CoreWeave’s (CRWV) $9B all-stock deal to acquire Core Scientific sent CORZ shares tumbling. Why did investors reject the merger? Here’s what you need to know.

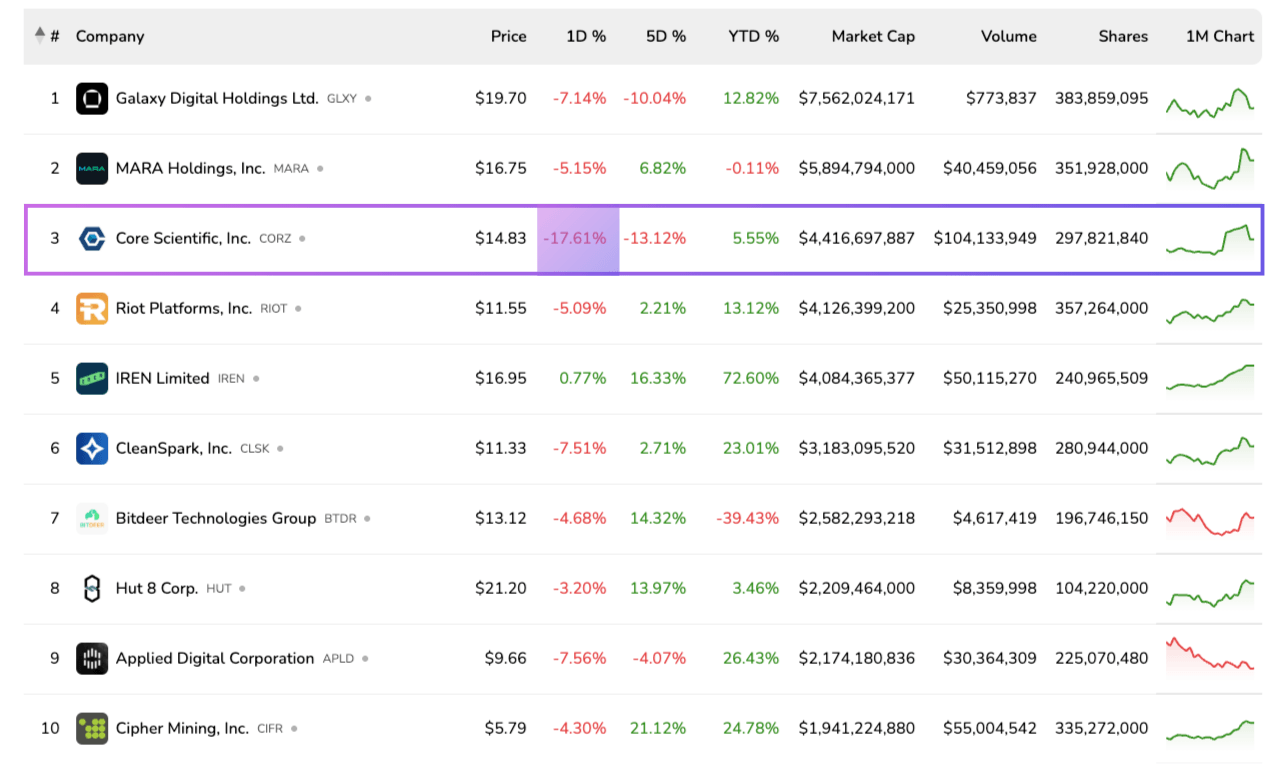

Core Scientific Takes a Plunge

//investors.corescientific.com/news-events/press-releases/detail/95/core-scientific-announces-exercise-of-final-contract-option-by-coreweave-for-delivery-of-approximately-120-mw-of-additional-digital-infrastructure-to-host-high-performance-computing-operations”>multi billion-dollar contracts

in place and overlapping infrastructure footprints, many figured it was only a matter of time. Now it’s official:

CoreWeave (CRWV) is acquiring Core Scientific (CORZ)

in an

all-stock deal valued at ~$9B

.

On paper, that sounds bullish, but investors hit the sell button faster than a rattlesnake in a desert. Let me break it down for you.

What’s the Deal?

Core Scientific shareholders will receive 0.1235 newly issued shares of CRWV for each CORZ share. At CoreWeave’s closing price of on July 3, the deal implies a total equity value of approximately $9.0 billion, which values CORZ at $20.40 per share—a 13.14% premium to CORZ’s pre-announcement price of $18.03.

At face value, a 13% premium might seem like a nice deal for CORZ holders. But here’s the kicker: It’s tied to CoreWeave’s stock price, and if that price takes a tumble, well, that 13% could vanish like a magician’s trick.

