Ah, the thrilling tale of Chainlink’s price-currently swirling around $20.31, like a persistent lover who simply can’t decide whether to commit to the top or retreat into the shadows. It lingers just below the upper boundary of its multi-year triangle, a pattern that’s been a silent witness to years of volatility. And lo, the stage is set for what could be an earth-shattering breakout. Well, if history’s any guide, these long-winded setups tend to precede grand gestures-moves that might just set the tone for the next chapter in this crypto romance. 📈

The Symmetrical Triangle: A Tale of Twists and Turns

Enter Ali, the analyst who sees into the future (or at least he thinks he does). According to his musings on X, the plot thickens with a potential breakout brewing. The triangle has been guiding the price action for nearly four years, like an old wise man leading a young hero on an epic journey. Ali, ever the optimist, suggests a possible dip toward $16.50 (right at the 0.5 Fibonacci retracement). For long-term investors, this could be the “gift” they’ve been waiting for. A moment to pounce! Like a cat waiting to strike, one might say.

In past cycles, this re-entry zone has been nothing short of magical for buyers. It’s a level of interest that sends whispers through the trading world, echoing the importance of getting back in at just the right moment. 🎁

Ali-our hero in the making-insists that if support holds, and the momentum does, in fact, pick up, Fibonacci’s predictions are downright thrilling. Upside targets of $32, $53, and, dare I say, $100 could come into view. A continuation of this coin’s multi-year trend. But hold your horses! That’s only if it manages to maintain strength above $19 and successfully breaks free from the $29 chains. Oh, the drama!

Traders? Well, they’re cautious, but hopeful. They see this structure as the key to determining the token’s fate for the year 2026. No pressure, LINK, no pressure. 😅

Market Data: Numbers, Numbers, and More Numbers!

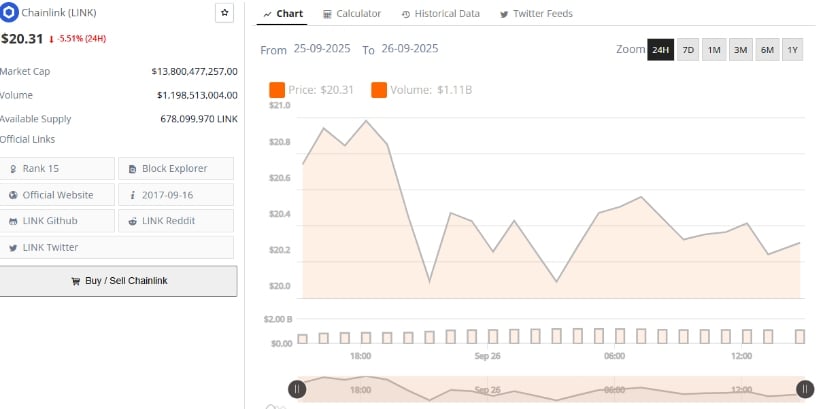

Meanwhile, let’s talk numbers. Yes, the BraveNewCoin crew has been working tirelessly to paint the picture for us. The current price of LINK? $20.31, down by a modest 5.51% in the last 24 hours-because who doesn’t love a little drama, right? Market cap is chilling at $13.8 billion, with a trading volume of $1.19 billion. It’s like the cool kid at the crypto party, not letting the small dips faze them.

With 678 million tokens in circulation, LINK’s rank as the 15th largest cryptocurrency remains untarnished, like a crown jewel that refuses to lose its shine. 👑

Over the past week, volatility has been tightening like a boa constrictor with price oscillating between $19.50 and $21.90. The forecasts? Well, they suggest that if $22-$23 resistance is cleared, there’s hope for stronger moves. Until then, the market remains patient-like a cat watching a mouse that may or may not come out of hiding. 🐱

Indicators: Cooling Down or Just a Dramatic Pause?

Oh, but let’s not get too carried away. The technical indicators, those pesky little things, are throwing cold water on our dreams of a glorious breakout. The daily chart shows LINK at a modest $20.17, having taken a little dip from its high of $27.87, with major support hanging out at $19.53. The MACD, a trusty sidekick, is waving its red flag, indicating bearish momentum. With the MACD line sitting at -0.46 below the signal line (-0.59) and a negative histogram at -0.13, the selling pressure remains real. 😒

There’s no bullish crossover to be found, which means the market’s mood is still a little… gloomy. But hope springs eternal, right?

And then, the Relative Vigor Index (RVI) chimes in with a reading of 43.88. It’s not exactly winning any popularity contests, but it’s not a disaster either. Both the RVI and its moving average are hovering just below the neutral 50 mark, signaling a market in waiting, patiently watching for the next chapter to unfold. 📉

This is the moment where traders watch for that magical divergence, or perhaps a surge in volume that could signal a change in the wind. Will the consolidation phase end? Only time will tell, my dear readers. ⏳

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD CAD PREDICTION

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- GBP USD PREDICTION

- Meme Coins: Madness or Money? 🤡💰

2025-09-27 01:14