Well, I say, old bean, it appears that XRP is teetering on the brink of what the chaps in the know-The Great Mattsby (Matt Hughes, no less) and Charting Guy (@ChartingGuy, the fellow with the graphs)-are terming a “volatility-compression setup.” Jolly good show, what? If the stars align and the key high-timeframe supports hold their ground, we might just witness a spot of upward jollity. 🕺💹

XRP’s Price: Poised for a Bit of a To-Do

Mattsby, the old sport, reckons XRP has been rather stout in defending its long-term trend support and is now coiling up like a spring, ready to bound forth. “XRP had a perfect bounce off the 20-month MA,” he trilled, “while the upper and lower bands continue to contract-setting the stage for its next explosive move higher.” Dash it all, he added with a wink, “It’s utterly bonkers how many chaps are bearish right at major high-time-frame support.” 🧐📈

On the monthly chart, XRP is bobbing about at $2.08629, perched above the Bollinger basis near 1.89623. The upper band, mind you, is labeled at $3.57705, while the lower band skulks at $0.21541. The takeaway, old boy, is the squeeze-the band envelope has tightened like a corset at a Victorian ball, a condition Mattsby links to “explosive” directional follow-through when it finally resolves. 🎆📉

The other nugget of wisdom on that panel is the 20-month moving average, which Mattsby highlights as the pivot. His October musings lean on a spot of historical rhyme: “XRP is repeating its 2017 antics. Consolidate sideways for months until it touched the 20-month MA. After that, it shot up to finish off the cycle.” In his view, the touch-and-hold dynamic is already in play this cycle, even if it’s “taking a tad longer.” 🕰️🔄

With the October 10 liquidation kerfuffle, XRP pierced the 20-month moving average and has since consolidated above it. If that read holds, the most explicit upside reference on-chart is the monthly Bollinger upper band around $3.57705, a level that would represent a return to the top of the current volatility envelope rather than an open-ended projection. 📏✨

Wyckoff-Style Re-Accumulation: A Path to $8?

