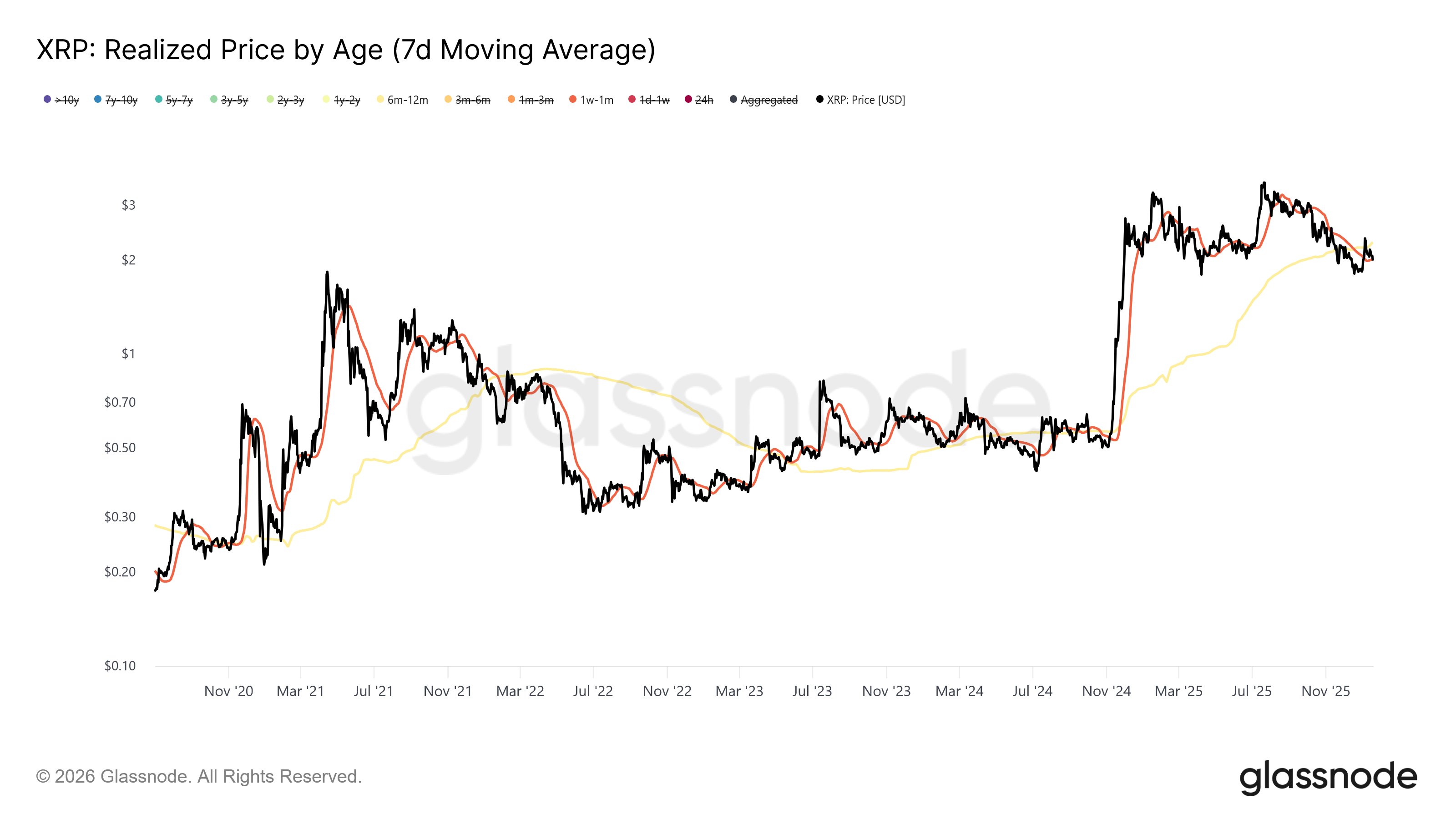

Ah, the merciless whims of the market! Glassnode, that sentinel of the crypto abyss, proclaims with a grim chuckle that XRP is regressing to its February 2022 self-a pitiful creature, trapped in a cost-basis labyrinth. Newer souls, blind to the folly of their predecessors, accumulate at levels that leave the old guard drowning in their own hubris. A tragic comedy, is it not? The on-chain tapestry reveals a setup ripe for sell pressure, a guillotine poised above key price zones, awaiting the slightest tremor.

In a missive flung into the void of X on Monday, the analytics firm-ever the harbinger of doom-noted a rotation in realized prices by age band. “The current market structure for XRP,” they intoned, “closely resembles February 2022.” A chilling echo, is it not? They speak of psychological pressure, a slow torture for those who bought at the peak, their patience tested like a saint in the desert. But patience, alas, is not rewarded in this cruel arena.

The Price of Folly: What Awaits XRP?

The heart of Glassnode’s prophecy lies in the wallets of the short-term faithful-those who dabble in the 1-week to 1-month window. They accumulate below the cost basis of the 6- to 12-month cohort, a cohort now marooned in the quicksand of their own greed. New demand steps in, oblivious, at prices cheaper than what their forebears paid. A cycle of madness, is it not? For when the price revisits the cost basis of these cohorts, they behave like cornered beasts. Underwater, they thirst to de-risk, to flee at breakeven, creating a ceiling of liquidity that stifles any hope of ascent.

Glassnode’s “Realized Price by Age” chart-a macabre dance of lines and numbers-lays bare this dynamic. The gap between the short-term and 6-12 month cost bases during the recent consolidation screams of February 2022, a ghost that refuses to be exorcised.

And lo, as XRP hovers below the $2 mark, a post from Glassnode’s archives-dated November 24, 2025-resurfaces like a specter. They speak of $2 as a psychological zone, a battlefield where Ripple holders have bled. “Since early 2025,” they lament, “each retest of $2 saw $0.5B-$1.2B per week in losses.” A level not just on the chart, but in the soul, where capitulation festers and forced de-risking becomes a collective hysteria.

February 2022, a month of folly and despair! XRP, after plunging to $0.6034 on the 2nd, soared to $0.8758 by the 8th, only to crumble under the weight of macro risk. By the 23rd, it had retreated to $0.70, a 20% fall from grace. The Russia-Ukraine invasion, that geopolitical tempest, struck like a thunderbolt, sending risk assets-crypto included-into a tailspin. A reminder, if we needed one, of the fragility of our digital idols.

At this hour, XRP trades at $1.9294, a number as meaningless as the dreams of its holders. Will it rise? Will it fall? The market, that fickle mistress, cares not for our predictions. But one thing is certain: in the theater of crypto, we are all but players, acting out our parts in a tragedy written by forces beyond our ken.

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Are ETH Holders Chasing Fool’s Gold with Ozak AI’s Promises?

- They Swapped Charts for Cheap Carbs! CEA Just Gorge-Bought BNB, Guts Still Sparkling 🤯

- EUR AUD PREDICTION

- ONDO PREDICTION. ONDO cryptocurrency

- IP PREDICTION. IP cryptocurrency

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

2026-01-20 12:04