Ah, Bitcoin! That enigmatic digital sovereign of numbers and dreams. It sits there, stubborn as a mule in a swamp, clinging to $118,000 like a miser clutching his last kopeck. While the rest of the crypto market tumbles into chaos—down over 5% in a day—Bitcoin barely flinches, dropping just 0.6%. Is this strength or simply an elaborate prank? 🤔

Such stoic behavior in a stormy sea usually hints at bullish ambitions. Yet, despite sellers seemingly on an extended vacation (or perhaps lost in the metaverse), Bitcoin refuses to rally. Instead, it lingers, teasing us like a cat dangling a mouse by its tail. Time to unravel this riddle wrapped in cryptographic mystery! 🐱

Taker Sell Volume: Where Have All the Bears Gone? 🐻➡️🌴

One cannot help but notice the dramatic collapse in taker sell volume—a metric so revealing it might as well wear a monocle and carry a ledger. On July 25, taker sell volume peaked at nearly $17.8 billion. Now? A paltry $1.2 billion. Yes, dear reader, the bears have packed their bags and left for warmer climes. Or perhaps they’ve simply given up, exhausted from trying to push Bitcoin off its perch.

When sellers vanish and prices hold firm, one would expect fireworks—an explosion upward, a triumphant march toward glory. But no, Bitcoin remains inert, like a nobleman refusing to rise from his armchair. Does this mean the bullish thesis is dead? Not quite. It merely means the trigger has yet to be pulled—or perhaps misplaced entirely. 🎯

Taker sell volume, for those uninitiated, tracks how aggressively traders are dumping coins. When this number plummets, it suggests fear has abated—or that the bears are too busy binge-watching TV shows about blockchain billionaires. Either way, reduced selling pressure is good news… unless nothing happens, which is precisely what’s happening. 😅

NUPL Peaks: Profit-Taking Strikes Again 💰📉

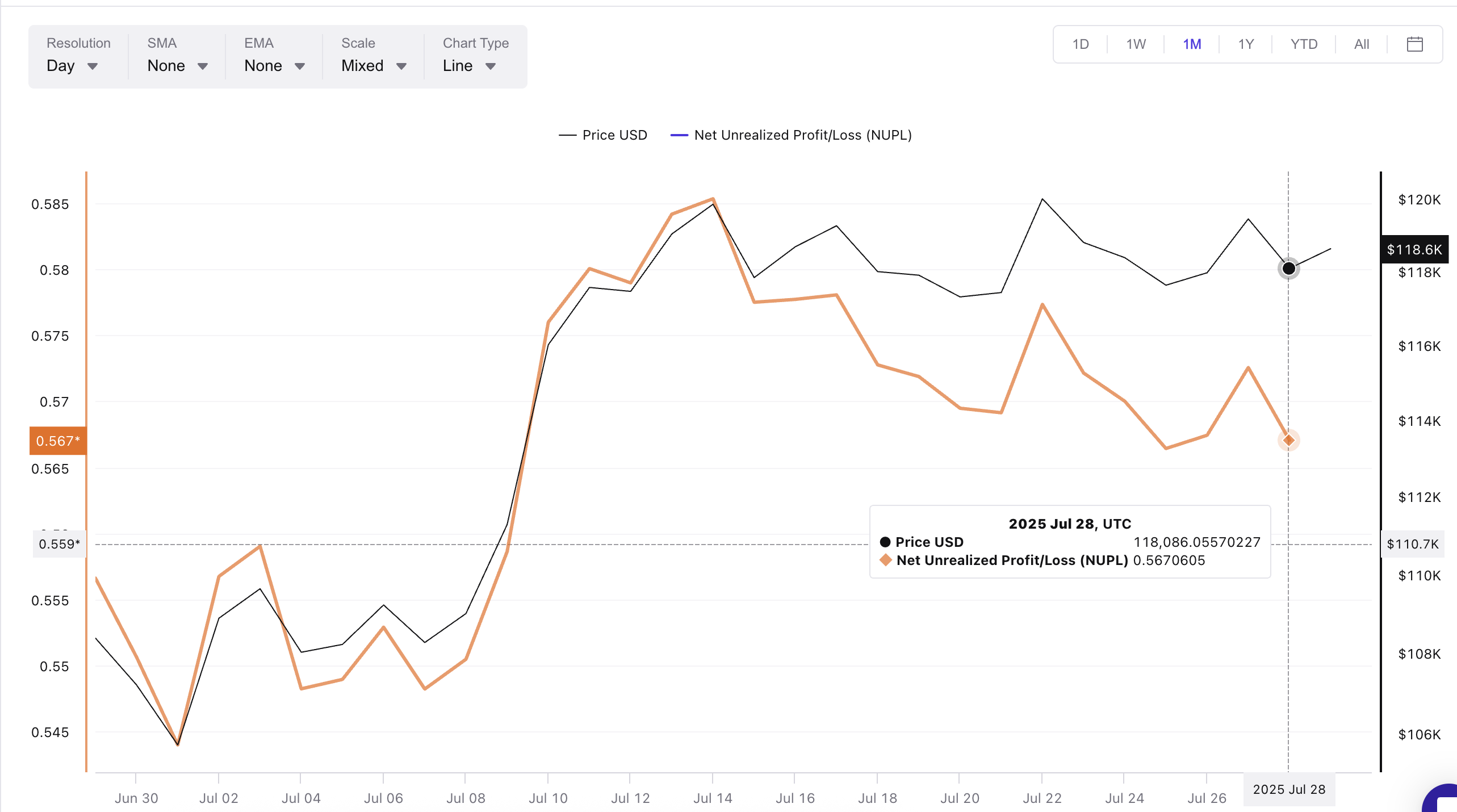

Enter NUPL—the Net Unrealized Profit/Loss metric, a tool so insightful it could double as a therapist for crypto enthusiasts. Over the past fortnight, Bitcoin repeatedly flirted with the $119,000-$120,000 range, only to retreat each time like a shy suitor. Coincidence? Hardly. This is profit-taking at work, plain and simple.