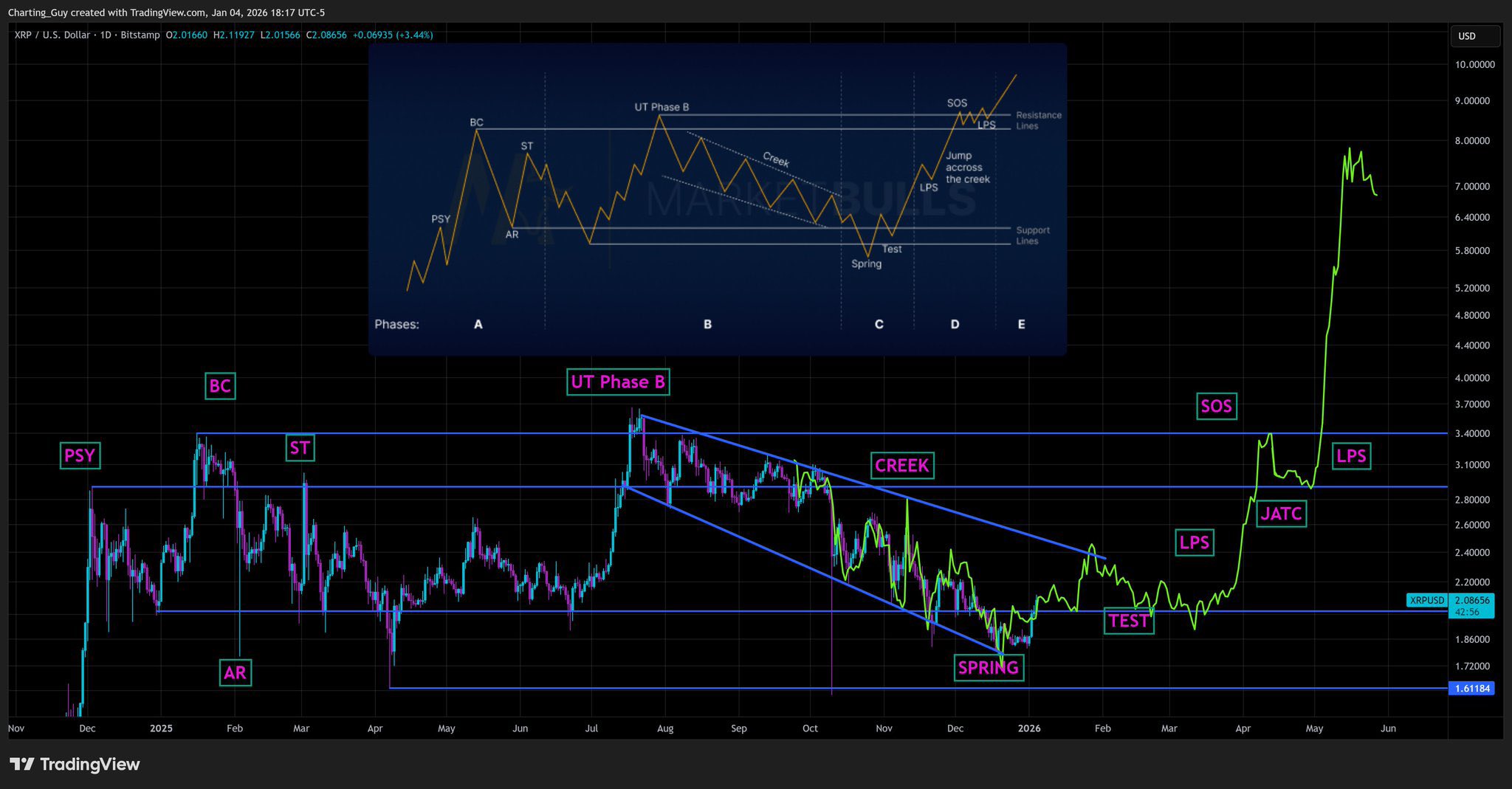

Charting Guy, the fellow with the daily chart, overlays a Wyckoff-style roadmap and labels the sequence as a re-accumulation transitioning into markup. Jolly clever, what? 🧭📊

The yellow projection assumes XRP is still grappling with overhead supply, with the ~$2.08 area (marked by the blue horizontal line and aligned with the current print) acting as the immediate gatekeeper. In that framing, $2.08 is not a comfort-zone support level yet; it is a level XRP needs to reclaim decisively and then stay above on retests for the bullish sequence to keep validating. 🚪🔒

A second constraint on the chart is the descending channel, the “creek” structure that defined the current downtrend. Charting Guy expects XRP to rally towards the upper trendline resistance, followed by a controlled pullback labeled “test,” where price checks whether demand is real and whether sellers can still force acceptance back into the old range. 🏞️🚣

If that test holds (another short-lived dip below $2.08 is fine), the roadmap then looks for an “LPS” (last point of support): a higher low that signals supply is being absorbed. Only after that does the yellow path call for “JATC” (jump across the creek), the clean breakout through the channel, followed by “SOS” (sign of strength) into the next major horizontal ceiling around ~$3.40. From there, the schematic expects another pause and “LPS” beneath that ~$3.40 zone, before the final markup leg accelerates into the ~$8 region. 🌉🚀

In short, the chart’s bullish outcome is conditional on sequential level-flips: first $2.08, then the channel, then ~$3.40, and finally $8. Until now, XRP is “following perfectly” the path, as the analyst noted via X. 🛤️✅

At press time, XRP traded at $2.13. Not too shabby, eh? 💰📊

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Gold Rate Forecast

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Shiba Inu Shakes, Barks & 🐕💥

- Brent Oil Forecast

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- USD CNY PREDICTION

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

2026-01-05 14:32