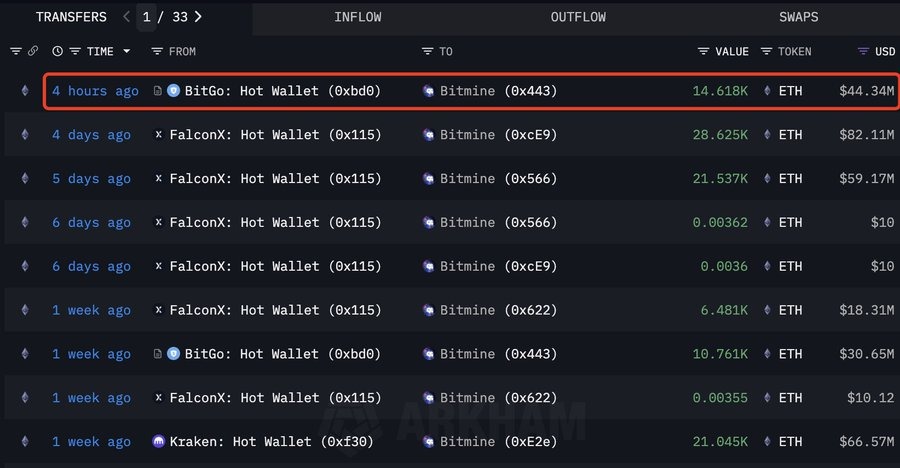

In the labyrinthine web of decentralized finance, where the promises of tomorrow intermingle with the cold realities of today, BitMine Immersion Technologies has been diligently amassing its Ethereum hoard. Led by the ever-optimistic market strategist Tom Lee, BitMine has continued to pour its treasury into Ethereum, recently adding no fewer than 14,618 ETH valued at a staggering $44 million.

And yet, despite this grand pilgrimage of capital towards Ethereum – a sumptuous feast of millions eagerly offered – the price of ETH stubbornly languishes, trading with all the enthusiasm of a snail at $3000. Arkham Intelligence data paints a grimly amusing picture: this transaction on November 28 was but a single note in BitMine’s symphony, contributing to a spendthrift ambition to possess no less than 5% of Ethereum’s entire bounty.

To put it plainly, they’ve already secured nearly half of their mighty goal. Counting all their gains, BitMine holds 3.63 million ETH, a quaint sum representing a fledgling 3% of the vast Ethereum flora. And yet, at the ticking eye-watering price of $3,027, the company postures proudly among the global titans of corporate Ethereum holders, their purse swelling to a jaw-dropping $10.39 billion.

Corporate hoarders of Ethereum are closing ranks at an alarming pace, collectively gobbling up $24.97 billion of the common supply, nearly 5.01%. With the glint of nascent technologies like staking and tokenized assets trailing in the wake of Ethereum, these giants perch quietly, ruffling the feathers of a future that seems all but inevitable.

As if staged by some cosmic joke, BitMine’s stock (BMNR) has, in a fit of irony, leapt about 9% to $31.74, feasting upon the crumbs of good tidings. Yet, the sad reality is that even after such sanguine feats, it continues to succumb to a weighty 37% slide over an ailing month, inseparably hitched to Ethereum’s fortunes and the broader market’s capricious swings.

In this peculiar era of paradoxes, allocations are increasing, yet prices refuse to budge. Ethereum’s value remains anchored near $3,030, a full quarter less than what it was a month before. Analysts quibble over reasons for the price’s chilling composure. While the tap of liquidity grows ever leaner, grand purchases by magnates may only graze the surface; they cannot single-handedly redefine the flow of an ailing river.

So, dear reader, whether this accumulation by BitMine is the harbinger of Ethereum’s eventual ascension, or merely another riddle in the cryptographic ledger of fate, only time, that silent raconteur, will spin its next yarn.

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Shocking UK Law Turns Cryptos into Private Property-The Future of Digital Assets?

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin’s New Kid: Can $HYPER Be the Next Crypto Gold Rush? 🐆🚀

2025-11-28 09:37