Ah, dear reader! Gather ’round as we delve into the curious case of Solana, a cryptocurrency that seems poised for a grand spectacle! With institutional demand strutting about like a peacock, all eyes are fixated on the $150 to $160 realm—a place that once ignited a rally so fierce, it could make even the most stoic investor weep with joy! 🦚

Solana Futures Demand: A Surge Worthy of a Comedy! 🎭

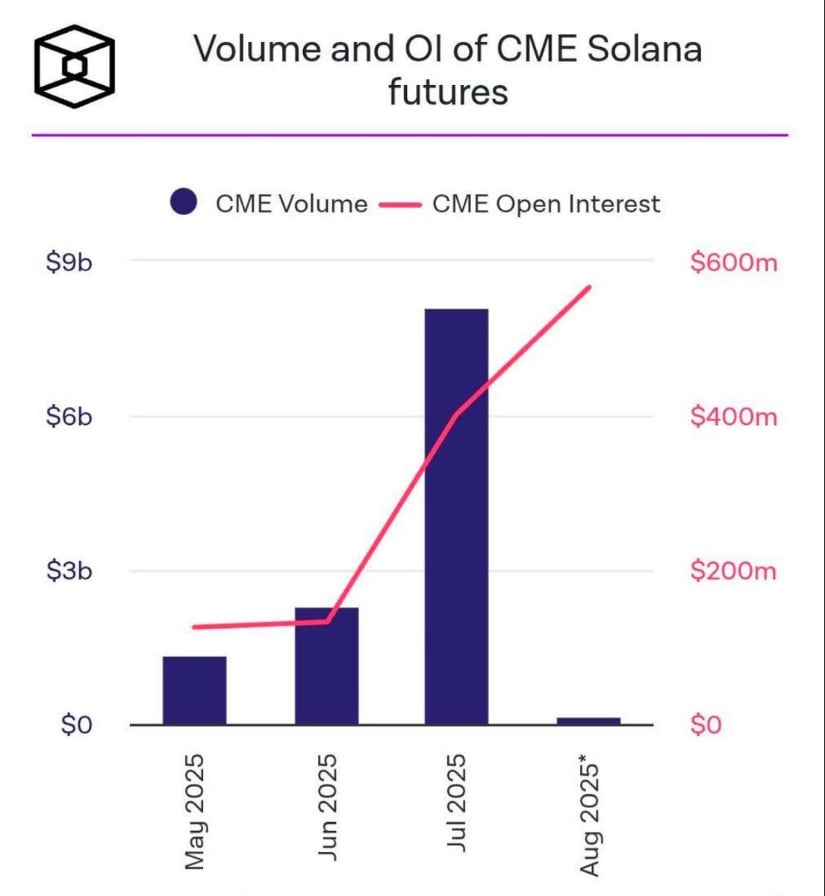

As August dawns, Solana finds itself in a delightful predicament! The CME futures open interest has ballooned to a staggering $800 million, a 370% leap from July’s modest $170 million. The chart, courtesy of SolanaFloor, reveals a dramatic shift in the appetites of our institutional friends, coinciding with the debut of the first U.S.-approved Solana staking ETF. It appears traditional finance has decided to join the party, leaving other exchanges like MEXC and KuCoin feeling rather left out! 🍾

This sudden rise in futures exposure is not merely a game of chance; nay, it is a strategic positioning! As open interest flirts with previous cycle highs, market participants are not just anticipating a fleeting moment of volatility. With Solana dancing around $160, the institutional flows tied to ETF optimism could very well become the sturdy foundation upon which both spot and derivatives markets shall build their castles! 🏰