1. All-Stock Structure Brings Uncertainty

The deal is tied to CoreWeave’s stock price. If CRWV falls before the deal closes (expected in Q4), CORZ holders take the hit. That 13% premium could vanish—or flip to a discount. It’s like winning a lottery and then finding out the ticket was printed in invisible ink.

On the flip side, if CRWV rallies, CORZ investors could strike it rich. But betting on that is like trusting a raccoon to guard your garbage. High-risk, high-reward, but mostly chaos.

2. CoreWeave Might Be Overvalued

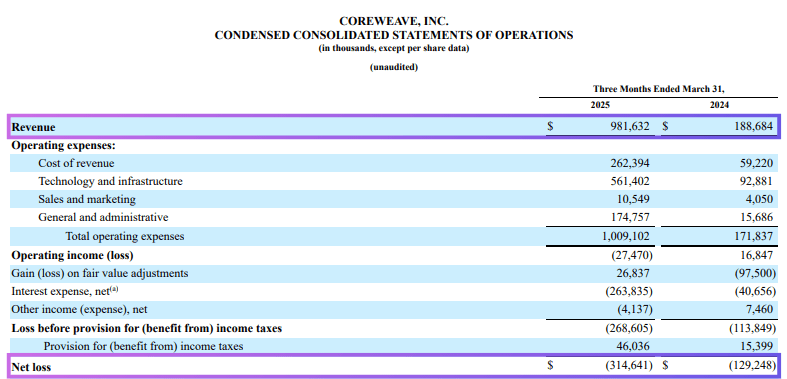

CoreWeave posted $981.6M in Q1 revenue, up nearly 5x YoY. However, despite explosive top-line growth, the company posted a net loss of $314.6M in Q1.

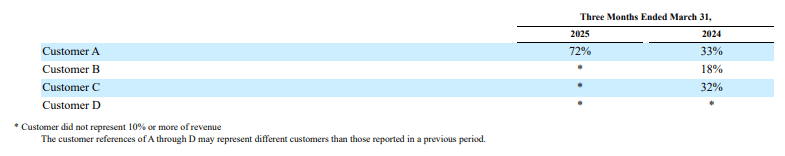

Moreover, Customer A made up 72% of revenue for the quarter – customer concentration is pretty high. CoreWeave’s like that kid who does all their homework but only for one class.

Its adjusted annualized run-rate loss is >$1B, and the business is heavily leveraged – $8.7B in net debt and over $3B in lease liabilities. That sharp increase in valuation since IPO (+299.25% YTD) seems more like hype than sustainable growth. It’s like calling a goldfish a sea monster because it swims in circles.

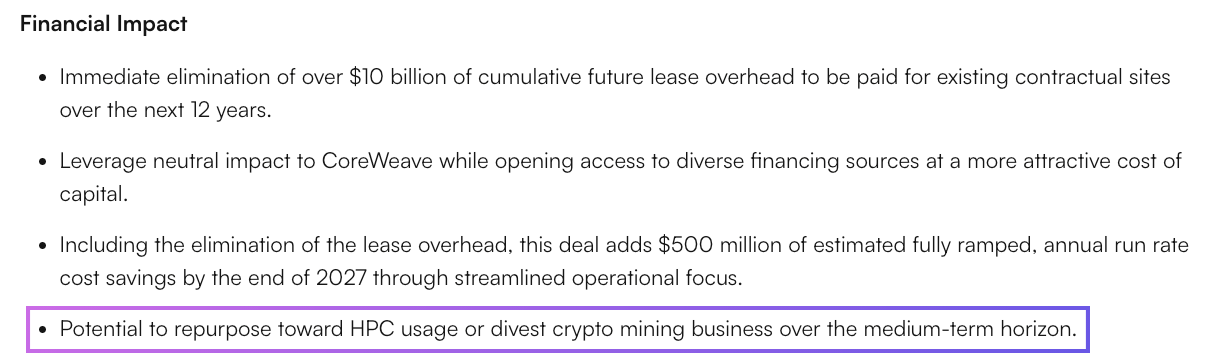

3. Lack of Bitcoin Exposure

The biggest red flag for some investors: CoreWeave may pivot Core Scientific away from Bitcoin mining. Oh boy, that’s like buying a hotdog stand and then deciding to sell tofu burgers instead.

