Following the US GENIUS Act, capital is pouring into yield-bearing stablecoins, with Ethena’s USDe leading the charge.

Oh, the sweet, intoxicating smell of *”next big thing”*-capital flooding in, fresh new stablecoins promising to revolutionize the crypto landscape. Who could resist? But is it the next *breakthrough*… or the next *UST*? The jury’s still out, but don’t worry, you’ll know soon enough.

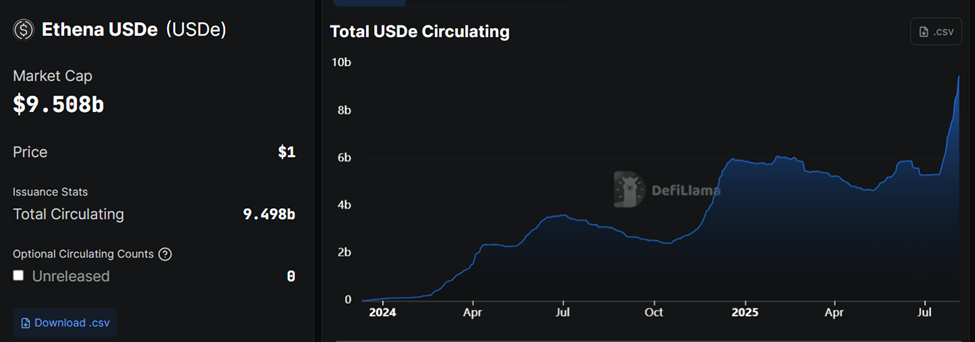

USDe Supply Surges to $9.5 Billion, Now Third-Largest Stablecoin

Ethena’s USDe stablecoin, much like a rocket launching into the unknown, is on an explosive trajectory. In just a month, its circulating supply has skyrocketed by 75%, reaching a rather audacious $9.5 billion, as DefiLlama’s figures delightfully inform us.

We’re talking a climb so steep, USDe now sits pretty as the third-largest stablecoin in the land, comfortably trailing Tether’s USDT and Circle’s USDC. Talk about a crypto Cinderella story, right?

Tom Wan, Head of Data at Entropy Advisors (and who probably spends a lot of time reading spreadsheets for fun), highlighted that USDe and USDtb’s combined market cap has now surpassed $10 billion. Impressive, but not too shabby if you have billions to throw around.

“Excluding the double count, Ethena still has $9.4B TVL, and will soon become one of only five DeFi protocols with $10B+,” Wan stated. Translation: watch out, giants.

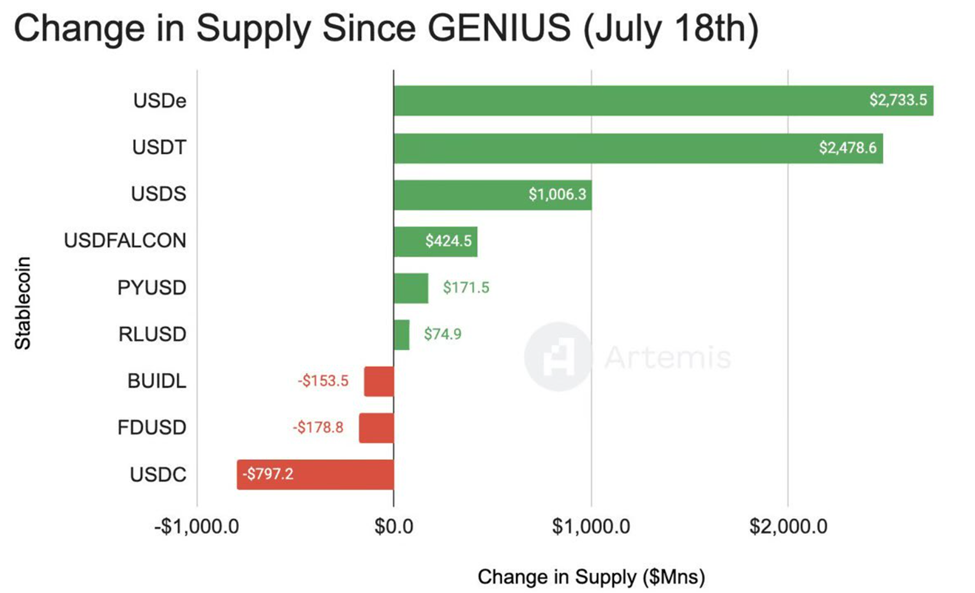

And the big boom? The GENIUS Act, passing on July 18th, catalyzed capital like a rocket booster aimed straight for the moon. Yet, while the lights are dazzling, there’s the faint hum of caution in the air.

