Flare Networks, in a move that surprised exactly no one who enjoys watching digital Monopoly money shuffle around, has somehow convinced people that their idle XRP-previously useful only as a coaster for crypto bros’ energy drinks-can now “earn returns.” The numbers sound impressive, but then again, so does “free pizza,” until you realize it’s just a coupon for a single topping.

Flare’s Bridge to Somewhere (Probably Nowhere)

According to Flare, a staggering 91.69 million XRP have been “bridged” onto its network-a term that makes it sound like they built a golden archway, when in reality, it’s just digital paperwork. About 75% of that is allegedly “working” onchain, though “working” here likely means sitting in a vault, staring at its reflection in a smart contract.

The Flare vault system, which sounds like something from a dystopian bank heist movie, claims to hold 90.55 million XRP after accounting for inflows and outflows. Meanwhile, the FXRP wrapper-essentially XRP in a digital straightjacket-holds 91.67 million tokens with a “100% reserve ratio,” which is corporate-speak for “we pinky promise we didn’t lose your money.”

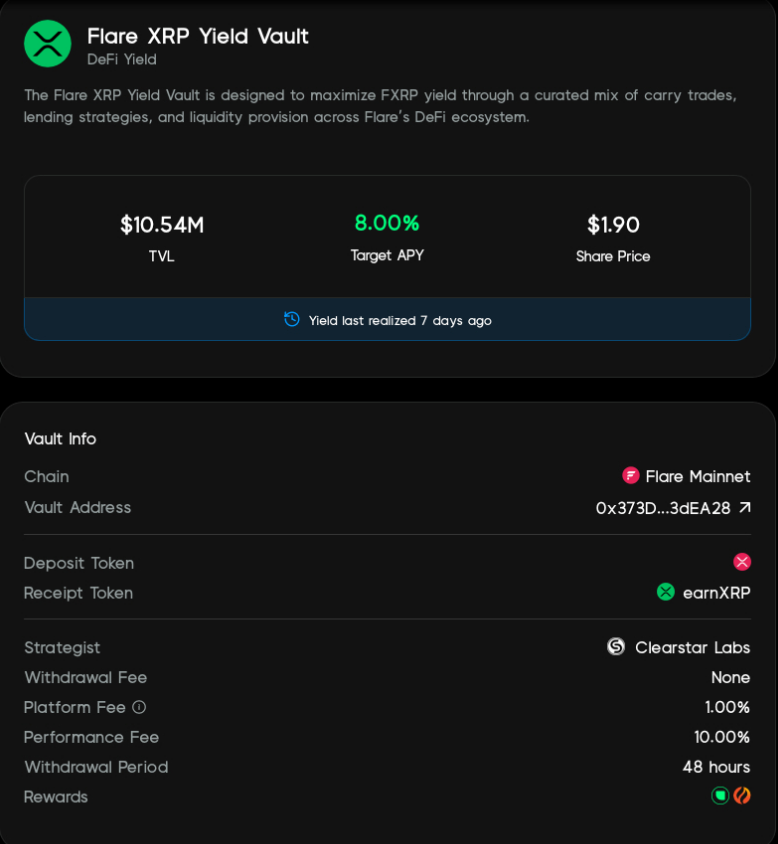

The Flare XRP Yield Vault, which sounds like a place where tokens go to contemplate their life choices, somehow scraped together $10.54 million in TVL in just 30 days. Quick growth? Sure. Sustainable? Well, let’s just say the last time something grew this fast unchecked, it was mold in my fridge.

How @FlareNetworks is becoming the center of XRP DeFi:

91M+ XRP bridged.

75%+ deployed onchain.And now: the Flare XRP Yield Vault powered by @upshift_fi ’s modular vault infrastructure, bringing automated strategy execution, risk frameworks, and scalable yield to XRP for the…

– Flare (@FlareNetworks) January 27, 2026

Deployment Rate: High, Like Everyone Involved

The “high deployment rate” suggests people aren’t just parking assets for an “easy bonus,” which is refreshing, because nothing says “trustworthy investment” like people frantically clicking buttons to chase yield before the music stops.

Upshift’s vault system, which automates yield processes (read: does math so you don’t have to), claims to apply “predefined risk controls.” Translation: “We promise not to YOLO your tokens into a meme coin… probably.” The actual strategies generating returns remain as mysterious as the contents of a gas station sushi roll.

Historically, crypto yields tend to nosedive faster than a celebrity’s reputation after a scandal. And let’s not forget that bridges and smart contracts-while fancy-have a habit of collapsing like a Jenga tower built by a toddler. But hey, what’s life without a little existential financial risk?

Where’s the Yield Coming From? (Don’t Ask)

Other firms, like Axelar and Hex Trust, have also wrapped XRP in digital duct tape to “earn returns,” because apparently, everyone’s desperate to prove XRP can do more than collect dust in wallets.

Meanwhile, Ripple-XRP’s corporate sugar daddy-has been busy flexing its business muscles: a $500 million funding round here, a regulatory license there. They even acquired GTreasury for a cool $1 billion, which launched “Ripple Treasury,” a product that sounds important but probably just moves numbers from one spreadsheet to another.

None of this, of course, actually explains how yield is conjured out of thin air. But in crypto, magic is just another Tuesday.

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Ethereum’s Price Plummets, But Its Economy Dances Salsa – Here’s the Plot Twist!

- SKY Crypto Surges: Is a Pullback Coming? 🚀

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Wall Street Pandemonium: Trump Grins, Crypto Traders Weep, Fed Plot Thickens

2026-01-29 06:05