Well, well, well. A recent New York Times article has pointed its finger at stablecoins, claiming they’re a handy tool for money laundering criminals. But, much like blaming your shoes for running a marathon, that argument doesn’t quite hold up.

Stablecoins: The New Scapegoat, Not the Villain

The Facts

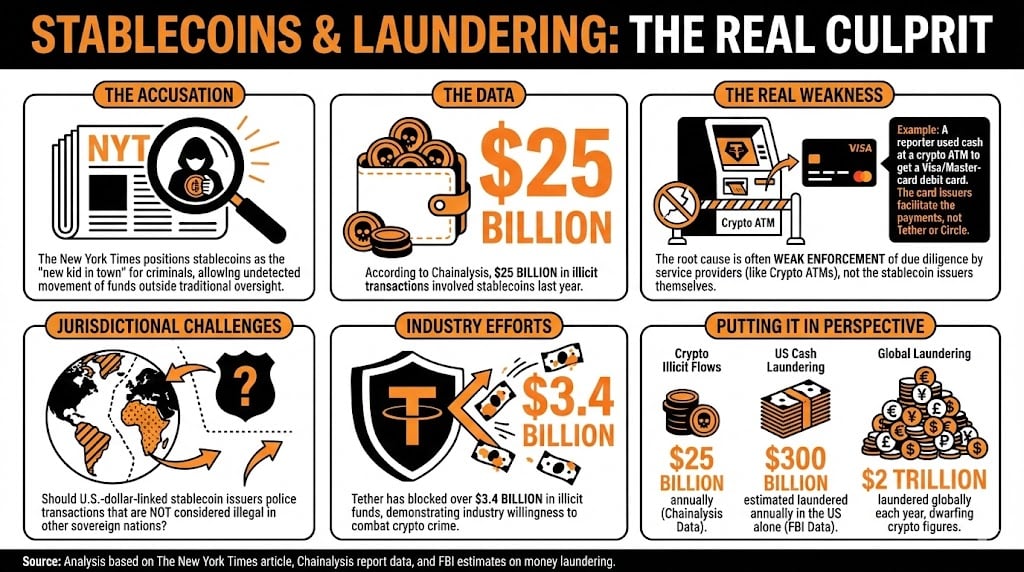

In an article that reads like the plot of a bad detective novel, The New York Times warned us all about how stablecoins are helping criminals sneak around undetected, moving funds without attracting the prying eyes of traditional financial systems. The implication? “Stablecoins are bad. Very bad.”

Now, let’s all take a deep breath and dig into this. According to blockchain research firm Chainalysis, $25 billion worth of illicit transactions involved stablecoins last year. But wait-before you light your pitchforks and call for a public burning of Tether and Circle (the lovely folks behind the two largest stablecoins)-let’s look at the bigger picture. The real culprit? Weak compliance measures and dodgy service providers. Yes, folks, it’s not the stablecoins, it’s the people who fail to check if criminals are hopping on board!

One of the examples from the article involved a reporter who bought stablecoins via a crypto ATM with cash. He then proceeded to get a debit card and waved it around like it was proof that stablecoins were the root of all evil. But guess what? Visa and Mastercard are the ones making those payments happen, not Tether or Circle. It’s a bit like blaming a bicycle for the traffic jam caused by a bad driver.

On a brighter note, the stablecoin industry has been making a solid effort to combat on-chain illegal activities. Tether alone has blocked over $3.4 billion in illicit funds. So, they’re not exactly just sitting around eating popcorn while criminals have a field day.

Why It’s Relevant

Let’s talk numbers. Yes, $25 billion sounds like a big chunk of change. But when you consider that the FBI estimates around $300 billion is laundered every year in the U.S. alone, the crypto figure is a mere speck in the ocean. Global money laundering? A jaw-dropping $2 trillion. So, while crypto flows are still significant, they’re just a teeny tiny blip compared to the well-established “traditional” methods. You might want to look at the real elephant in the room.

Oh, and did we mention that the U.S. Senate is in the midst of discussing crypto market regulations? Convenient timing for such a sensational headline, don’t you think? Stablecoins are becoming quite the political hot potato, and some folks aren’t too thrilled about the way they’re being painted.

Coincenter’s Neeraj K. Agrawal chimed in saying that the real issue lies with credit card networks, not stablecoins. Haun Ventures’ Rachael Horwitz accused the banking lobby of planting this story to make stablecoins look bad. Well, we wouldn’t put it past them.

Looking Forward

As stablecoins become an increasingly important part of the U.S. government’s strategy to extend the global dominance of the U.S. dollar, the solution to money laundering isn’t to blame the crypto for the crime. Rather, it’s to tighten up compliance measures across the entire system. After all, exposing stablecoins as the go-to laundering tool while conveniently ignoring the gaping holes in the financial service platforms’ compliance is, let’s be honest, rather disingenuous.

Read More

- Gold Rate Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- USD THB PREDICTION

- Brent Oil Forecast

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- AI and Copyright: Mark Twain’s Take on the Modern Patent Circus

- Will Bitcoin and Ethereum Survive the $2B Options Expiry Drama?

- Gold Tokens: The New Gold Rush or Just Fool’s Gold? 🤔💰

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

2025-12-09 16:26