David Arnal, a researcher at Sentora (formerly IntoTheBlock), gleefully points out that USDe added $2.7 billion in new supply post-GENIUS. That’s right, this is no small-time player. Meanwhile, Tether saw its usual flood of inflows at $2.4 billion, while USDC decided to take a break with nearly $800 million in outflows. Well, someone’s feeling bold.

“…yield-generating stablecoins are no longer just a trend but a new structural element of DeFi,” Arnal observed. Smooth. Just like that, you’re no longer *following* trends. You’re making them.

Analysts Warn USDe Growth Could Be Fragile

Hold up-before we get carried away with the balloons and confetti, let’s remember one thing: not everyone is popping champagne. While the numbers *look* impressive, not every analyst is convinced that USDe is as rock-solid as it seems. And let’s face it, who doesn’t love a little skepticism?

Crypto analyst Duo Nine, who probably lives in a world where risk is his daily companion, warns that USDe is yet to prove itself in a real bear market. Shocking, I know.

“This basis trade synthetic token remains unvalidated. Until it passes a proper bear market, it’s just a concept. Its ballooning market cap increases risk when bears return,” he cautioned. So, no pressure, right?

But wait, here comes Alan the Yield Farmer, dropping an ominous UST-LUNA comparison. You can almost hear the eerie music playing in the background. Could Ethena’s USDe be the next cycle’s version of the dreaded UST collapse? Alan sure thinks so. And who wouldn’t when USDe offers a modest 3.5% APY, while others like USDS and USDY are overachieving with 4.5%. Talk about a high-stakes poker game.

But hold your horses, folks. Some believe this comparison is as fair as comparing apples to, well, pumpkins. Yuki, an on-chain analyst, pointed out that USDe hasn’t attempted to replicate Terra’s disastrous de-pegging mechanics. Always a good thing when avoiding historical disasters, right?

The @ethena_labs did quite a big operation in both marketing and tech $USDe succeded in challenging $USDC and $USDT utter dominance over everything, without having crazy depeggable mechanisms like $UST had before

25th biggest coin by MC, and integrated more and more in DeFi

– Yuki ₍^. .^₎⟆ (@0xyukiyuki) July 8, 2025

And for those still holding their breath, Bunjil offers a crucial difference: USDe is backed by staked ETH and short hedges, not a hyperinflationary token like LUNA. Huge. Massive. It’s like bringing a shield to a sword fight. Or in crypto terms-safety first.

“If they started collateralizing with $ENA, I’d run,” Bunjil warned, clarifying that Ethena has avoided that mistake. Very wise, Bunjil. Very wise.

Ethena Labs Founder Reveals Risk Controls and DeFi Integration

And then, enter Guy Young, founder of Ethena Labs, offering his calming words on the situation. He reassures us that they’ve got it all under control with some nifty integrations to stave off the risk of liquidation.

“…Important to note USDe oracle on Aave now set to USDT removing liquidation risk for any temporary USDe deviation from $1.00 50% APY on USD with multi-billions of capacity Only possible in DeFi, and only possible with Aavethena,” Young stated. Nothing says “trust me” quite like an oracle integration.

In the end, the debate continues: Are we on the cusp of the next giant leap for DeFi? Or is USDe just another flash in the pan waiting for the inevitable market crash? Stay tuned-history might just repeat itself… or it might not. Only time will tell.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Gold Rate Forecast

- USD CAD PREDICTION

- Brent Oil Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- Bewitching Meme Coins That Will Surely Charm August 2025

- EUR CNY PREDICTION

2025-08-05 12:12