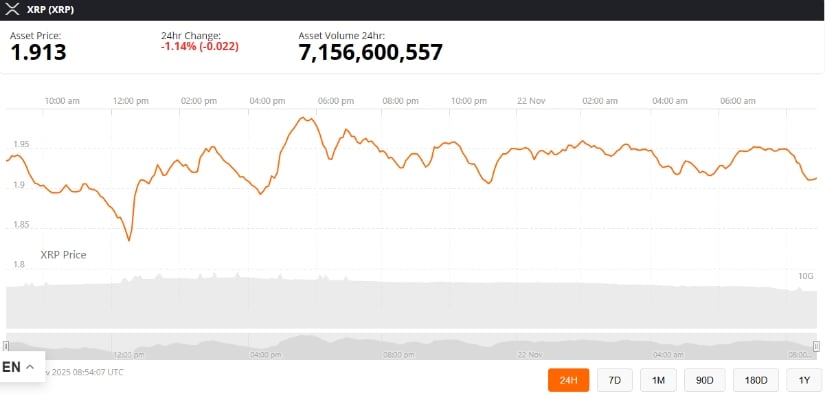

Ah, the riveting tale of XRP, where every twist and turn sends traders into a frenzy, and the markets dance to a symphony of uncertainty. Today, our protagonist trades at a modest $1.95, rising from the ashes of recent lows around $1.83-how poetic! The saga continues, with technical and on-chain signals suggesting a possible rebound… but only if the macro conditions play nice.

XRP Approaches Key Technical Support Amid Volatility

Our dear analyst, Ali Martinez, points out that XRP is getting cozy with the monthly 20EMA. In times past, this level has been the ultimate pivot-like a crossroads in the forest where the bull and bear debate their next move. Will they continue down the rocky path of volatility, or will they settle in the warm embrace of stability? Only time will tell, my dear readers.

Martinez also reminds us, with a touch of irony, that past rebounds from this 20EMA have led to some glorious consolidation phases or short-term recoveries. So, keep your eyes peeled, for a confirmed breach might signal a retreat to the dreaded abyss of retracements.

1.8 Billion XRP at $1.75 Creates Strong Support

Ah, here comes the cavalry-1.8 billion XRP gathered at $1.75, standing like a mighty fortress. According to Glassnode, this support cluster is formed by wallets holding long-term positions, a truly steadfast bunch. These tokens could be the difference between a market meltdown and a miraculous rebound, provided the bears don’t get too comfortable.

But hold your applause-let’s not get too carried away. While this cluster could act as a stabilizing force, past history has shown that such support zones can sometimes be like a sponge, soaking up sell pressure, but failing to prevent further downward spirals. But who am I to say? The market is a fickle beast.

Network Activity Shows Signs of Fatigue

Glassnode has reported a dramatic decline in network participation-a 91% drop since mid-June. From over 577,000 active addresses, we’re now looking at a meager 50,000. It’s almost like a party that’s been going on too long and everyone’s slowly heading for the door. But not all hope is lost! New address creation has slowed by more than 50%, which could signal a lull in the chaos. Or is it the calm before the storm?

Meanwhile, whales have been selling off their XRP like there’s no tomorrow, with 1.58 billion tokens exiting the market in the past two months. If you think the market feels a bit… shaky, you’re not wrong. But fear not, my dear traders! There are still institutional inflows. The mighty ETF gods, like Canary Capital’s XRP ETF (XRPC), have recorded a hefty $292.6 million in inflows. Perhaps this will restore some balance to the force.

TD Sequential Buy Signal Suggests Potential Momentum Shift

Here’s a twist you didn’t see coming-a TD Sequential “9” buy signal has appeared on the daily chart. This mystical pattern is known for predicting potential trend exhaustion after long periods of decline, though it’s not a guarantee. It’s like predicting the weather based on an ancient prophecy.

Martinez, ever the cautious optimist, points out that the last two TD ‘9’ signals led to rebounds of 14% and 18%. But, as always, it’s conditional-like predicting the end of a drama based on a cliffhanger.

Scenario-Based Outlook: Monthly 20EMA Support

Ah, the crux of the matter-will XRP hold the monthly 20EMA support? Traders are eagerly awaiting the outcome. If the support holds, we might see XRP rise to the $2.20-$2.30 range, with the monthly 10EMA lurking as the next resistance level. It’s like a game of chess, where every move could change the game entirely.

-

Maintain tight, protective stop-losses. After all, a good defense is the best offense.

-

Focus on precision entries near key support levels. The art of the perfect entry!

-

Wait for trend confirmation before assuming a reversal. Haste makes waste, my friend.

With the historical accumulation at $1.75, the TD Sequential signals, and institutional inflows, we could be in for a multi-week relief rally-provided the macro and crypto conditions cooperate. It’s a delicate balance.

Historical Context Supports Cautious Optimism

History, as they say, repeats itself. XRP’s past behavior around EMAs and accumulation clusters offers a glimmer of hope. During the 2023 correction, a support zone near $0.65 preceded a glorious 30% rebound. But don’t get too excited just yet. There were times when TD Sequential signals failed to turn the tide, especially during the bleak days of 2022.

Final Thoughts

The fate of XRP hangs in the balance, my friends. The near-term trajectory will depend on whether it can hold support at the monthly 20EMA, and whether the broader market decides to play nice.

If XRP can stay above that level, we may see a technical rebound toward the mid-$2 range. However, a breach below $1.75 could send us down a much darker path. So, trade wisely, my fellow adventurers, and remember-fortune favors the prepared!

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Gold Rate Forecast

- USD CAD PREDICTION

- USD CNY PREDICTION

- XRP ETF Crushes Solana – First Day Madness! 🎉🚀

- TIA PREDICTION. TIA cryptocurrency

2025-11-22 22:58