So, here’s the tea:

- Bitcoin whales are having a major sell-off, with one whale shifting a whopping $4.7 billion (casual).

- This could be super bullish for Ethereum and altcoins before the current bull cycle ends (yaaas, altcoin season is coming).

- Analysts expect the current altcoin market cap to nearly double soon, if the momentum continues ( Cha-ching!).

The crypto space was left shook this week as a mysterious Bitcoin whale (one of the oldest and wealthiest holders, btw) shifted over $4.7 billion worth of BTC to a new wallet. Like, what’s the plan here? 🤔

This move comes just days after transferring a similarly large amount of coins to asset manager Galaxy Digital. It seems like there’s some major capital rotation going on, and Bitcoin is not the favorite child anymore. 😔

A $4.7 Billion Bitcoin Transfer From the Satoshi Era (aka the OG days)

Blockchain analysts at Lookonchain reported the massive transfer on July 17. The whale moved 40,192 BTC, worth approximately $4.77 billion into a new wallet. That’s a whole lotta cash. 💸

Interestingly, just days earlier, the same whale sent 40,009 BTC to Galaxy Digital, which then routed 6,000 BTC to major crypto exchanges Binance and Bybit. It looks like this whale is dumping their tokens like they’re hotcakes. 🥞

What makes this even more interesting is that this whale originally received the BTC in April and May of 2011, when Bitcoin was trading between $0.78 and $3.37. Talk about a blast from the past. 📆

The Bitcoin OG with 80,009 ($9.46B) just transferred another 40,192 ($4.77B) to a new wallet bc1qs4 and may continue to sell.

— Lookonchain (@lookonchain)

This whale had been silent for over 14 years, which means that the sudden movement of its entire crypto holdings is worth paying attention to for traders, analysts, and Bitcoin historians. It’s like a crypto soap opera. 📺

Could This Whale Be Triggering Bitcoin’s Price Pullback? 🤔

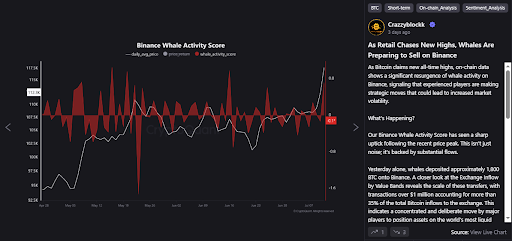

Bitcoin recently touched an all-time high of just over $122,000 on Monday. Some analysts, like CryptoQuant’s Crazzyblockk, believe the recent pullback in BTC price may have been triggered by whales like this one taking profits after the massive rally. Makes sense, tbh. 🤑

When large wallets move coins to exchanges, it’s often interpreted as a sell-off waiting to happen. If this is the case, the fear of further selloffs could weigh on Bitcoin’s price in the short term, even as the bullish momentum wanes. The drama never ends. 🎭

A Smaller Bitcoin Whale Follows Suit After Six Years of Silence (awakened from hibernation)

In a related incident, Lookonchain also identified another whale that reactivated after six years. This smaller wallet moved 1,042 BTC, worth roughly $123 million, into a new address. Not bad for a sleepy whale. 😴

This second whale was originally funded by Braiins Mining and Xapo Bank, when Bitcoin was priced around $8,746. The wallet’s holdings were worth just $9.12 million at the time, and the reactivation of this long-dormant wallet further reinforces the sell-off narrative. It’s like a crypto game of telephone. 📞

Meanwhile, Altcoins Begin Their Surge (the underdogs are rising)

While Bitcoin is suffering sell-off after sell-off, altcoins are quietly stealing the spotlight. Several technical indicators and price patterns are pointing toward a long-awaited altcoin season. It’s like the crypto equivalent of a plot twist. 📚

For example, crypto trader Jelle recently pointed out a cup-and-handle breakout on the TOTAL3/USD chart.

have broken out from the multi-year cup & handle!

One last hurdle to overcome, but once this clears 1.1T – everything goes nuts.

Time for our patience to be rewarded. Finally.

— Jelle (@CryptoJelleNL)

According to the analyst, the chart shows that a move from $1.1 trillion to $1.98 trillion could be incoming. Which means that the altcoins might be ready to collectively double in price. Cha-ching, indeed! 💸

Veteran trader Peter Brandt noted a similar pattern on TOTAL2, which includes all crypto assets except Bitcoin. The expected target for that breakout is an even higher $2.78 trillion market cap. Overall, if TOTAL3 does break past the $1.1 trillion neckline and if Bitcoin’s dominance continues to weaken, we may be ready to see one of the biggest altcoin runs since the 2017–2018 cycle. Buckle up, folks! 🚀

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- USD CNY PREDICTION

- Gold Rate Forecast

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Brent Oil Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Shiba Inu Shakes, Barks & 🐕💥

- Silver Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2025-07-17 18:03