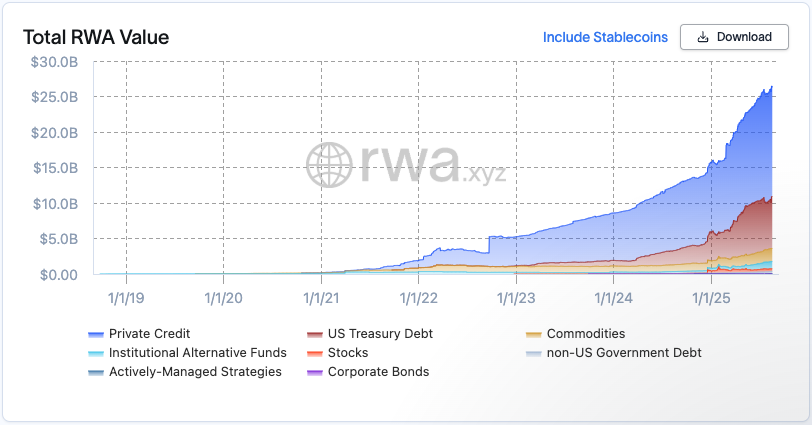

Oh, the grand stage of finance! Stablecoins, those steadfast jesters, still hold 90% of the real-world assets (RWAs), yet the other players in this comedy of finance are making their moves with swift agility. 🎭💰

- RWAs, sans the stablecoin troupe, have doubled their fortune within a year. 🌟

- Private credit and tokenized treasuries, the new court favorites, grow faster than a baker’s yeast under the watchful eye of the financial nobility. 🍞👑

- And who leads this merry band? None other than BlackRock’s BUIDL fund, reigning supreme in the tokenized Treasury segment. 🏦,

In the annals of recent history, on the 18th of August, the total value of tokenized assets ascended to a princely sum of $26.3 billion, a staggering leap from the mere $12.4 billion observed in the same period last year, as reported by the ever-reliable scribes at rwa.xyz. 📜📈

Tokenized private credit, the king of this realm, commands more than half of all RWA value, a majestic $15.3 billion. Meanwhile, tokenized treasuries, the rising star, have seen an 80% growth year to date, reaching a splendid $7.31 billion. 🌟💰

BlackRock’s BUIDL fund, offering the finest tokenized U.S. Treasuries, stands as the undisputed champion among all RWA issuers, boasting a value of $2.397 billion. Tether Gold (XAUT), the alchemist’s dream in tokenized form, follows closely behind with a value of $1.252 billion. 🤴Alchemy

Why Wall Street’s Finest Bet on RWAs

Tokenized assets, dear friends, are like the magic potion that grants investors easy access to the treasure trove of traditional assets. Private credit, once reserved for the elite banks and institutional investors, now beckons a wider audience. With RWAs, companies can seek funding from a diverse crowd, much like a playwright seeking patrons for his next masterpiece. 🎤💰

And what of tokenized U.S. Treasuries? They provide a golden key for foreign investors to unlock the riches of this market. Thus, Wall Street, ever the savvy merchant, sees an opportunity to expand its domain and attract more players to the game. 🌐🏦

A curious note, however, is the role of stablecoins. These tokens, akin to the currency of the realm, technically represent the largest segment of RWAs. With a combined value of $266.74 billion, they could claim over 90% of the RWA market if included. Yet, due to their unique utility, they remain a separate entity, much like a jester who dances to his own tune. 🤹♂️🎭

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Blockchain Dawn in the Developing World 🌍✨

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Brent Oil Forecast

- AI and Copyright: Mark Twain’s Take on the Modern Patent Circus

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- USD THB PREDICTION

- Coinbase’s Magical Announcement Sends Two Altcoins Soaring 🚀💰

2025-08-18 19:15