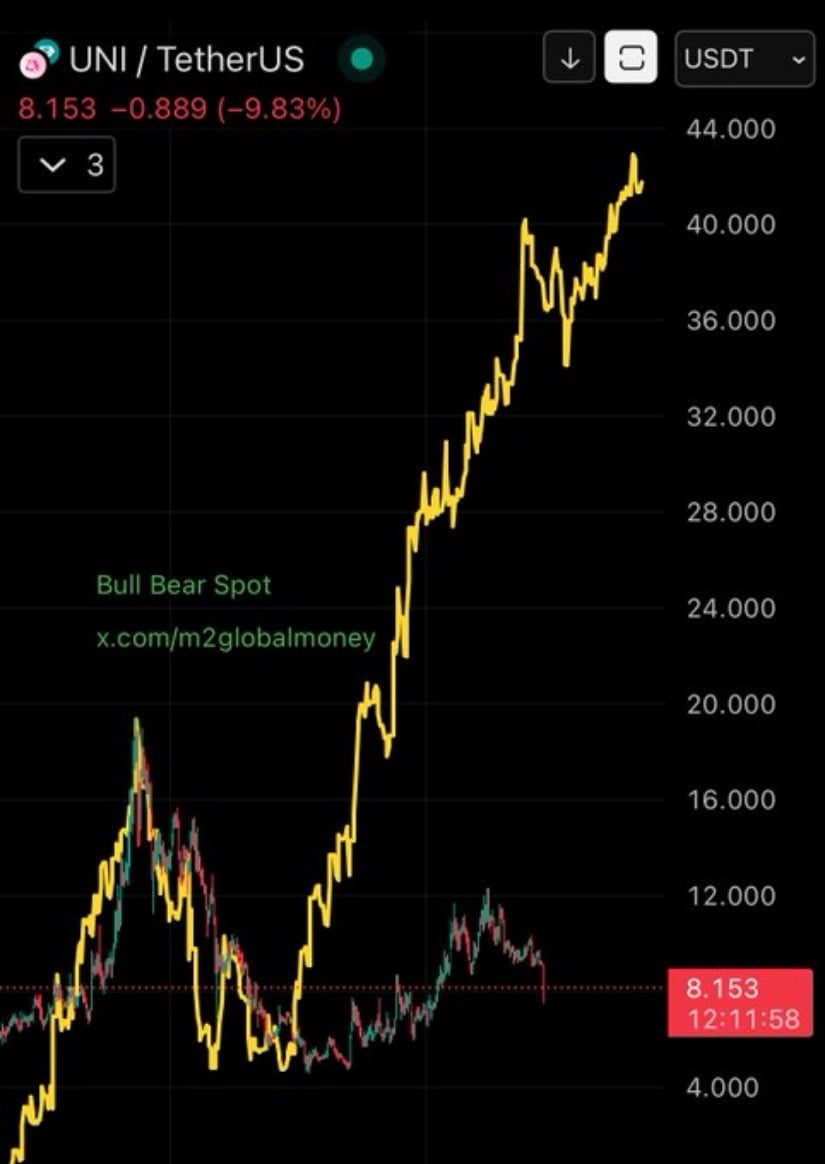

In a recent X post (because who reads blogs anymore?), analysts pointed out the widening gap between global liquidity and market prices. Liquidity is swelling like a baker’s ego, while prices are stuck in the $8.15 mud. This, they say, hints at an undervalued market-or maybe just a market that’s taking a nap. 🤔💤

History, that fickle old coot, suggests these divergences don’t last. Past cycles show liquidity expansions leading to delayed but dramatic price rallies. The current sideways chart looks like a trader’s version of a yoga class-everyone’s just accumulating and waiting for the big stretch. If history repeats (and it’s got a knack for that), this consolidation might be the calm before the storm. Or just another false alarm. 🧘♂️🌪️

If liquidity keeps flexing its muscles, breaking past $10 could be the trigger for a bullish fiesta. Targets near $16? Sure, why not? Stranger things have happened-like NFTs selling for millions. With liquidity as the backdrop, the stage is set for a market catch-up rally. Or a market faceplant. Who knows? 🎭🤷♂️

Price Weakness: The Drama Queen of the Crypto World

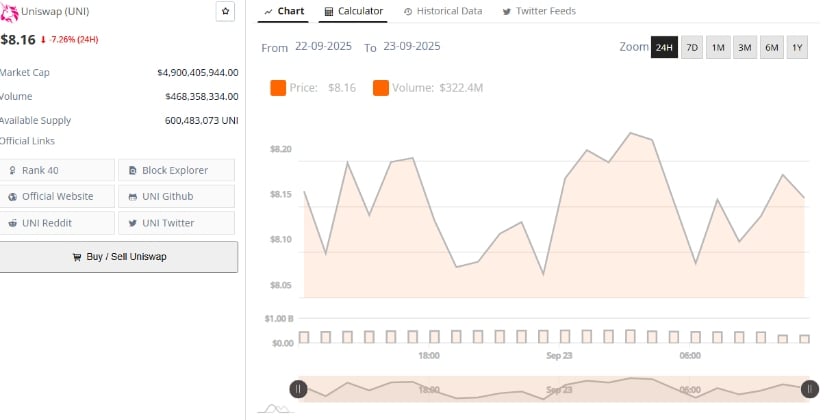

BraveNewCoin data shows UNI trading at $8.16 after a 7.26% nosedive in the past 24 hours. Market cap? $4.9 billion. Trading volume? A cool $468 million. The price is bouncing between $7.95 and $8.25 like a ping-pong ball at a frat party. The slip below $8.20 screams “short-term weakness,” while $8.00 is the last line of defense before we tumble toward $7.50. 🏓🛡️

Despite the selloff, activity is hotter than a jalapeño popper. Volume spikes on every dip, hinting at distribution-or maybe just traders playing hot potato. Liquidity trends might provide a safety net if momentum stabilizes. If UNI can hold $8.00 and claw back above $8.20, it could spark a recovery. First stop: $8.50. But let’s not hold our breath. 🌶️🥔

Technical Indicators: The Bearish Buzz Kill

At the time of writing, UNI is chilling at $8.20 on the daily chart, a far cry from its $12.28 glory days earlier this quarter. The MACD is still in bearish territory, sulking below the signal line like a teenager grounded for the weekend. The Relative Vigor Index (RVI) is at 34.34, confirming buyer strength is weaker than a decaf espresso. ☕💤

If $8.00 support crumbles, we could slide toward $7.50 faster than you can say “crypto winter.” On the flip side, reclaiming $8.50 would be a glimmer of hope, with $9.20-$9.50 in the crosshairs if the bulls decide to show up. Until then, technical indicators are as bearish as a honey badger on a Monday morning. 🐻☕

Read More

- USD COP PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CAD PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- USD CNY PREDICTION

- HYPE PREDICTION. HYPE cryptocurrency

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- 🚨 Last Call for $BEST: The Wallet Revolution Ends in 3 Hours! 🚀

2025-09-24 00:34