The price recovers: slow, uncertain, recalcitrant. The market, ever the indifferent warden, watches as if it has all the time in the gulag of eternity. After the bleakness of intraday lows—a trough so deep even the crows took a detour—Dogwifhat, that most meme-ish of assets, shuffled upward. Consolidation lingered like a stale draft in a Siberian barrack. Yet, there was talk—always talk—of potential upside, though “potential” in finance is a word like “hope” in the camps: frequently uttered, rarely delivered.

Some say the waves—those mythical Elliott ones—signal the end of correction, as if mathematics could bracket the chaos of capital. The moment, at least, is one of equilibrium: indicators, like guards on a midnight round, are neutral. Still, the price hovers above $1, clutching at its dignity, daring fate to knock again.

Elliott Wave Suggests Completion of ABC Correction

On the 4-hour chart—shared by our soothsaying analyst @Morecryptoonl, who probably hasn’t slept since the last bull market—a classic three-wave ABC correction appears. Did it begin at July’s melodic peak of $1.73? Yes. Has it now crawled to the 50% Fibonacci level at $0.92, forming what passes for a bottom? Perhaps. In this house of mirrors, bottoms are often just trapdoors to new cellars.

The support zone aligns with previous price battles—many lost, a few drawn—and subwave formations as mysterious as a KGB memo. Maybe this range is the new floor. Maybe, like so many “floors,” it’s just another spot to pace restlessly. Some still believe—bless them—that if wave C has concluded, a bold upward movement is next. Optimism: an incurable disease among traders.

Between $0.92 and $0.74 lies a confluence of technical omens, Fibonacci zones crowding together like state informers at a market stall. Rebound here, and wave III—much anticipated, perennially late—could begin, so the bulging wallets tell themselves. Resistance awaits at $1.25 and $1.73, testing traders’ resolve in the same way Moscow’s winters test boots. Only after these are conquered do Fibonacci extensions whisper about $2.74 and $3.94. Until then, confirmation is just a word—one more used-up match in a drafty cell.

Short-Term Price Action Holds Above Key Support

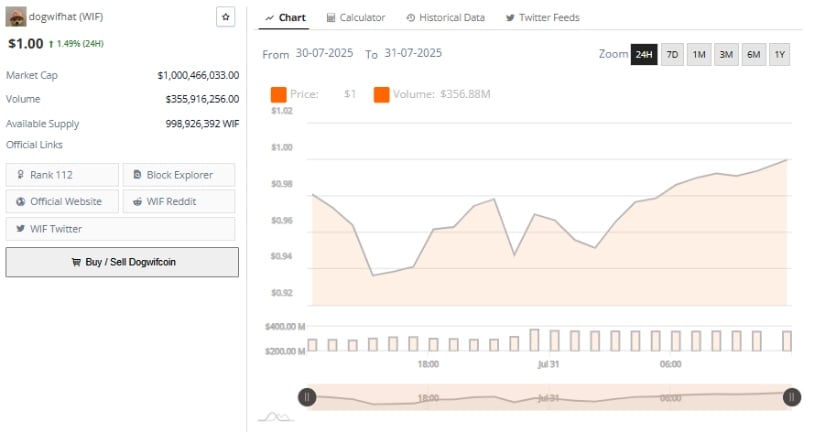

From July 30 to July 31, the price crept up from $0.92 to near $1.00, as if afraid to disturb the bureaucratic quiet. Higher lows and higher highs—sure, the technical textbooks would be proud, if anyone ever bothered to read them. WIF clawed its way back to $0.96, trundling ever-nearer to that psychological $1.00 like a dog circling the only warm stove in the settlement.

The absence of wild swings—no frenzied speculation, just a grind—suggests the latest recovery may not be simple gambler’s luck. Or maybe the gamblers are just bored.

Volume tells a similar story: $356.88 million changed hands. Perhaps healthy trading, or perhaps people simply trading misery—hard to say. Yet, consistent accumulation gives the appearance of intent. Around $1 traders cluster, pondering: “Should I break out, or break down? Or simply break?”

If the price props itself above $0.96, perhaps there’s a path forward; a slip below, and $0.85 looms, a pitfall ready to swallow optimism whole. The market grinds on, unmoved by either hope or despair—there is always another tomorrow to disappoint.

At the Time of Writing: Indicators Signal Market Equilibrium

At the time of this writing—which will be outdated by the time you finish this buyers peeking around corners, sellers napping at their posts. Momentum indicators, typically unreliable narrators, offer little.

MACD at 0.020 stares longingly at a signal line of 0.044, its histogram at -0.024. A bearish crossover, they call it, which in human terms means “please keep expectations low.” Rarely does a rally gain steam as long as the MACD refuses to rise—though, as history shows, hope springs eternal (and, occasionally, delusional).

The RSI—forever torn between optimism and surrender—sits at 48.38, neither bullish nor bearish, just vaguely exhausted. Range-bound for weeks, breaking neither up nor down. Like a dog chasing its tail, round and round, in a circle of indecision. Above 50, hope flares. Below 45, resignation. Buyers and sellers eye each other across the frozen river, waiting to see who shivers first.

If the technicals swing upward, perhaps WIF will make its break. If not, there’s always the next cycle—or the next decade. But for now, the asset waits, half-asleep, half-watchful, hat on, ready to leap (or just nap) at the slightest sound.

Read More

- Altcoins? Seriously?

- Gold Rate Forecast

- IP PREDICTION. IP cryptocurrency

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- USD VND PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- EUR USD PREDICTION

- FIL PREDICTION. FIL cryptocurrency

2025-07-31 20:58