As I pen this surprisingly thrilling tale of HBAR, it finds itself trading at a rather modest $0.27163, reflecting a delicate -1.33% pullback—a mere blip in the grand game of digital speculation, wouldn’t you agree? Alas, even amidst this fleeting stagnation, the capital inflows and those ever-predictable momentum indicators whisper sweet nothings of upward potential. 🌈

Whale Wallet Growth Signals Institutional Confidence

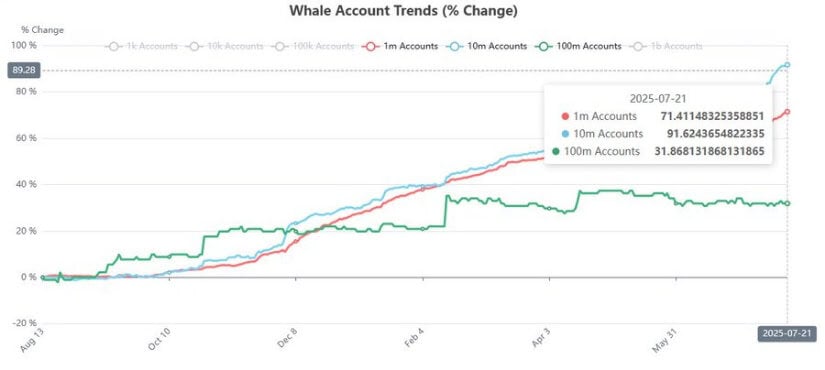

Ah, but lo! A recent communique from our esteemed analyst, @Steph_iscrypto, unveils a splendid chart of wallet distribution. Herein lies a most notable surge in the accumulation of medium to large wallets. Behold! A tantalizing 91.6% increase in wallets hoarding 10M HBAR and a rise of 71.4% in those minuscule 1M addresses since the fateful month of August 2024. Who knew the sea of digital currency could draw in such whales? 🐋

The largest tier, those wallets boasting over 100M addresses, has risen a mere 31.9%. It appears that our institutional friends have made their grand entrance, opting for the stage rather than lurking in the shadows of earlier adopters. Pray, does this not hint at the wise positioning of “smart money” for a delectably anticipated price expansion? 💸

The 10M wallet tier is experiencing a meteoric rise, gaining vigor since March 2025 as if spurred by some arcane sorcery. This robust ascent suggests that interest is long-term, possibly fueled by the splendours of network developments, enterprise adoption, or some extravagant protocol upgrades. How simply riveting! 🌟

When coupled with the mirrored growth in the 1M tier, the indications of a broad-based confidence among mid-sized holders reveal themselves clearly. One cannot help but notice that analysts often interpret such behavior as a harbinger of price appreciation; history has indeed shown the correlation between wallet accumulation and euphoric bull runs within the grandeur of digital assets.

Market Activity Supports Ongoing Accumulation Phase

The latest 24-hour trading chart for our illustrious HBAR reveals delightful intraday volatility. With a high of $0.2751 and an audacious recovery from earlier losses—despite a modest -0.67% daily dip—the session settled near $0.27, illustrating how our buyers valiantly defend the short-term support zones. What a gallant struggle! 🛡️

The volume profile, like an eager audience, reinforces this observation with an impressive $640.21 million traded over the day—a refreshing increase, indeed! Price movements, inextricably entwined with volume spikes, suggest that market participants (those gallant souls!) are actively accumulating, particularly through the brief interludes of correction.

Encased in the elegant cloak of a market capitalization of $11.5 billion, HBAR serenades its way to rank #19 among the cryptocurrencies that dazzle us. With a circulating supply far exceeding 42.3 billion tokens, the behavior of our large-cap investors proves critical in this delicate dance of directional momentum.

The price, nestled between $0.265 and $0.280, seems to offer a delectable base for potential upward pirouettes. Should the bulls maintain their steadfast support, and if the volume continues to elevate, analysts might foretell a breakout toward the tantalizing $0.30 region—and oh, beyond! All contingent, of course, on the whims of the broader market. 🎩✨

Technical Indicators Maintain Bullish Outlook

From a technical vantage point, the indicators continue to envelop us in a bullish embrace. The MACD (12, 26) revels in positive territory, with the MACD line at 0.03004 dancing above the signal line at 0.02505, while the histogram modestly reads 0.00499.

Though the histogram bars narrowly suggest a possible cooling of momentum—like an actor losing his audience—the crossover has yet to take place. Thus, the trend remains favorable in the short to mid-term, unless, of course, the indicators decide to throw a dramatic curveball.

The Chaikin Money Flow (CMF) stands gallantly at +0.07, a sign of ongoing net capital inflow. While it may not match the giddiness of peak accumulation phases, the CMF reading lends credence to the notion that institutional and large-scale buyers remain engaged in this merry affair. 🎉

Should the CMF rise further, we might just witness a glorious resurgence of momentum and a cavalcade of price exploration toward the revered previous high of $0.3227. Continued performance above $0.26, coupled with a confirmation of bullish volume trends, may well ignite a further ascent, as interest from our illustrious whales intensifies.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

- Why Your Crypto is a Disaster (And Why You’re Still Buying)

- Bitcoin’s Descent: Bounce or Breakdown? 🚀💸

- GBP EUR PREDICTION

- Crypto Chaos: How Hackers Are Pulling Off the ‘Classic EIP-7702’ Wallet Heist

2025-07-24 01:14