World Liberty Financial (WLFI) is currently trading around the modest sum of $0.21, marking a rather gloomy 12% dip over the last 24 hours. Since its grand entrance at $0.33 on September 1, WLFI has gracefully corrected by a whopping 37%-a correction that seems more like a plot twist in a tragicomedy of financial proportions.

At first glance, one might think WLFI is a token under siege, a ship sinking in a sea of red. However, a closer inspection of the on-chain data and liquidation maps paints a more complex picture. Despite the apparent storm, whales continue to accumulate WLFI with the enthusiasm of a dog chasing its own tail, while the derivatives markets are flooded with short bets. The final liquidation clusters hint at a pivotal level where WLFI might just find its footing and rise again, like a phoenix from the ashes, or perhaps more accurately, like a cat that always lands on its feet 🐱.

Whale Buying Stays, But Dip Buying Slows Down

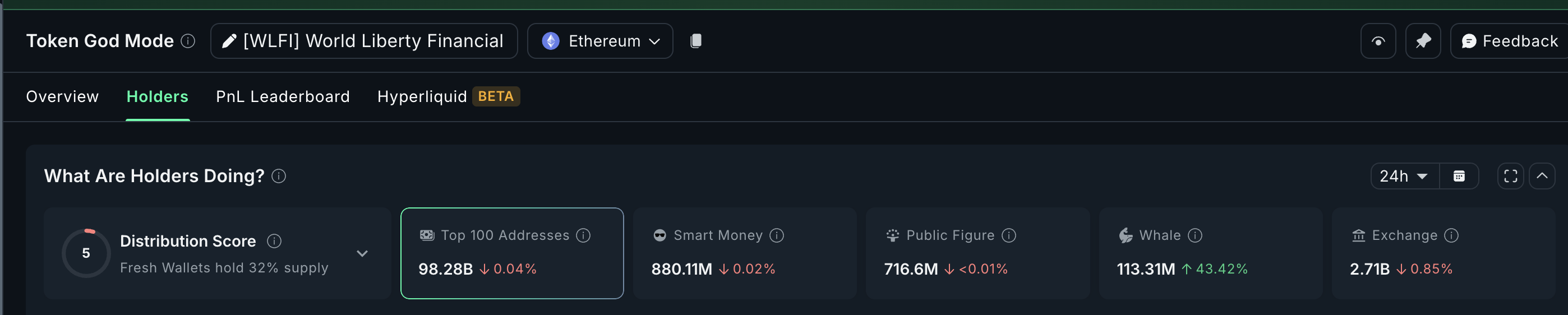

Even amidst WLFI’s precipitous decline, whale wallets have grown like mushrooms after rain. In just 24 hours, their holdings swelled by an impressive 43.42%, jumping from 79.01 million WLFI to 113.31 million WLFI. This translates to an additional 34.30 million tokens, worth nearly $7.2 million at today’s prices. One can only imagine the conversations in these whale circles: “I say, old chap, another million or two won’t hurt, will it?” 🤑