Solana: Entering the Fabled Demand Zone! 🏞️

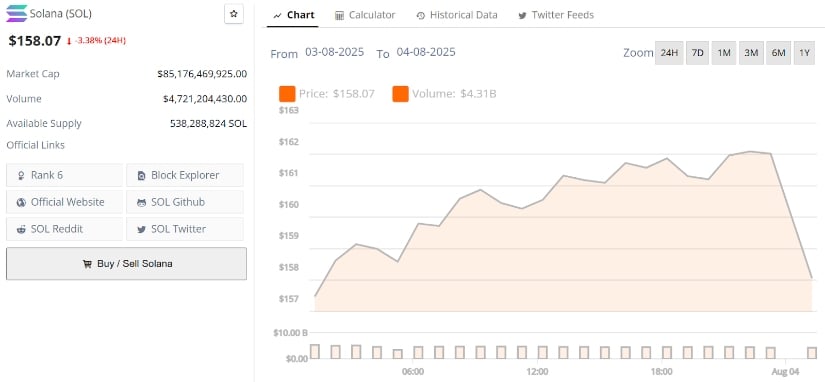

Lo and behold! Solana’s price action is aligning with the rising futures activity like a well-rehearsed play. After reaching heights above $206, our dear SOL has now retreated into a familiar demand zone between $150 and $160—a region that once served as the launchpad for bullish reversals. The chart shared by BitGuru reveals a retracement phase that respects prior breakout levels, hovering just above the 0.618 Fibonacci zone, a classic reset point during uptrends! 🎢

If this level holds firm and a bounce ensues, the technical setup favors a recovery leg with targets soaring back towards $180. Past price reactions in this range, especially the mid-cycle double bottom, suggest that buyers are ready to don their armor and defend their territory once more! ⚔️

Solana’s Technical Analysis: A Comedy of Errors? 🤡

Solana now finds itself testing the lower boundary of a well-defined parallel channel, a guiding force since April. As depicted in the chart shared by The Boss, SOL is reacting to Bitcoin’s broader pullback but remains steadfast within its trend structure. The current level around $160 aligns with the base of this channel and the 0.5 Fibonacci retracement zone from the recent $206 high. Thus far, this area has served as a reactive region, halting deeper drawdowns like a well-timed punchline! 🎤

If this lower boundary holds, the next visible resistance levels are marked near $206 and $274, corresponding with both the upper band of the channel and the 0.618 and 0.786 Fib zones. Given the recent surge in institutional futures activity, this chart reinforces the notion that current price action could merely be a healthy consolidation phase within a grander trend! 🎭

Solana’s Liquidation Heatmap: A Trigger Zone of Comedy! 🔥

Ah, the liquidity map of Solana is flashing a key short-term trigger level! According to CW8900’s latest chart, the largest concentration of liquidation sits just above $170.4, totaling a whopping $73.01 million! This pocket represents a cluster of over-leveraged short positions, meaning any decisive move above it could unleash a wave of forced buys, igniting a short squeeze that would make even the most seasoned trader chuckle! 😂

In the context of the broader technical structure and rising ETF-driven futures demand, this $170 level becomes even more relevant. A reclaim of that zone would not only break local resistance but also position SOL back into breakout territory from the lower boundary of its channel. What a delightful twist in our tale! 🎉

Final Thoughts: Solana’s Price Prediction—A Comedy of Key Levels! 🎬

Solana’s recent pullback into the $150 to $160 demand zone is not just another dip; it could be a critical retest! With institutional futures interest surging and ETF tailwinds still in play, this correction appears more like a technical cooldown than a full-blown reversal. If SOL holds this zone and reclaims the $170 liquidation trigger, we may witness a resurgence of bullish momentum, with $180 to $206 back on the table! 🍿

Looking ahead, the $170.4 short squeeze zone could act as the ignition point. Reclaiming that level not only shifts sentiment but also aligns with the broader channel and Fibonacci structure. Solana’s price prediction eyes a bullish move that could set the stage for a grand August performance! 🎭

Read More

- Gold Rate Forecast

- Altcoins? Seriously?

- Silver Rate Forecast

- Brent Oil Forecast

- IP PREDICTION. IP cryptocurrency

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- USD VND PREDICTION

- USD CNY PREDICTION

- EUR USD PREDICTION

- Truebit’s Midlife Crisis Costs $26M – 2026’s Hacking Spa Day 🛁💰

2025-08-04 01:02