Ethereum’s derivatives market is barreling into December with the same vibe as a family dinner where someone’s about to bring up politics – a cocktail of bloated open interest, options chaos, and “max pain” levels that suggest traders are either buying caffeine or therapy sessions. 🤯

The Numbers: A Tale of Two Markets (Or Why Everyone’s Checking Their Screens Every 5 Minutes)

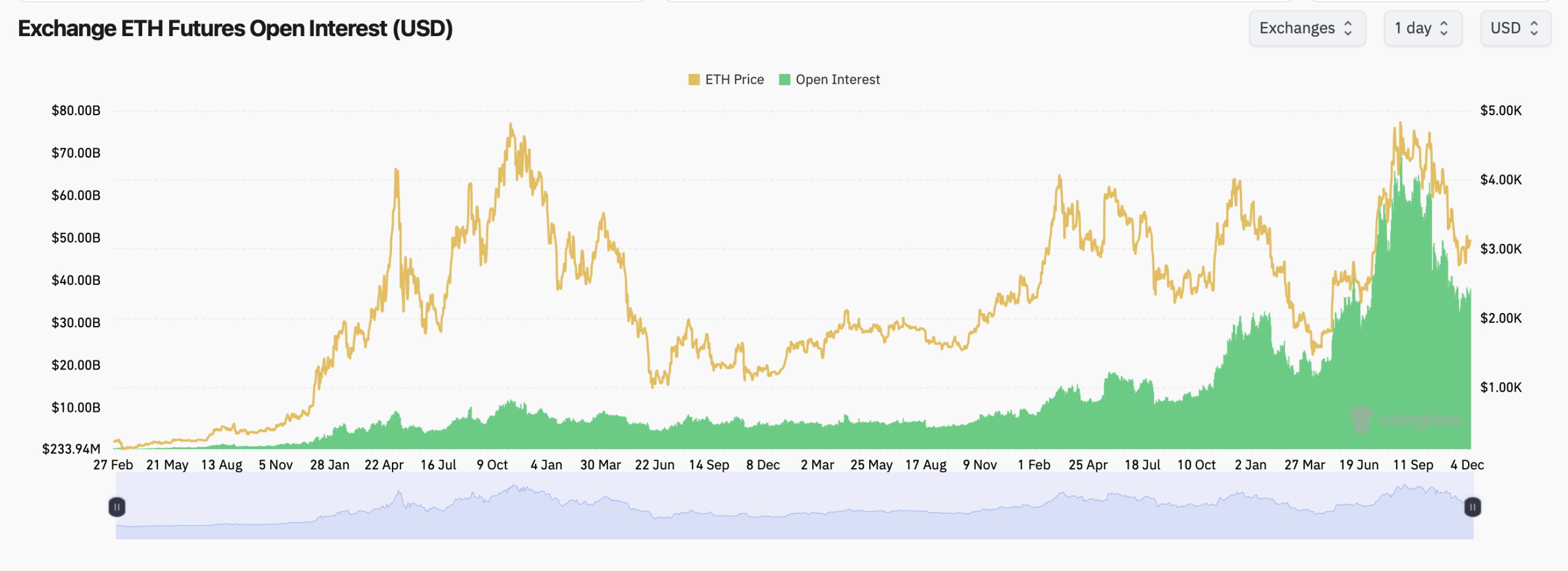

Ethereum is clinging to $3,291 like a toddler holding a candy bar they’re about to drop. Futures open interest? A cool $38B across exchanges, per coinglass.com data. But here’s the kicker: the market’s about as balanced as a three-legged chair. 🪑

CME’s got 16.5% of that action – 2.02 million ETH – and it’s cooling off faster than a leftover slice of pizza. Binance, holding 21% (2.57 million ETH), is doing the financial equivalent of nervously tapping their foot under the table. Traders are trimming risk like it’s a bad haircut. 💸

Bybit and Kucoin? The only ones daring to be different, sucking in inflows like a Dyson vacuum. Meanwhile, the rest of the exchanges are watching open interest drop faster than a mic at an open-mic night. Traders aren’t doubling down – they’re de-risking like a vegan at a BBQ joint. 🥗🔥

Futures? Still stacked like a Jenga tower in a earthquake zone. High open interest + sideways price = a coiled spring. December’s got a history of turning “meh” into “holy $%&@!” moves. 🚀