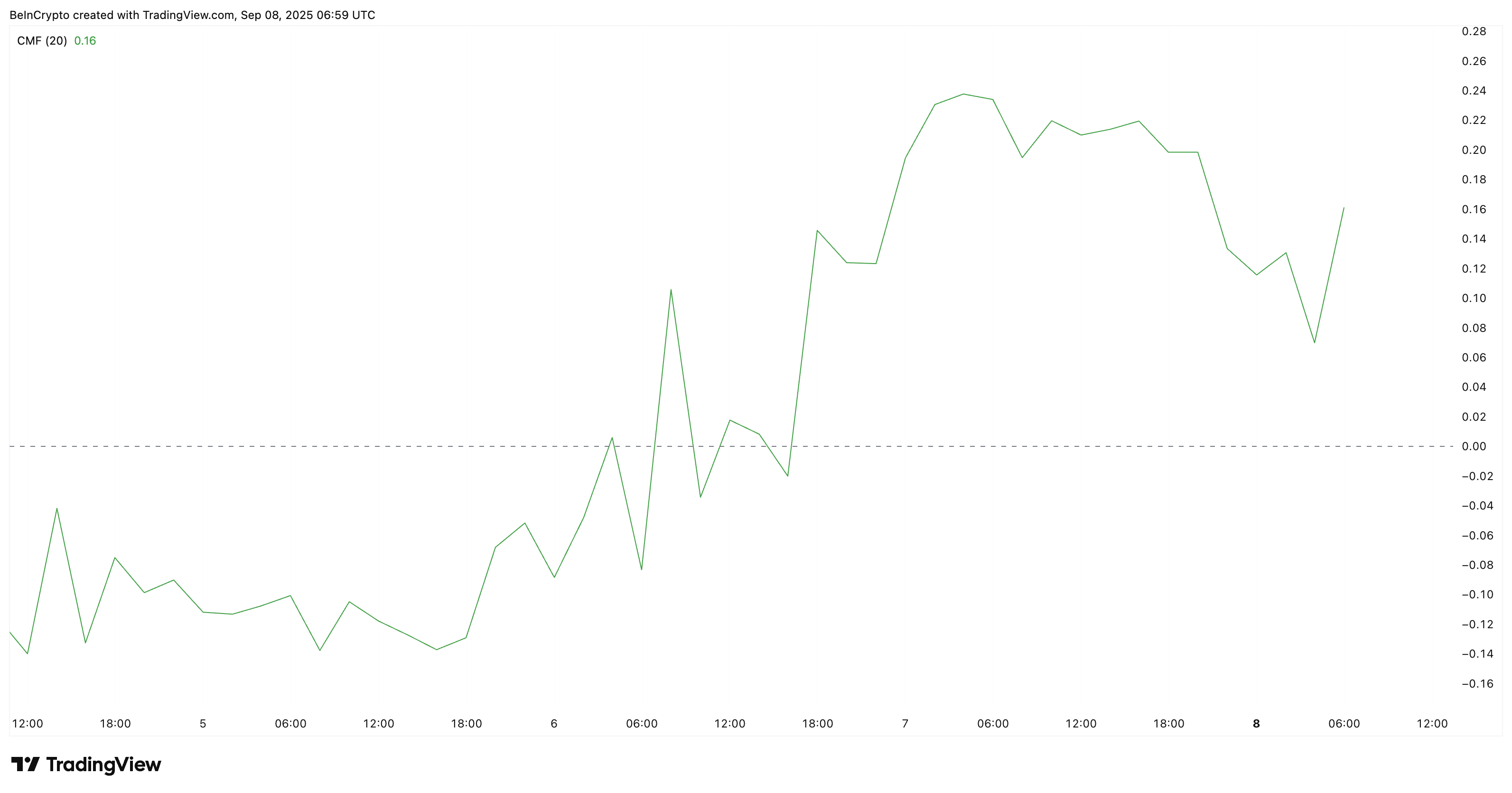

This buying spree is reflected in the Chaikin Money Flow (CMF), a metric that measures the broad flow of funds into or out of a token. Despite the market’s downturn, the CMF remains stubbornly positive at +0.17, a clear sign that large investors are still pouring money into WLFI. It’s as if they’re saying, “The show must go on, and so must our investments!” 🎭

For those eager to dive deeper into the world of tokens and trading, consider signing up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

//beincrypto.com/wp-content/uploads/2025/09/Screenshot-2025-09-08-at-12.25.27%E2%80%AFPM.png”/>

//beincrypto.com/wp-content/uploads/2025/09/WLFIUSDT_2025-09-08_12-28-53.png”/>

The alignment of the $0.18 liquidation cluster with chart-based support underscores why this level is considered the rebound zone. If WLFI can maintain its position above $0.20 and avoid a break below $0.18, the setup favors a bounce. However, if it fails to hold these levels, the bearish trend could extend further, leading to a market where even the whales might start to question their strategy. 🤔

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Ethereum’s Price Plummets, But Its Economy Dances Salsa – Here’s the Plot Twist!

- Gold Rate Forecast

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Shiba Inu Shakes, Barks & 🐕💥

2025-09-08 20:02