On the balmy day of August 29, 2025, that intrepid asset manager Grayscale sashayed into the spotlight, filing their S-1 forms with the eager grace of a debutante at her first ball, seeking blessing for ETFs that would dally elegantly with the whims of Polkadot (DOT) and Cardano (ADA).

One mustn’t forget that this isn’t some fresh dalliance; nay, it began as a whisper in February of the same year, when Nasdaq and NYSE Arca played the kindly matchmakers, submitting initial 19b-4 forms on Grayscale’s behalf. The ever-pragmatic Bloomberg analyst James Seyffart assured us that these recent sashayings are but continuations – sequels rather – to an already riveting regulatory romance.

ETF Structure and Trading Details

Imagine the Polkadot ETF waltzing on Nasdaq’s grand floor under the suave ticker “DOT,” pirouetting in tune with the CoinDesk DOT CCIXber Reference Rate, striving to mimic every flutter and dip of Polkadot’s mercurial price. Meanwhile, the card-carrying Cardano ETF takes center stage on NYSE Arca, donning the eccentric ticker “GADA,” faithfully following the CoinDesk Cardano Price Index.

Twain these funds shall hold their respective cryptocurrencies securely, not like some reckless flâneurs, but through the prim and proper Coinbase custody services. Neither will resort to the scandalous intrigues of leverage or derivatives – a relief for institutional dandies and retail curates craving simplicity.

The Polkadot trust, ever the romantic, plans to stake up to 85% of its holdings, pending “Staking Conditions” as mysterious and undefined as the plot of a Wildean satire. However, do beware the 28-day unbonding period – a sort of social pause – that may hobble liquidity when the market’s mood turns capricious.

Regulatory Timeline and Challenges

Come October 26, 2025, the Securities and Exchange Commission (SEC) will don its judgmental robes and deliver a verdict on the Cardano ETF application. It’s a final call under the 19b-4 ceremonial framework: approve, reject, or perhaps dart a raised eyebrow.

Both trusts, like elegant debutantes registering their lineage, were incorporated as Delaware Statutory Trusts on August 12, 2025 – a ritualistic prelude to their grand SEC submission debuts, orchestrated with Grayscale’s customary flourish.

The Cardano filing arrives with a cautionary note, lest one forget the thrilling possibility that if the SEC deems ADA a security, it might bring about “material adverse impacts” – in other words, a scandal of such proportions it could force the trust to exit stage left.

Crowded Market for Crypto ETFs

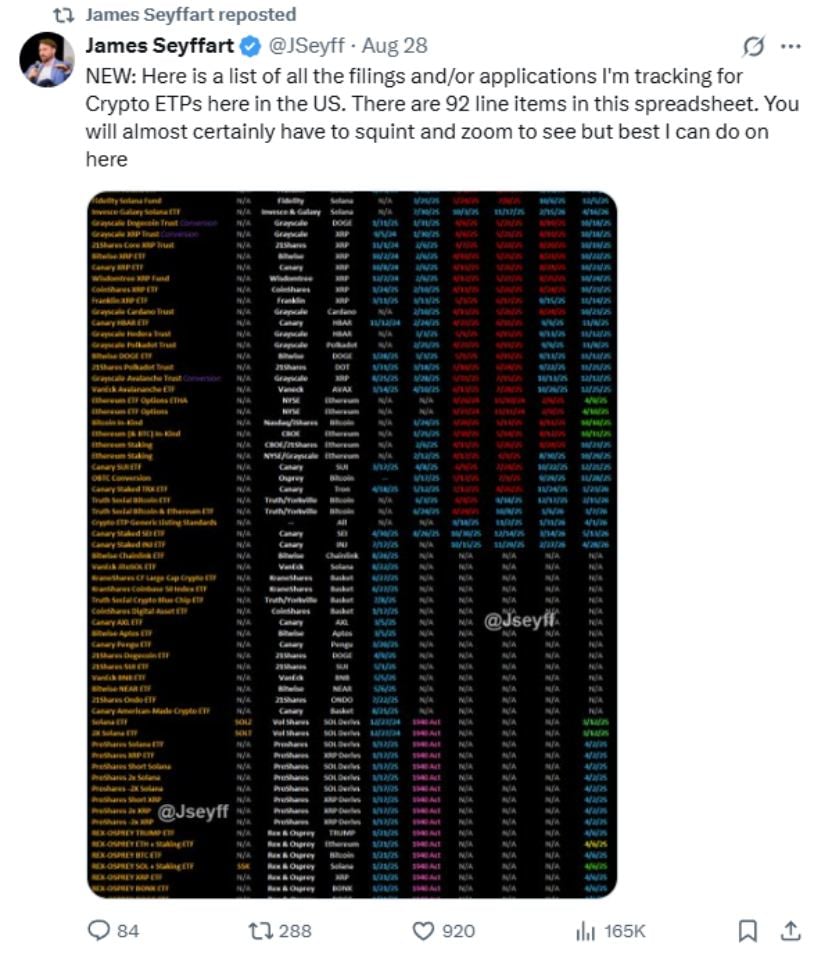

Our protagonists join an already jam-packed ballroom of no fewer than 92 crypto ETP suitors, all eagerly awaiting the SEC’s nod – or rejection – mostly by the climactic curtain call of October 2025.

Leading this exuberant dance are Solana with eight suitors, followed closely by XRP with seven. Other notables like Litecoin, Dogecoin, and a motley crew of altcoins mumble their applications beneath their breath, hoping for a shot at the dazzling spotlight.

Prediction markets are positively giddy: Solana enjoys a 99% chance of approval (a meteoric rise from 72% in May), XRP hums along with 87%, and Dogecoin bounces with an impressive 82% – almost double its June odds. One might say the altcoins are positively beaming like peacocks at a glittering soiree. 🦚💃

will it crown crypto ETFs with regulatory splendor, or will cautious glares and bureaucratic dance refusals persist in this grand financial festival? Only time, and perhaps a good dose of Wildean wit, will tell. 🕰️🍸

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

- XRP XTRAVAGANZA: Is This the Crypto Comeback of the Century? 🚀💸

2025-09-01 00:29