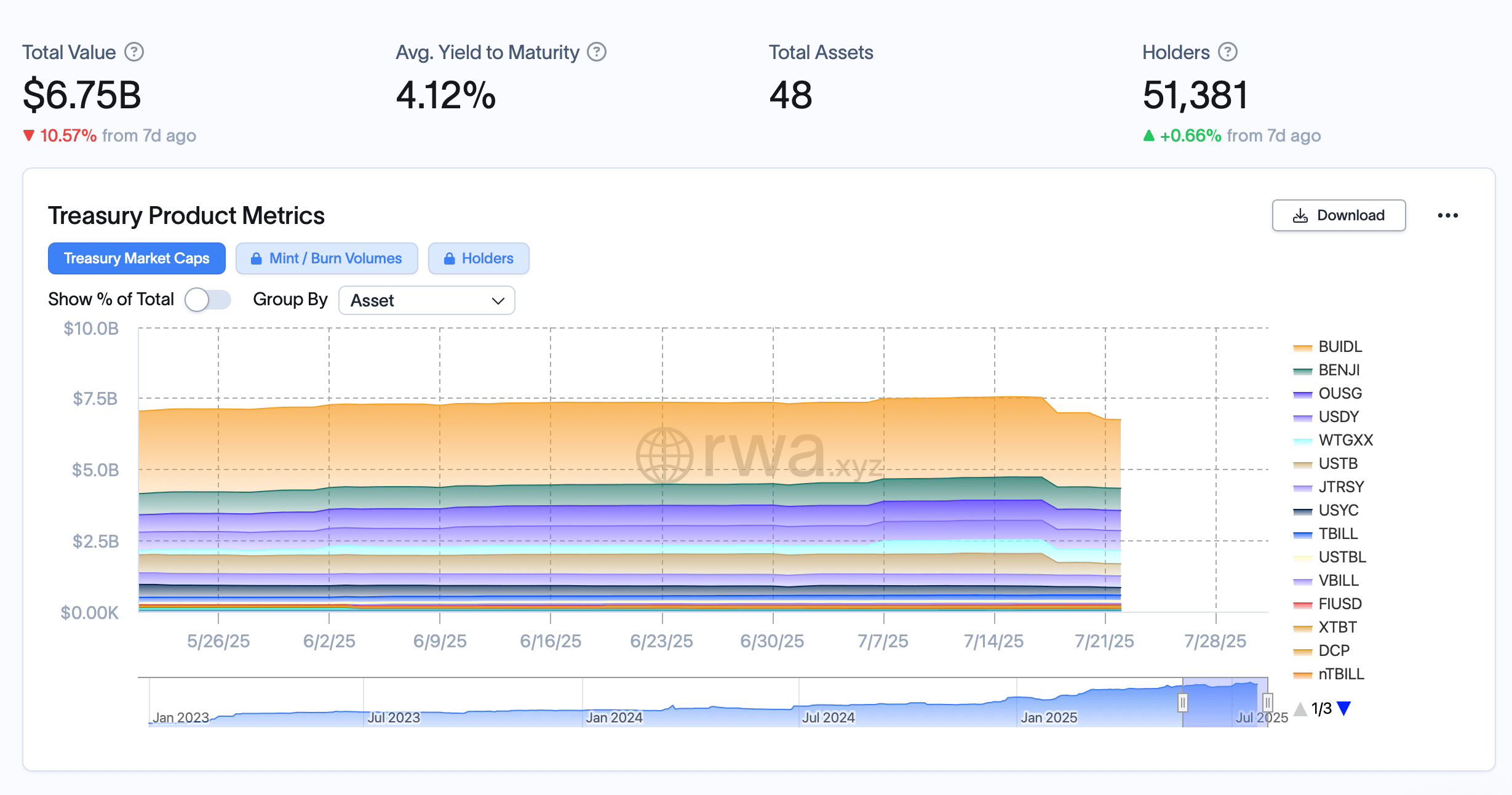

The latest chronicles reveal that the tokenized U.S. treasuries market has descended into chaos, losing a staggering $800 million over the past seven suns. This debacle marks a drop of 10.57% from its lofty perch just a week prior.

Blockchain T Bonds Take a Breather as Capital Bags its Passport

Thus far this year, the tokenized treasuries sector has been a veritable rocket ship, soaring skyward without so much as a hiccup—well, that is, until a curious thing happened. The momentum that once propelled it into the stratosphere seems to have taken an unexpected vacation. On June 12, our dear friends at TopMob trumpeted that the tokenized treasuries market reached an astonishing $7.34 billion. Yet, come mid-July—specifically July 16, 2025—the party hit its zenith at an eyebrow-raising high of $7.55 billion.

In a nutshell, from that sun-drenched July day to now, $800 million has whimsically vanquished from the sector, as quantified by the ever-watchful eyes at rwa.xyz. Data points to approximately $409 million doing the tango out of the behemoth fund, Blackrock’s BUIDL, which pirouetted down from $2.819 billion to a reticent $2.41 billion over the course of a week. Meanwhile, Franklin Templeton’s BENJI took a modest tumble of $29.51 million in that same dance.

The third-place medalist, the Ondo Short-Term U.S. Government Bond Fund (OUSG), managed a whisper of a rise at 0.12% this past week, as did the Ondo U.S. Dollar Yield Fund (USDY) and the Wisdomtree Government Money Market Digital Fund (WTGXX), collectively inching higher—like a tortoise pursuing a goal with unwavering determination.

But on the flip side, the Superstate Short Duration U.S. Government Securities Fund (USTB) found itself awash in the crimson tide, hemorrhaging $310.38 million. Together, BUIDL and USTB seem to have imbibed the majority of this week’s financial cocktail. While a handful of funds continue to bask in the sunshine of inflows, the significant outflows from major players hint that a fat cat repositioning is indeed afoot.

The burning question now is whether this signals a passing chill or the dawn of a more troubling trend as capital seeks new pastures. What once appeared to be an unrestricted surge of growth within the tokenized treasuries now stands at a crossroads. The coming weeks will surely shed light on whether this dip is mere background noise or an omen of a more profound shift in the market’s symphony.

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Shiba Inu Shakes, Barks & 🐕💥

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- USD CNY PREDICTION

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Silver Rate Forecast

2025-07-24 21:57