And who stands at the forefront of this speculative stampede? None other than $BTC, the crown jewel of cryptocurrencies, boasting a colossal $2.22 trillion market cap. It’s the obvious choice for cash fleeing money markets, isn’t it? After all, where else would you park your billions? Real estate? Stocks? Art made of bananas? Please. 🍌

But ah, here lies the rub: the Bitcoin network, noble as it is, was built for security and decentralization-not speed or scalability. When too many traders pile onto its digital highways, congestion ensues. Transactions slow down, fees rise, and chaos reigns supreme. Sounds delightful, doesn’t it? 😅

Enter $HYPER, the plucky underdog of Layer-2 solutions, which has already raised over $14.7 million in its presale. Could this be the hero we deserve? Investors certainly seem to think so, pinning their hopes on Bitcoin Hyper as the savior that will make transactions cheaper, faster, and more efficient. Oh, how humanity craves convenience!

A New Dawn for Bitcoin: High-Speed Trading & DeFi Galore

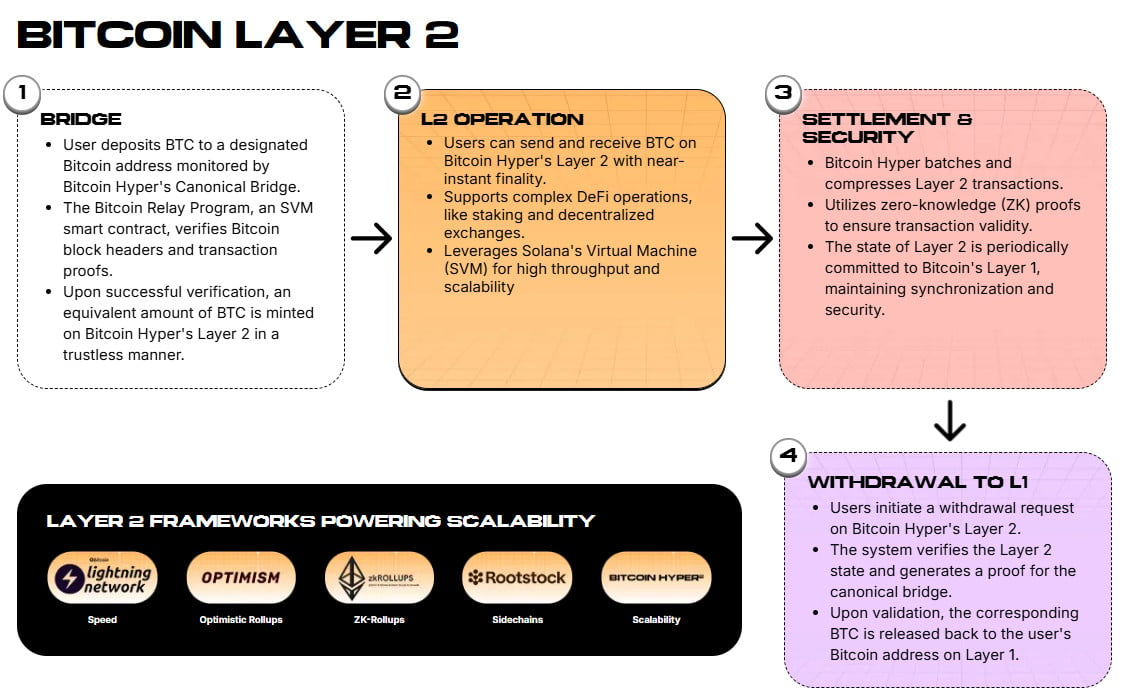

Bitcoin Hyper promises to solve these “pain points” (a phrase I’m sure Dostoevsky himself would have appreciated) with its Canonical Bridge and Solana Virtual Machine (SVM). Imagine depositing your $BTC through this bridge, which verifies transactions before minting equivalent tokens on the L2. Faster than you can say “blockchain,” your transfers are settled almost instantly. What sorcery is this? 🪄