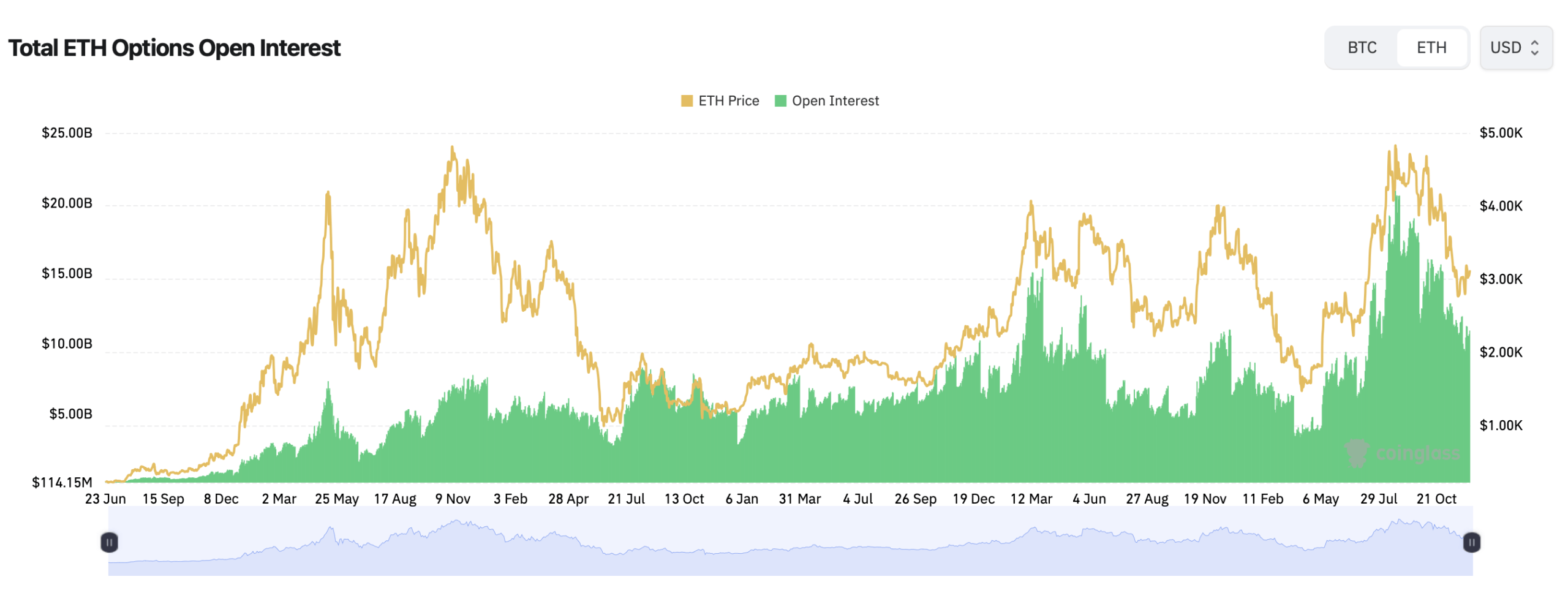

Ethereum’s options market? A psychological thriller. Calls outweigh puts 62.6% to 37.4% – everyone’s betting on upside like they’re trying to convince themselves Santa’s real. But then… last 24 hours show puts spiking to 42%. Translation: traders are quietly buying seatbelts while pretending they’re not scared. 🚗💨

Deribit’s strike prices? $6,000, $7,000… sure, why not? Traders are dreaming of a “Santa Rally” while the spot price clings to $3,100 like a sinking ship. It’s not optimism – it’s denial. 🎁🚢

Max pain levels? Deribit’s pointing to $3,000s for December, then a “surprise” leap to $4K+. Binance? Same script, $3K cluster. In English: ETH’s probably heading to the low-$3Ks, but everyone’s still buying lottery tickets for $5K+. 🎟️

Analysts? They’re split between “meh” and “maybe $3,800?” It’s the crypto version of “eh, could be worse.” The market’s bracing for swings like a kid in a pillow fight. Fakeouts, whipsaws, and a holiday miracle? December’s got all the charm of a root canal. 😬

Bottom line: Ethereum’s derivatives are screaming “something’s gonna give.” Futures are big, options are hedged, and max pain says “brace yourself.” Traders aren’t panicking – they’re just… sweating a little. 💦

FAQ ❓

- What’s driving Ethereum’s December chaos?

High open interest, options panic, and max pain levels conspiring like a group chat of exes. - Why the sudden love for puts?

Traders are hedging downside like they’re buying travel insurance for a volcano. - Max pain levels say what?

$3K-$3.3K range is the “least worst” outcome. Classic compromise. - Futures market compared to last month?

Still bloated, but traders are cutting leverage faster than a breakup text.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- Silver Rate Forecast

- USD CNY PREDICTION

- EUR USD PREDICTION

- UNI PREDICTION. UNI cryptocurrency

- UK Oil Company Ditches Tea for BTC: Mining Bitcoin with Stranded Gas 🚀

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- Gold Tokens: The New Gold Rush or Just Fool’s Gold? 🤔💰

2025-12-09 20:16