Each attempt above $119,000 saw NUPL peak between 0.57 and 0.58, signaling that holders were cashing out faster than you can say “HODL.” And why not? After all, who wouldn’t want to lock in gains after such a tantalizing ascent? The result? A temporary stall, as the market digests these withdrawals without fresh waves of panic-selling. Ah, the delicate dance of greed and caution! 💃🕺

Bitcoin Price: Stubborn Support Meets Stubborn Resistance 🤼♂️

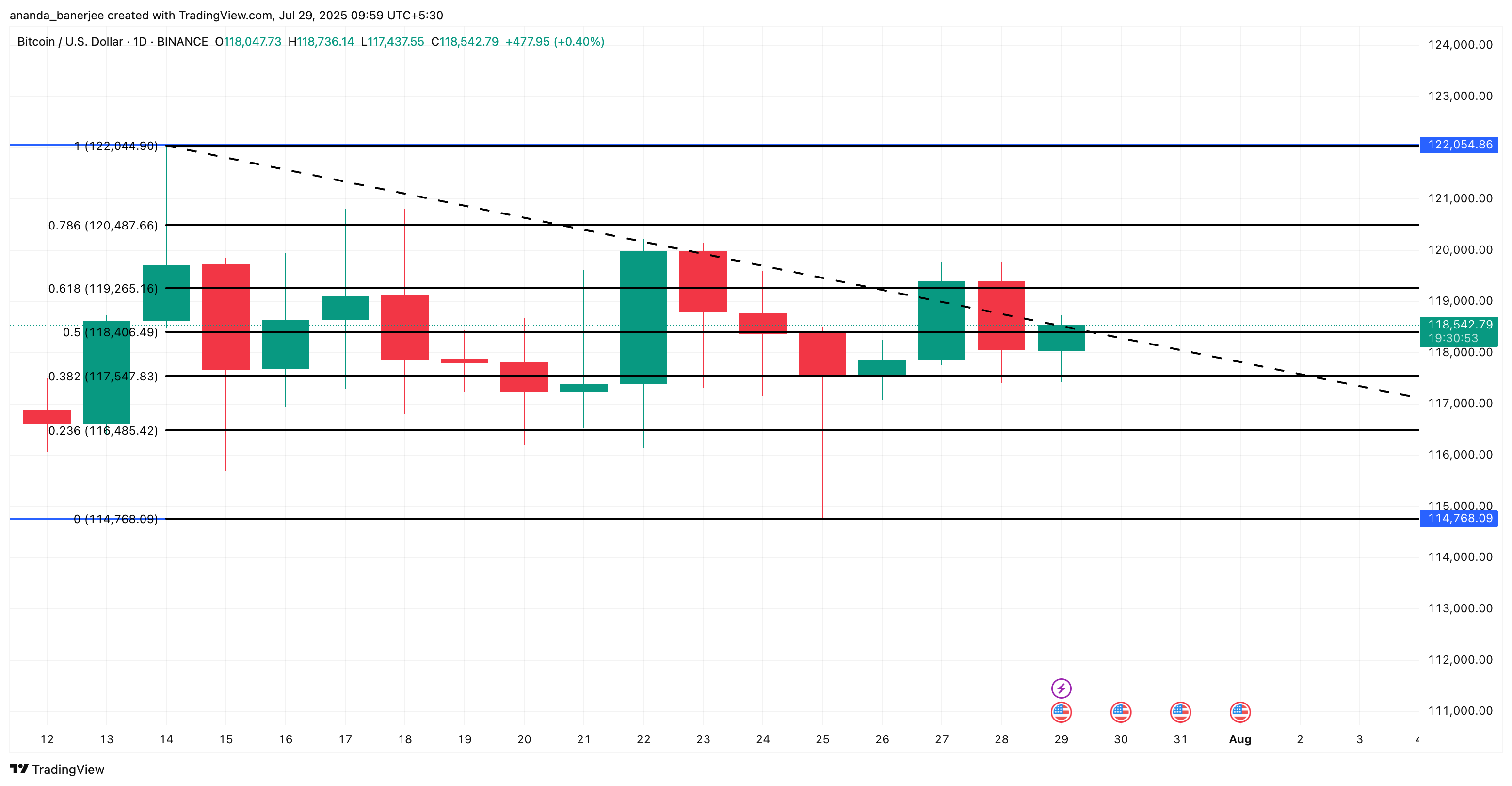

Despite repeated failures to break above $119,000, Bitcoin clings tenaciously to support levels near $117,000-$118,000, fortified by Fibonacci retracement levels that seem more impenetrable than medieval castle walls. Sellers may have stepped aside, but buyers appear equally hesitant, leaving the price trapped in limbo like a chess piece caught between moves.

The culprit? Resistance, both technical and psychological, looms ominously at $120,000. Until Bitcoin clears this hurdle with conviction, the rally remains as elusive as a pot of gold at the end of a rainbow. But should it succeed, the path opens wide—with $122,000 beckoning like a siren’s call. 🌈💰

Yet beware, dear speculator! Should Bitcoin dip below $117,000, the structure flips bearish, opening the gates to $114,000. One misstep, and the entire edifice crumbles like a house of cards. Such is the precarious nature of markets, where fortunes are made and lost in the blink of an eye. 👀

For token analysis and market updates: Craving more insights like these? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. Because knowledge is power—and power, my friend, is the ultimate currency. 💪📈

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD THB PREDICTION

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

2025-07-29 08:42