XRP’s price flounders beneath the $2 threshold, a trembling leaf in a tempest of market unease. Traders, like ants scurrying under a fallen log, gawk at whether the coin’s pitiful scribble will rally like a phoenix or collapse like a soufflé. The broader market wails in its crib, unable to soothe itself into stability, while volatility flutters about like a drunkard’s shadow.

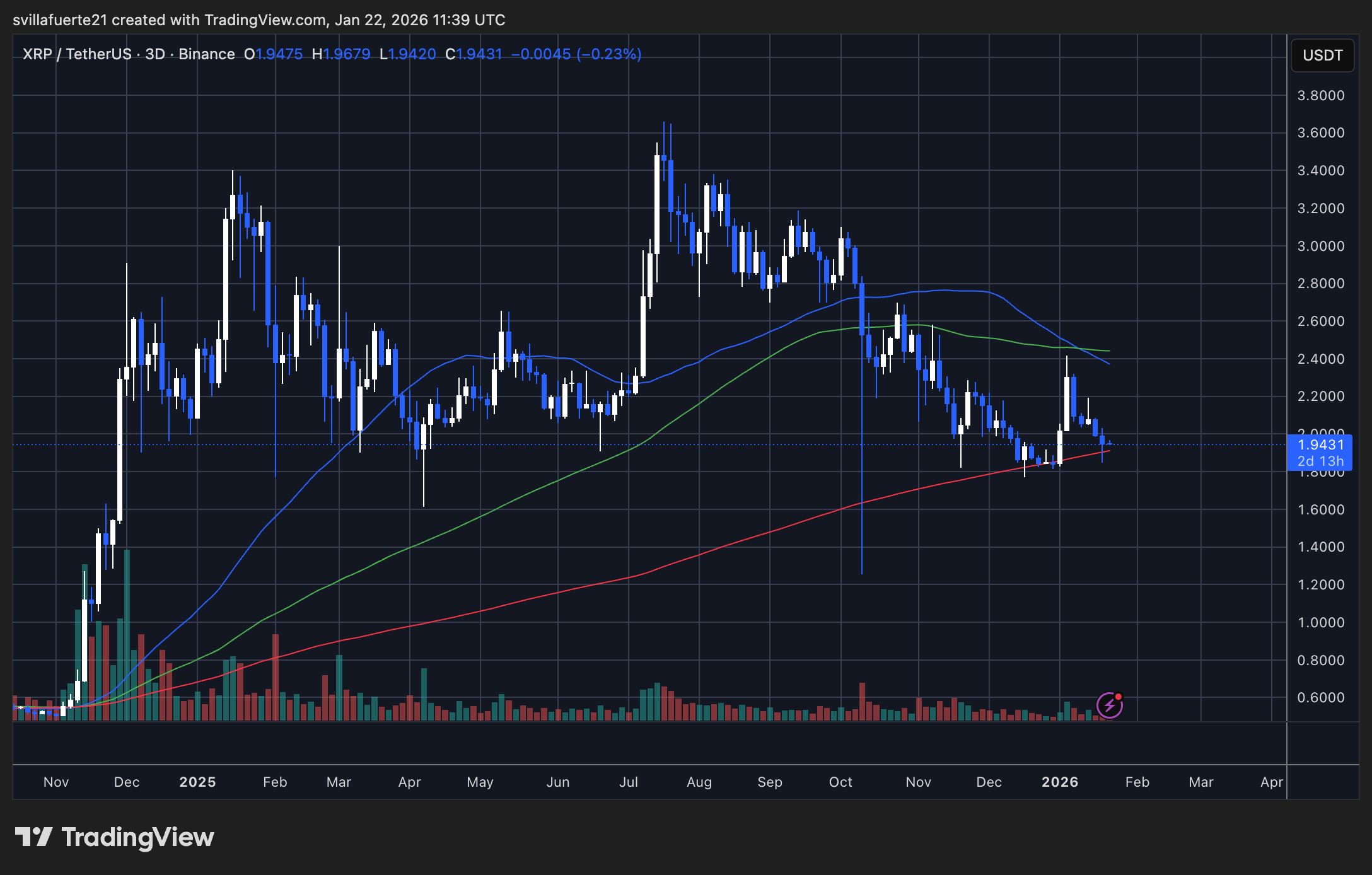

XRP now strides 47% from its July 2025 zenith, a monolith of ambition carved by the hands of greed and panic. Yet one must ask: Is this merely a pause in the symphony, a breve for weary violins? After a crescendo of 600% since November 2024-a virtuoso performance of greed-the market, like a conductor mid-chorus, pauses to sip profits and spit out latecomers into the void. Such is the melancholy cadence of wealth redistribution.

This price range, frail as a moth’s wing, hints at equilibrium. Buyers, if they exist, must prove their worth by defending supports like medieval knights. Should they falter, the coin may yet tumble into the abyss of prolonged paralysis.

Negative Funding Rates: A Symphony of Shorts

Darkfost, sipping pessimism with a straw, suggests the bearish consensus is as inept as a court jester’s jest. Short sellers, arriving not at the summit but at the precipice of ruin, have crowded the stage as if rehearsing for a finale they never saw scripted. Binance’s funding rates, a smoking gun of bearish bravado, have clung to negativity since December. One might think the bankers have built a cathedral of wagers, not a marketplace.

History, that sly old oracle, whispers: markets revenge late consensus like a scorned lover. Shorts, multiplying like dandelions in a tempest, sow seeds for their own downfall. Should XRP dare reclaim ground, these pitiful bets may collapse into woke parity, mistaking liquidation for resurrection. A twisted rebirth, indeed.

Darkfost recalls two such episodes since 2024: a thriller in August-September 2024, and a sitcom in April 2025. In both, negativity matured into a subplot for bullish rebirth. One might call it a market’s way of saying, “Let the last short cover first.”

Now, with shorts straddling the line between folly and farce, XRP’s next move might spark a climax. Buyers, like Icarus with a calculator, could ignite a revival-though history suggests they’ll tolerate no rehearsals.

XRP’s Dance Beneath $2 Finds Its Rhythm

XRP’s 3-day chart reveals a waltz out of sync with the frenzied ballet of earlier selloffs. At $1.94, it clings to a support line (Q4 2025’s memory), a breath less than a debt. Sellers, though, breathe less heavily now, out of puff after their December tango. The market, once hammering lower lows, nowчик considers a tea party of consolidation.

Downward-moving averages, like pessimists in a cathedral, tower above the $2.10-$2.30 range. Rebounds, weak and weepy, flounder. Yet the coin’s surrender to consolidation offers a glimmer-a knight’s shield in a game of cards.

If XRP reclaims $2, perhaps the buyers will erupt in a fugue of defiance. But should the $1.85 floor hemorrhage, the coin may yet plunge into the arms of gravity, its recovery a jest.

Read More

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin & Gold: Because Money is Weird

- Michael Saylor’s Bitcoin Shenanigans: ‘Bigger Orange’ and Market Mayhem!

- Trump’s Davos Hot Takes: Greenland, Crypto, and ‘I’m Kind of a Big Deal’

- EUR AUD PREDICTION

- NYSE’s 24/7 Trading Platform: Finally, a Market That Never Sleeps… Or Eats? 💸

- The Tragicomic Descent of Pi Network: A Token’s Lament

2026-01-23 08:11