4. Is 13% Premium Enough?

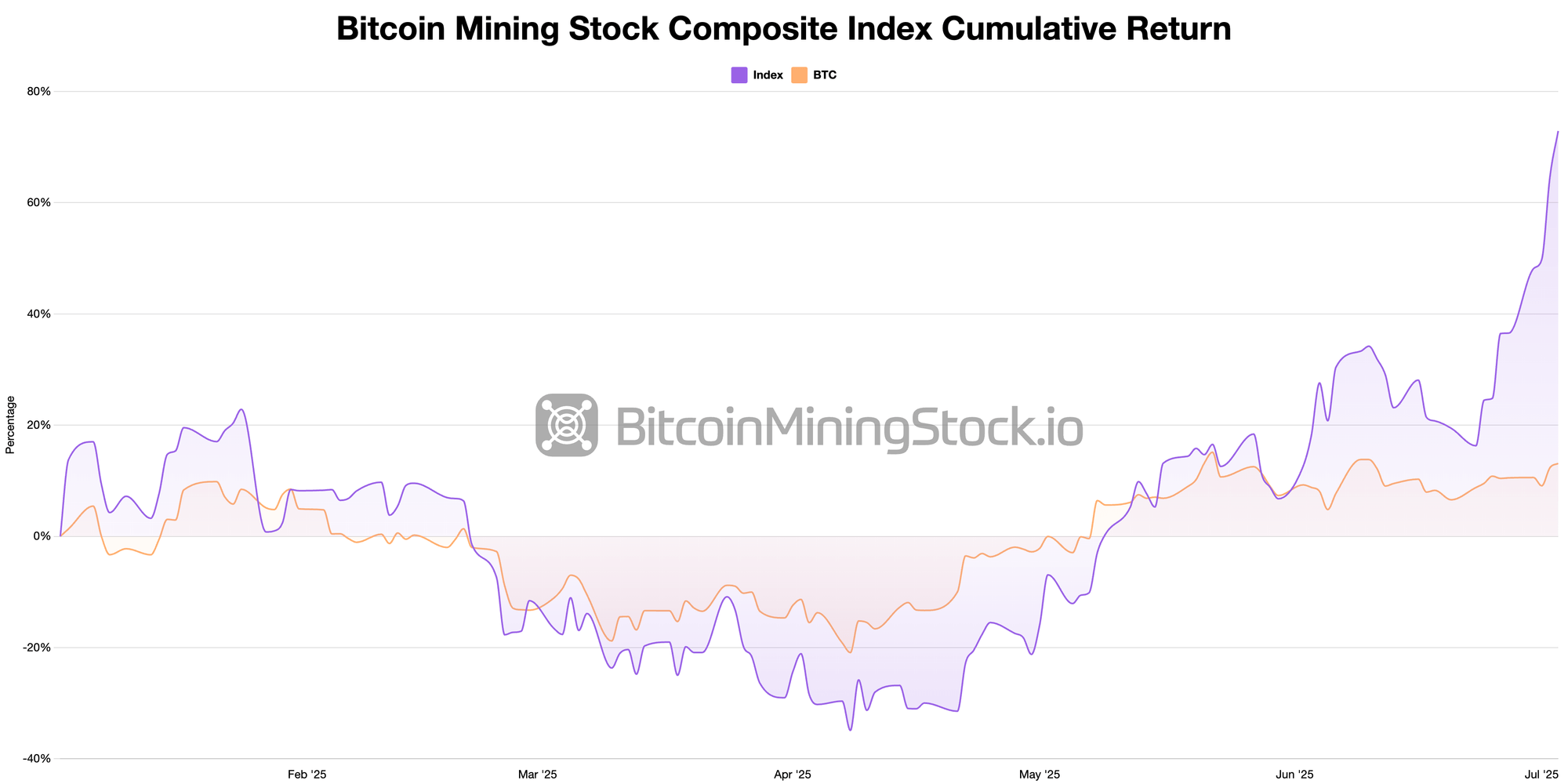

Recently, the Bitcoin mining stock sector has been outperforming Bitcoin itself. Yet, investors are still turning their noses up at this deal, questioning if a 13% upside is enough for the risks involved. I’d say it’s like getting a coupon for 13% off a rollercoaster ride, while the ride itself might be built by amateurs.

Final Thoughts

From a business standpoint, the deal makes sense—CoreWeave gets 1.3 GW of gross power, deep operational expertise, and eliminates $10B in future lease obligations. It’s like CoreWeave hitting the gym while Core Scientific takes a nap.

But for Core Scientific shareholders, this feels more like a trip to the dentist than a day at the beach. The all-stock structure, reliance on CoreWeave’s stock, and potential pivot away from Bitcoin mining have investors feeling a little queasy.

If the deal closes as planned, Core Scientific could become another crypto-native infrastructure player absorbed into the AI trend, leaving Bitcoin behind like last season’s fashion. All things considered, this merger might just be the plot twist no one saw coming.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- The Grand Melancholy of Crypto: A Tale of Greed, Fear, and Foolish Hope

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Gold Rate Forecast

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Wall Street Pandemonium: Trump Grins, Crypto Traders Weep, Fed Plot Thickens

2025-07-09 01:58