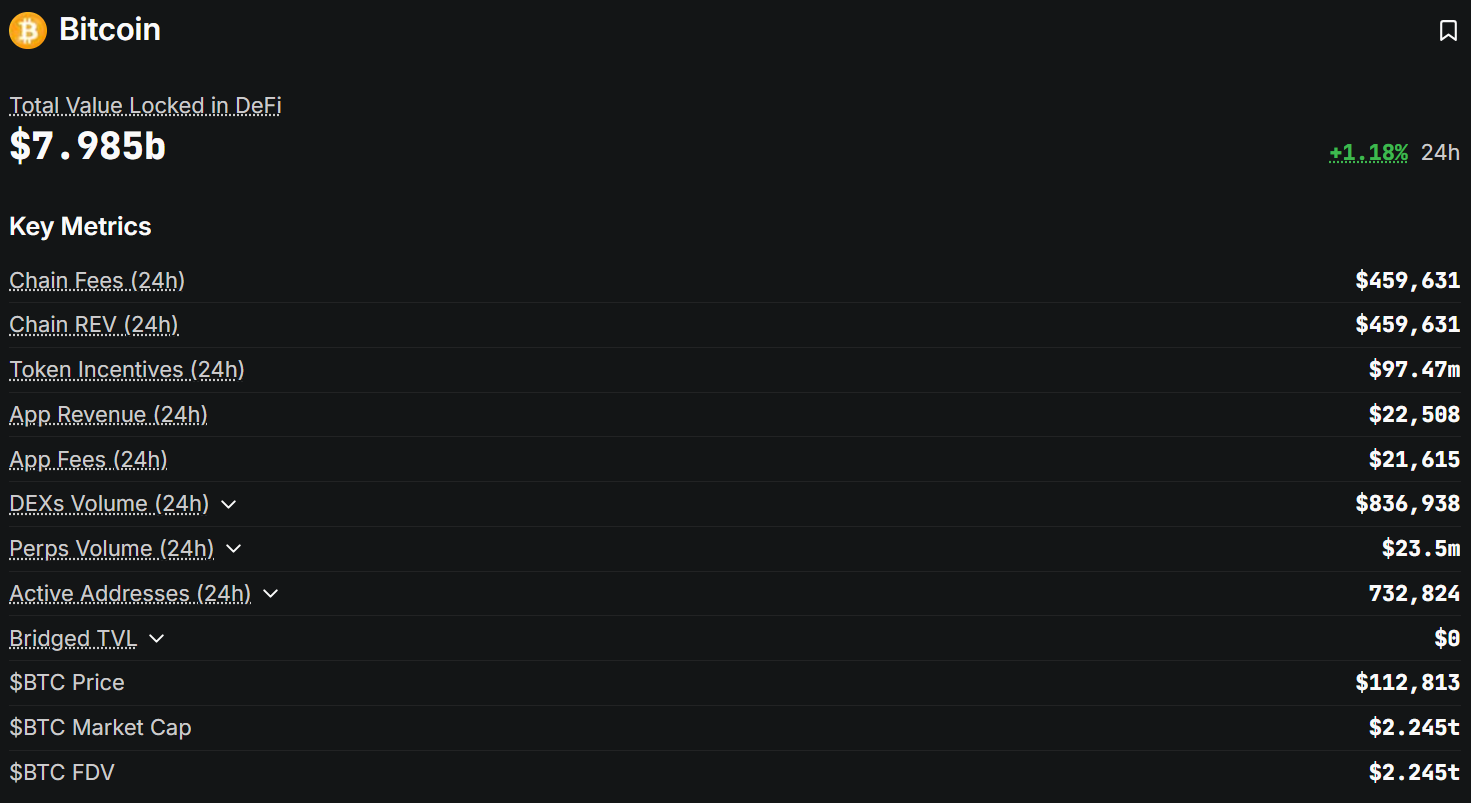

And let us not forget the SVM, which brings smart contract functionality to Bitcoin at Solana-level speeds. Finally, decentralized finance (DeFi) opportunities may flourish on the Bitcoin network, bridging the gap between Ethereum’s dominance ($91.61 billion TVL) and Bitcoin’s paltry $7.985 billion TVL. Will Bitcoin Hyper level the playing field? Or will it collapse under the weight of its own ambition? Only time will tell. ⏳

Both the Canonical Bridge and SVM aim to reduce transaction fees, each in their own quirky way. The bridge batches deposits off-chain, while the SVM processes transactions at lightning speed. This could lower Bitcoin’s average gas fee of $0.786, making it a cost-efficient alternative to Ethereum’s $0.553. And let’s not overlook the fact that Bitcoin currently handles a measly 11.91 transactions per second (tps), far behind Ethereum’s 20.57 tps. Truly, progress is sorely needed. 🙄

On the L2 network, $HYPER holders will enjoy reduced fees, staking rewards (currently a juicy 75% APY), and governance rights. Plus, a full 30% of the token supply is reserved for ongoing development-a sign, perhaps, that the team actually cares about the project’s future. How refreshing! 🌱

Could $HYPER Be Your Ticket to Riches? 🤑

As $BTC continues its relentless march toward mainstream adoption, Bitcoin Hyper positions itself as the knight in shining armor, ready to slay the dragons of congestion, high fees, and limited functionality. By unlocking DeFi potential and improving scalability, it seeks to elevate Bitcoin to even greater heights. Noble intentions, indeed.

So why not join the $HYPER presale for just $0.012885 per token? Rumor has it that prices will soar tomorrow and could reach $0.2 by year’s end-a potential 1,452% return on investment. Who needs a savings account when you can gamble on crypto, right? 😉

In conclusion, Bitcoin Hyper does not merely build upon Bitcoin-it transforms it. Elevating its capabilities, addressing its flaws, and daring to dream of a brighter future. Will $HYPER become the next crypto to 1000x? Or will it fade into obscurity like so many others before it? Place your bets, my friends. The game is afoot. 🎲

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Ethereum’s Price Plummets, But Its Economy Dances Salsa – Here’s the Plot Twist!

- Solana Resilient? Yeah, Sure, Even Hackers Love It Too!

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SKY Crypto Surges: Is a Pullback Coming? 🚀

2025-09-09 19:49