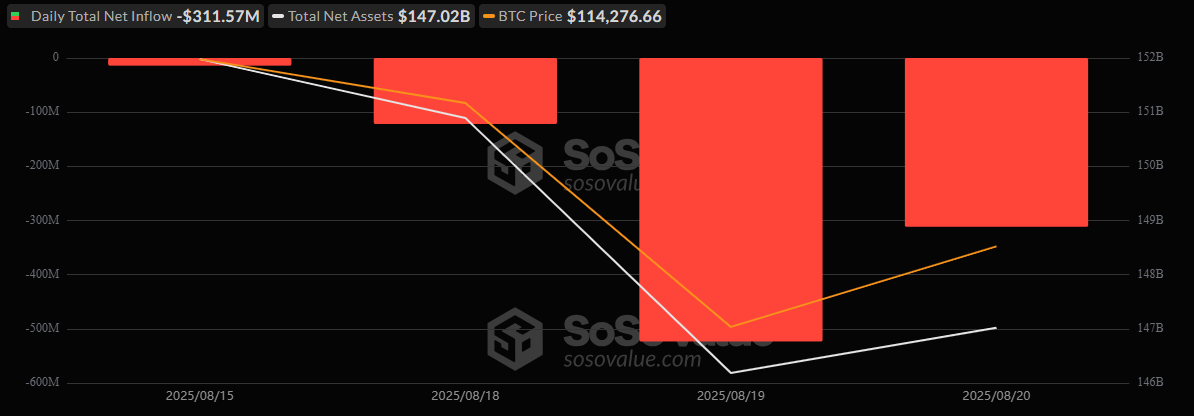

Bitcoin ETFs lost $312 million and ether ETFs shed $240 million on Wednesday, extending the heavy outflow streak to a fourth consecutive day. In total, crypto ETFs have now seen $1.9 billion leave over the past four trading sessions.

Bitcoin ETFs See $312 Million Exit, Ether Funds Lose $240 Million in Relentless Selloff

The selloff in crypto exchange-traded funds (ETFs) is showing no signs of slowing. For the fourth day in a row, both bitcoin and ether funds bled capital, with a combined $552 million flowing out on Wednesday, Aug. 20, alone. Investors, spooked by macro headwinds and risk-off sentiment, are now driving one of the heaviest weekly ETF outflow streaks in months. It’s like a digital Black Friday, but without the good deals! 🛍️💔

Bitcoin ETFs recorded $311.57 million in net outflows. Institutional favorite, Blackrock’s IBIT was hit hardest, losing $220 million in a single session. Ark 21Shares’ ARKB followed with a $75.74 million exit, while Grayscale’s GBTC and Fidelity’s FBTC shed $8.98 million and $7.46 million, respectively. It’s like a crypto version of “The Producers,” where everyone’s betting on the failure! 🎭🔥

Only Bitwise’s BITB managed to post a marginal inflow of $619.81K, barely denting the sea of red. Trading remained active at $3.44 billion, but net assets steadied at $147.02 billion. It’s like trying to stop a leaky faucet with a Band-Aid! 🚰💔

Ether ETFs were not spared. They logged $240.14 million in outflows, led by a massive $257.78 million loss on Blackrock’s ETHA. Some relief came from inflows into Grayscale’s Ether Mini Trust (+$9 million) and Fidelity’s FETH (+$8.64 million), but it wasn’t enough to offset the damage. Trading volumes stood at $2.65 billion, with net assets at $26.86 billion. It’s like trying to catch a falling knife, but the knife is made of digital currency! 🔪💸

In just four days, the damage has piled up. Together, bitcoin and ether ETFs have seen a staggering $1.9 billion in capital outflows, underscoring a sharp shift in investor sentiment after weeks of historic inflows. It’s like the crypto market decided to take a page out of my playbook and go for a wild ride! 🎢😂

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- SEI PREDICTION. SEI cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- FET PREDICTION. FET cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- EUR USD PREDICTION

2025-08-21 23:18