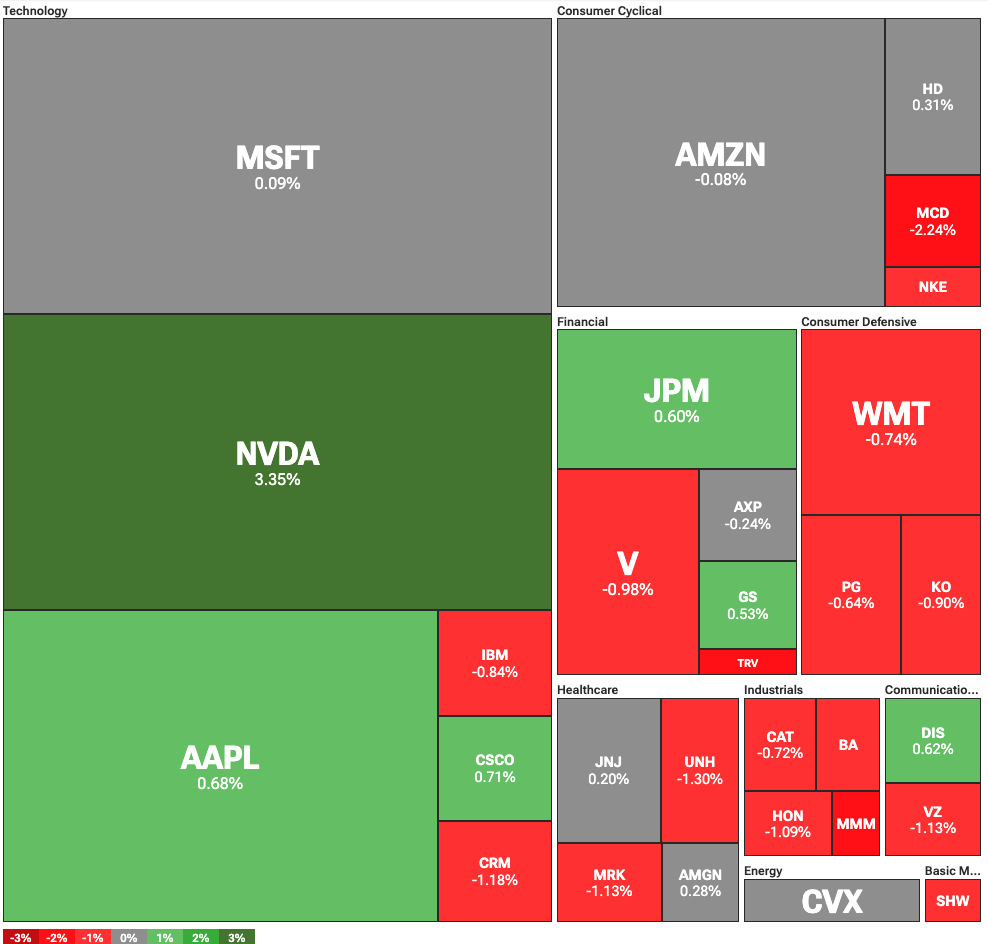

Upon the recent cessation of hostilities between Israel and Iran—such delightful neighbours, truly—the market, with all the nervous sensibility of Miss Marianne Dashwood on a blustery spring morning, found itself quite restored to composure. The S&P 500, that most eligible of indices, drifted ever so coyly nearer to its record, seduced onward by the flirtations of technology stocks.

The grand assemblies of Wall Street were in a state of curious imbalance; while the venerable Dow Jones—so stately, so ponderous!—declined by 151.95 points (let us not be too dramatic, merely 0.35%), the sprightly and slightly scandalous Nasdaq ascended by 0.24%, wagging its finger at tradition. The S&P 500, meanwhile, maintained an air of polite indifference at a handsome 6,090 points, daring anyone to recall its dazzling February debut at 6,144. (We all know how society is with records: one moment a paragon, the next a mere footnote.)

Stocks, like a party just recovering from the entrance of Lady Catherine de Bourgh, were at last finding their equilibrium after quite the suspension of nerves due to the recent international unpleasantness. Only days prior, whispers of general conflagration had swept the ballroom, with America in danger of yet another entanglement—though nothing quite spoils a waltz like the distant sound of cannon fire.

The price of crude oil, never one to let itself be ignored, seized its moment and rose 2% to $65 per barrel, as if in conscious rivalry with the monthly highs achieved amidst the drama. In contrast, technology stocks—ever the favoured younger sisters—capitalised on renewed gossip of imminent rate cuts, and, with a knowing smile, sauntered upward.

Nvidia Approaches the Ton’s Acme; President Trump Seeks a New Master of the Coin

Unquestionably, the belle of this week’s financial ball has been Nvidia, gliding up by 3.4% to a resplendent $152.93—barely a hair’s breadth from its previous triumph at $153.13. The spectacle also crowned Nvidia with an almost immodestly grand market cap of $3.71 trillion, thereby breezily overtaking Microsoft’s rather less impressive $3.65 trillion. One can only imagine the murmurs amongst the dowager countesses of the tech world! 👀

Many attribute this display of fortune to the Bank of America’s affectionate recommendation—one might almost call it matchmaking—identifying Nvidia as the heiress-apparent of the AI chip estate. Naturally, there is further excitement in the drawing room, as the shadow of President Trump’s proposed monetary policy softening looms ever larger: a veritable spring breeze carrying away the remnants of caution.

Meanwhile, after months of prodding that cannot but remind one of an overzealous matriarch, Mr. Trump now confides that he is whittling down his select list of candidates to succeed Mr. Jerome Powell as Federal Reserve Chair. Whether Mr. Powell’s departure shall be occasioned by the natural course of term limits or by presidential fiat remains a delicious point of speculation—a prospect which no proper Austen heroine (or financial analyst) can resist gossipping over. 👒

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Shiba Inu Shakes, Barks & 🐕💥

- If Your Altcoins Were Parties, They’d Be Dead 🥳 – The Cryptocurrency Comedy of Errors

- NYSE’s 24/7 Trading Platform: Finally, a Market That Never Sleeps… Or Eats? 💸

- The Tragicomic Descent of Pi Network: A Token’s Lament

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

2025-06-25 20:55