It seems the good ship Worldcoin has hit a rather choppy patch of sea, with the token’s recent slide reflecting a distinct lack of enthusiasm among buyers and a decidedly cautious market mood. As open interest takes a nosedive alongside the plummeting price, our dear traders appear to be as hesitant as a cat approaching a bath, with the balance decidedly tipped in favor of the bears. The burning question now is whether the magical figure of $0.86 can hold its ground or if the token will continue its melancholy march downward. 🌪️📉

Persistent Selling Momentum Drives Price Lower

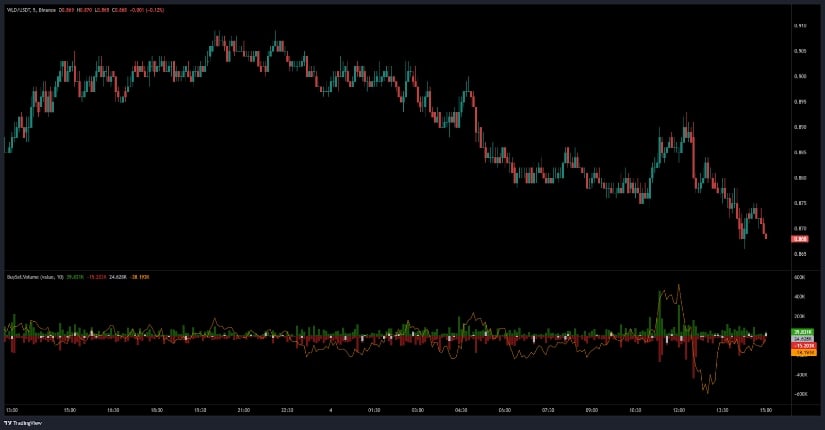

The Open Interest chart on the 5-minute timeframe, my dear readers, is a veritable masterpiece of bearish dominance. The price, much like a gentleman who has lost his way in a blizzard, steadily fell from around $0.91 to near $0.868, forming a pattern of lower highs and lower lows-a classic sign of sustained selling pressure, one might say.

Brief attempts to bounce back near $0.885 were as fleeting as a Mayfly’s lifespan, quickly fading as sellers reclaimed control, revealing a market where every rally is met with a renewed wave of selling intensity. The candlesticks, those little waxy friends of ours, reflect this struggle with a clarity that would make a crystal ball jealous.

The Buy/Sell Volume indicator, a faithful barometer of market sentiment, shows sporadic buy volume green bars being consistently overshadowed by larger sell volume red bars. Net order flow lines, like a rollercoaster ride gone wrong, display sharp negative spikes during price drops, signaling aggressive liquidations and stop-loss cascades. It’s enough to make one reach for a stiff drink.

Though there are occasional brief surges in buying activity, these have been as fleeting as a Jeevesian smile, doing little to change the prevailing downtrend. This confirms that the bears, those pesky fellows, currently hold the upper hand as WLD edges ever closer to critical support. 🐻🔥

Intraday Trading Highlights Volatility and Struggle for Control

Turning to the 24-hour TradingView data, WLD has been navigating a particularly treacherous session. Starting around $0.89, it tested an intraday high near $0.91 before the inevitable selling pressure forced multiple dips. The token slid as low as $0.87, only to bounce strongly late in the session, much like a rubber ball determined to defy gravity.

This back-and-forth, a true tug-of-war, reflects the volatile struggle between buyers stepping in near the $0.87-$0.88 range, which has emerged as a crucial short-term support zone, and sellers pushing for lower levels when momentum falters. It’s a spectacle that would make a Roman gladiator blush.

Volume remained steady through these swings, suggesting active trading but no decisive dominance. The quick rebounds from support show buyers are still present, cushioning price declines, yet the inability to sustain gains near $0.90 indicates bulls as cautious as a cat on a hot tin roof.

Traders will be closely watching whether the asset can hold above this support band-if it fails, the path to further losses could accelerate, while a bounce might spark a short-term relief rally. It’s a bit like waiting for the other shoe to drop, isn’t it? 🤞💰

Technical Indicators Signal Bearish Bias Amid Signs of Possible Stabilization

On the daily chart, WLD is trading near $0.867, down 3.34%, and pressing against the lower Bollinger Band at roughly $0.835. This proximity to the band suggests oversold conditions, a potential setup for a bounce or continued bearish pressure if sellers remain as aggressive as a bear with a toothache.

The middle Bollinger Band at $0.934 remains well out of reach and currently acts as resistance, reflecting the distance bulls must cover to regain control. It’s a bit like trying to climb Mount Everest with a pair of slippers.

The Relative Strength Index (RSI) at 41.78 further supports this cautious outlook, sitting below the neutral 50 and highlighting diminished buying momentum. The RSI’s position beneath its moving average confirms that sellers currently outweigh buyers, much like a seesaw with a sumo wrestler on one end and a sparrow on the other.

While oversold readings can hint at a near-term reversal, it’s clear that a recovery won’t come without renewed buying strength, ideally confirmed by a break above the $0.934 level. Until then, the risk of further downside toward $0.80 or even lower remains, a prospect as appealing as a trip to the dentist without anesthesia. 😬📉

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Brent Oil Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- USD CNY PREDICTION

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin Miners Hilariously Boost Reserves by $220M & BTC Plays Hard to Get at $90k

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2025-09-05 03:20